In the rollercoaster that is investing in emerging markets, funds rise and fall all the time, be it for market forces, wrong stockpicking decisions or country-specific reasons.

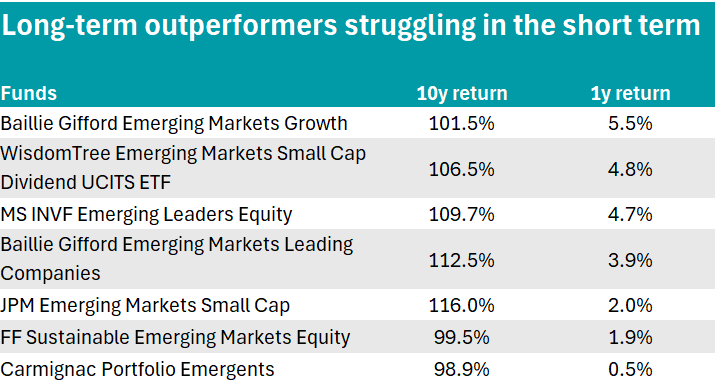

In the past decade, the good fortunes of seven funds in particular have reversed, going from the top to the bottom quartile of the IA Global Emerging Markets sector.

We highlight them in the study below as a proof that even good managers do not outperform every single year, together with the funds that had the opposite journey and went from long-term laggards to one-year successes.

In the cohort of struggling favourites, Baillie Gifford took centre stage with two strategies showing up: Emerging Markets Growth and Emerging Markets Leading Companies.

Despite being run by two different teams, the funds have seven of their top 10 holdings in common and had a correlation of 98% in the past 10 years. They were, respectively, the fifth- and third-best funds in their 74-strong peer group over the past decade but couldn’t keep up with the competition over shorter timeframes.

Source: Trustnet

RSMR analysts attributed some of the volatility of the Growth strategy to the ownership of cyclical companies and that the managers can invest in less highly-rated sectors than those favoured by investors with a pure focus on secular growth names.

Still, they rated the fund and particularly appreciated the top-down research resource in the field of geopolitics, which was recently strengthened.

They said the fund can be used as a core holding as a stand-alone or blended with more value-orientated strategies.

Further down the list, Carmignac Portfolio Emergents made the worst 12-month returns of the strategies in the list (0.5%). Managed by Xavier Hovasse, the portfolio is a concentrated selection of 37 holdings (the top being Taiwan Semiconductor at 9.8%) and has an active share of 81.2%, meaning that its performance is more determined by decision-making than by benchmark movements.

Hovasse thinks the economic decoupling between the US and China, which keeps rattling markets, will not have the negative consequences previously anticipated.

Therefore, he keeps a 21.1% allocation to the market, which has been beneficial this year, when the MSCI China index has grown 45.5%

On the other hand, the MSCI India index dropped 1.7% in the same timeframe – not as helpful to Vishal Gupta, manager of MS INVF Emerging Leaders Equity, who has 45% of the fund’s total assets ($849.7m) invested in the region. That’s more than double the 19.4% of its benchmark, the MSCI Emerging Markets index.

As the mostly large-cap funds above struggled, those focused on smaller companies haven’t flourished either. An example was JPM Emerging Markets Small Cap, which made a 2% return over the past year against the 11.8% of the average peer.

Managers Amit Mehta and Weiying Dong favour South Africa (with an exposure 2.5 percentage points higher than the benchmark, the MSCI Emerging Markets Small Cap index), Mexico (2.2 percentage points) and Brazil (1.7) and are more cautious on India (-4.6), Korea (-2.3) and Taiwan (-2.2).

A passive fund, the WisdomTree Emerging Markets Small Cap Dividend UCITS ETF, was also included in the list.

Source: Trustnet

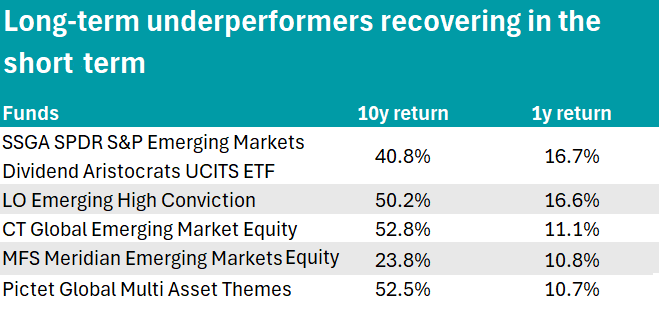

Another exchange-traded fund (ETF) was the leader of the list of long-term laggards that redeemed themselves this past year.

It is the SSGA SPDR S&P Emerging Markets Dividend Aristocrats UCITS ETF, which was designed to track the performance of high-yielding companies within the S&P Emerging Plus LargeMidCap index that have followed a policy of increasing or maintaining dividends for at least five consecutive years.

It had the best one-year returns in the list, up 16.7%, followed by two smaller vehicles: LO Emerging High Conviction and CT Global Emerging Market Equity.

The Pictet Global Multi Asset Themes and MFS Meridian Emerging Markets Equity funds concluded the list.

This article is part of an ongoing series. Previous instalments include: UK small-caps, IA UK All Companies and IA Asia Pacific Excluding Japan.