Columbia Threadneedle has lost its mandate on SJP Strategic Managed, after St. James’s Place (SJP) announced that the unit trust will be run by Royal London Asset Management instead.

Picking up the £4.6bn portfolio will be Trevor Greetham, head of multi-asset at Royal London, who will continue to invest in line with the current approach, focussing on UK and overseas equities, fixed interest and index-linked securities as well as other funds.

There are cost-efficiency reasons behind the move, according to SJP, as Greetham's active asset allocation will predominantly comprise of low active risk strategies that minimise tracking error, which is expected to help maintain access to a broad range of asset classes but at a lower cost than is typically associated with active management.

According to Justin Onuekwusi, chief investment officer at St. James’s Place, the change increases the choice available to investors, accessing different types of strategies across SJP's multi-asset range.

"The disaggregation of platform and advice charges from our funds later in the year will mean that our investment proposition will be priced on a like-for-like basis and be extremely competitive versus other funds in the market. The Strategic Managed Fund is an example of this," he said.

"The increased use of low active risk strategies means the fund will respond differently to various market conditions, offering clients greater choice and enhanced diversification."

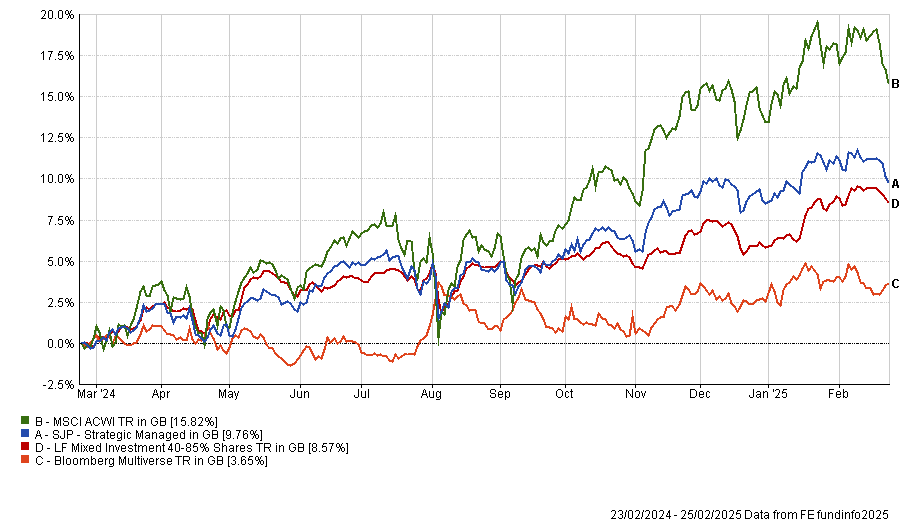

Performance of fund against index and sector over 1yr

Source: FE Analytics

In the past 12 months, SJP Strategic Managed has maintained a small advantage to its average peer in the LF Mixed Investment 40-85% Shares sector, as the chart above illustrates.

The longer-term track record is more nuanced, however, with second-quartile results over three years and third-quartile performance over five and 10.