The enduring popularity of the 60/40 portfolio is based on the assumption that stocks and bonds are complementary.

Equities are the growth engine but although they have the potential to generate much higher returns than fixed income, they can be volatile and vulnerable to sharp downturns.

Bonds anchor the portfolio by providing steady income and more predictable returns without shooting the lights out, helping to dampen down the portfolio’s overall volatility. Most importantly, bonds should theoretically provide protection when equities fall.

The trouble is that this has not always happened in practice. The starkest recent example was in 2022 when Russia’s invasion of Ukraine led to higher energy prices and inflation spiking, and central banks responded by hiking interest rates aggressively. Global bonds and equities both plummeted.

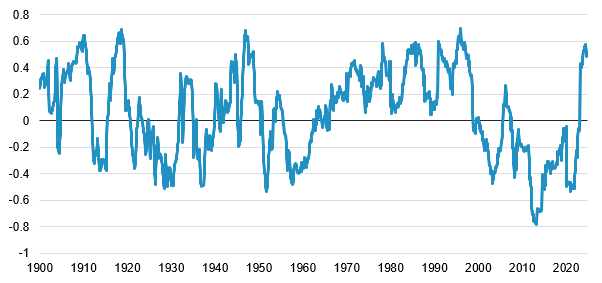

An analysis of historical data reveals that although bonds and equities have been negatively correlated for much of the past two decades, that period was an anomaly, said Ian Samson, multi-asset portfolio manager at Fidelity International.

“Historically, the relationship between equities and bonds has fluctuated, shifting in response to economic conditions, inflation expectations and market sentiment.”

3yr rolling correlation of monthly returns from S&P 500 and 10yr US Treasuries

Sources: Fidelity International, Robert Schiller database, data to Feb 2025

This is important because several fund managers think the global economy is experiencing a regime change. The era of low inflation and persistently negative correlations between equities and bonds that characterised the past couple of decades is coming to an end.

Zara Nokes, global market analyst at J.P. Morgan Asset Management, said many factors kept inflation at bay between 2000 and 2019, such as the introduction of central bank inflation targets and positive supply shocks, including China’s admission to the World Trade Organisation in December 2001 and the rapid expansion of US shale oil and gas.

“Going forward, we are more likely to see sharp spikes in inflation as global trade becomes increasingly fragmented, governments become more profligate in their spending and the frequency of climate events increases,” she said.

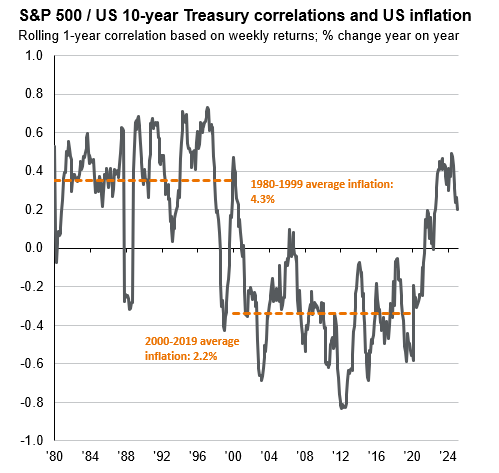

This means correlations between equities and bonds are unlikely to stay consistently negative, as the chart below illustrates.

Sources: BLS, LSEG Datastream, S&P Global, J.P. Morgan Asset Management, data as of 19 Feb 2025; US inflation refers to headline CPI

Inflation is at the centre of the debate because, broadly speaking, bonds and equities move in tandem when inflation is higher.

Based on data going back to 1952, bonds and equities had a positive correlation for 98% of the time when five-year annualised inflation breached 3%, said David Aujla, lead manager of Invesco’s risk-targeted Summit multi-asset funds. When inflation was below 3%, correlations were not necessarily negative but they were more likely to be lower, he explained.

Inflation isn’t the only piece of the puzzle; the relationship between equities and bonds also depends upon whether market sentiment is being driven by economic growth or inflation concerns, Samson pointed out.

“When investors are primarily concerned about economic growth and less worried about inflation, as was the case from 2000 to 2020, bonds and equities tend to be negatively correlated. Better growth prospects are typically good for equities but not for bonds, with the opposite being true when growth falters,” he explained.

“However, when investors are more concerned about inflation than growth, correlations tend to be positive, as was the case between 1980 and 2000 and again since 2022. In this scenario, central banks’ efforts to control inflation through interest rate hikes or cuts become the dominating market force. A more hawkish central bank puts pressure on both bonds and equities, while the reverse is true of a dovish central bank.”

Correlations retreated somewhat last year as major central banks got inflation under control but US president Donald Trump’s second term could push correlations up again. “The new US administration’s policy agenda of fiscal stimulus, lower migration and tariffs could all cause inflation to remain a top concern,” Samson warned.

Structural forces including deglobalisation, demographics, deficits and decarbonisation could all contribute to higher inflation and, ipso facto, higher bond-equity correlations over the medium term, he added.

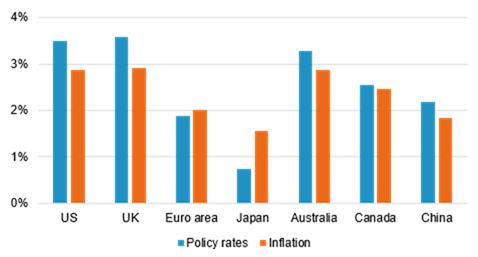

Fidelity’s forecasts for average inflation over the next 10 years

Source: Fidelity International; 10-year average expectations of inflation and central bank policy rates from Fidelity’s Capital Market Assumptions H2 2024

How volatile and unpredictable inflation becomes is even more impactful than its absolute level, Aujla argued. Uncertainty over inflation makes it hard to predict interest rate movements or gauge what the real returns from fixed income assets will be and therefore bonds become difficult to value and their prices more volatile. “The defensive part of your portfolio might behave less defensively,” he added.

Market sentiment also comes into play, Samson observed. “How worried investors are about inflation is just as important as how high inflation is. This means that, even if inflation remains relatively subdued, recent memories of the inflationary shock over the past few years might cause larger than usual market reactions to inflation data and therefore more positive correlations.”