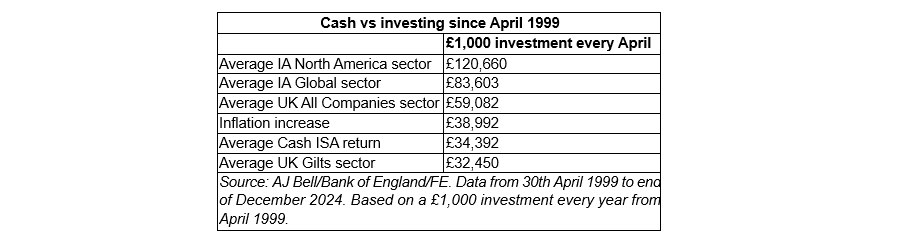

Savers sticking entirely to cash ISAs could have missed out on £50,000 or more by not moving to a stocks and shares ISA, research from AJ Bell has found.

An investor who added £1,000 each April to their cash ISA since the inception of the tax wrapper in 1999 would have built a pot of £34,492 from a total contribution of £26,000, the research showed. This was £4,000 below inflation, with savers needing to grow their cash pot to at least £38,892 for it to have kept pace with price rises.

The results were not much better for investors who had made a single £1,000 contribution in April 1999. Putting this in a cash ISA, with no further additions, would now be worth £2,016, only slightly ahead of inflation (£1,856).

Laura Suter, director of personal finance at AJ Bell, said: “Some savers might be over the moon with doubling their money, but looking at inflation growth over that time will bring them back down to earth with a bump.”

Despite this, cash ISAs remain extremely popular amongst investors, with “around 14.5 million people holding a cash ISA, while just 4 million have a stocks and shares ISA”, she said.

Some 3 million people have more than £20,000 in a cash ISA without also holding a stocks and shares ISA, and 1 million have more than £50,000 in their cash ISA, based on data from the Financial Conduct Authority (FCA).

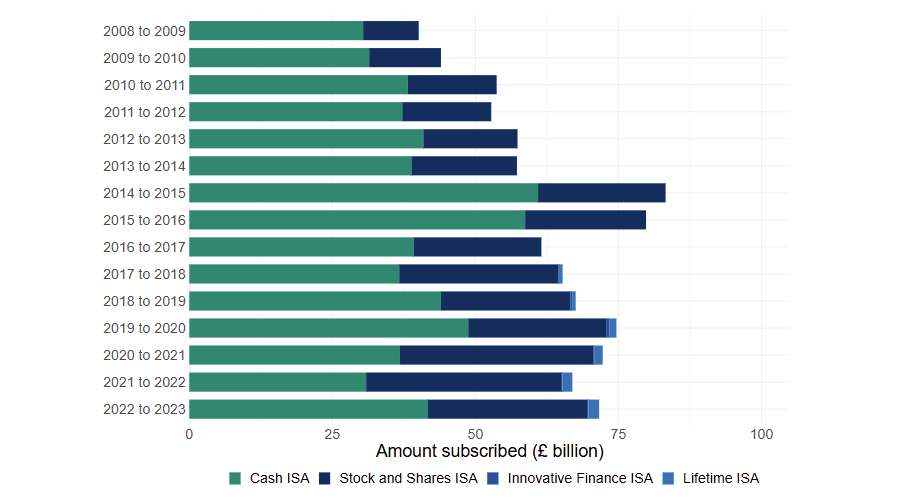

Cash ISAs continue to prove incredibly popular. HMRC’s latest figures for the tax year 2022-2023 showed investors continued to prefer cash, putting an extra £10.7bn into cash ISAs compared to the prior year, while the amount added to stocks and shares ISAs fell by £6.1bn during the tax year.

Amounts subscribed to adult ISAs per tax year

Source: HMRC

However, Sutter explained that investors who had poured money into stock market funds since 1999 would have experienced a “much rosier picture”. The average IA Global fund would have turned an initial £1,000 investment into a return of £4,611, while an investor who added £1,000 a year would now have a pot of more than £83,000 beating the average cash ISA by almost £50,000.

Elsewhere, a single investment of £1,000 in IA North American funds would have delivered “almost six times your initial investment”, and continuous contributions would have caused the pot to surge by £120,660.

Even investors in the IA UK All Companies sector, which Suter explained has “been unloved in recent years and experienced sustained outflows” would have beat the returns of a cash ISA based on both one-off and continuous contributions.

She added: “While cash is enjoying a sweet spot of higher returns, and cash ISA interest rates have risen this ISA season, cash is not king.”

Source: AJ Bell

“These figures are only averages, so a savvy saver who switched their money to the top-paying cash ISA account could have earned a higher return. But equally, someone invested in the top-performing investment fund could have generated far higher returns”, Suter said.

While this sheds light on the opportunities investors might miss by defaulting to cash, Suter warned investors not to abandon haven assets.

She argued that cash and bonds still play crucial roles within a portfolio but investing in cash should be a “conscious decision, rather than unthinkingly hoarding it”.

“When it comes to choosing between a cash ISA and a stocks and shares ISA, the key question is: are you saving for the short term or the long term? If you’re setting money aside for an emergency fund, typically three to six months’ worth of expenses, then a Cash ISA is a solid option. It keeps your money accessible while offering tax-free interest,” she said.

“But if you’re looking at medium- to long-term goals, such as saving for retirement alongside a pension, for a house deposit, home improvements in future or a career break, then a stocks and shares ISA could be a more effective route, given that markets tend to rise over time and outperform cash, despite short-term fluctuations.”

Regardless of time horizon, Suter said investors need to make sure they understand what they are buying and why they think it will make money. They must know how the investment works and all the risks before committing cash.

There are other considerations as well. People should pay down any pricey debt before investing, otherwise the interest will “more than wipe out the gains you make investing”.

“Investing is also generally only suitable for money that you don’t plan to spend for five years or more. So, make sure that you’ve got your emergency savings in cash, as well as any money you’ll need in five years – for a big holiday, a new car or your first home, for example. Any savings goal that’s further out than five years could be ideal for investing.”

For first-time investors, she said although it can be “daunting”, an ‘all-in-one’ fund such as those in the Vanguard LifeStrategy range “are worth looking at”, as these spread money across different equity markets and various asset classes, with an option of having more or less in stock markets versus bonds, gold and cash, depending on an investor’s risk appetite.

“Alternatively, first-timers could buy a cheap ‘tracker’ fund, which mimics the performance of a broad global index, such as the MSCI World. Fidelity Index World is one option for this, which has a low annual cost of 0.12%,” she concluded.