Choosing a fund isn’t always about deciding between black or white options such as growth or income, value or momentum, developed or emerging markets; investors must also choose a favourite between funds that are largely similar, which potentially makes things even more difficult.

In the IA UK Equity Income sector, for example, there are many successful and popular funds that can serve as core options and differentiating between them can feel like splitting hairs.

Funds such as Artemis Income and Royal London UK Equity Income both have a good reputation with highly regarded investment managers, robust processes and decent track records.

But although they may look similar enough, three fund selectors all had a clear favourite – the Artemis fund. Below, they share the reasoning behind their preference and reveal what they look for when making such decisions.

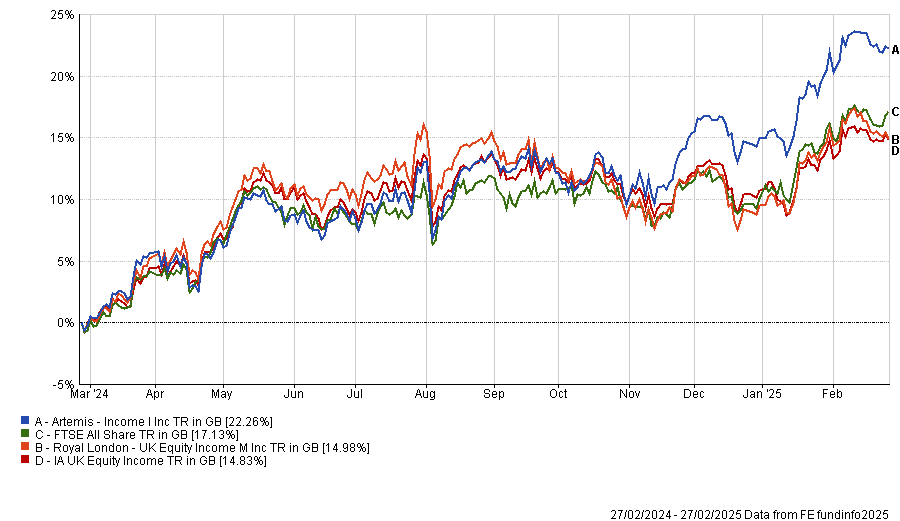

Performance of fund against index and sector over 1yr

Source: FE Analytics

The management teams

The Royal London strategy is led by Richard Marwood, who ran the portfolio single-handedly between 2021, when longtime manager Martin Cholwill left, and 2024, when he was joined by Joe Walters. Walters’ tenure however lasted just nine months before he was replaced by Max Newman last November.

Samir Shah, senior fund research analyst at Quilter Cheviot, said: “Much of the fund’s success was due to the reputation and performance of Martin Cholwill,” said Shah. “It appears that the new team has not been able to sustain the track record to same level as the previous managers.”

For team stability and consistency, Artemis therefore has a key advantage. Adrian Frost has been in charge of the fund since 2002, with Nick Shenton joining in 2012 and Andy Marsh in 2018. All three remain in situ and share the same philosophy of investing in companies that can combine income with some capital growth to provide a broader return profile. According to Shah, three heads are better than two.

Paul Angell, head of investment research at AJ Bell, agreed: “There’s an argument that Royal London’s new team compares unfavourably to the vastly experienced trio of managers on the Artemis Income fund, who have an average tenure of over 14 years on the fund.”

For Ben Yearsley, director at Fairview Investing, Royal London has handled the transition from Cholwill well, whereas Artemis will have “no need to transition from Frost”, who in his view will be there for a long time still, and the two co-managers are “excellent”.

Portfolio characteristics

With higher exposures to the communications (12%), financials (27%) and consumer cyclical (10%) sectors, Artemis Income is more adventurous that the Royal London fund, which in turn has higher allocation to energy (12%), materials (8%) and utilities (4%).

According to Shah, this leads the Artemis portfolio to have a lower underlying yield (3.9% versus Royal London’s 4.7%), but more room for capital growth, as well as higher sales and cashflow generation.

On the other hand, the Royal London portfolio has more exposure to defensive companies that pay out the bulk of their earnings, leaving little room for future growth, such as Shell, Astra Zeneca and BP.

“There is nothing wrong with this philosophy, but we prefer portfolios that offer an attractive yield combined with some element of capital growth. Artemis has companies such as Pearson, LSEG, Informa and NatWest that reflect this return profile,” Shah said.

Previously, Yearsley noted, Royal London UK Equity Income was a bit more growth-focused than Artemis, with the latter leaning towards value, but Artemis has moved and is “less of a old school value income fund now”.

Both have to hunt mainly within the FTSE 350 universe of large- and mid-caps, partly down to choice and partly to fund size.

The Royal London portfolio is worth £1.2bn, while at £5bn, Artemis Income is by far the largest fund in the UK Equity Income sector and almost twice the size of the second largest. This was somewhat concerning to Angell, who decided not to include Artemis’ fund in AJ Bell’s best-buy list, going instead for a few smaller options such as Man Income and BlackRock UK Income.

“Due to their smaller level of assets under management, they can be more nimble. The Man fund is typically invested in more undervalued businesses, whilst BlackRock's more balanced investment style, with a focus on free cash flow generation, results in a core exposure more akin to the Artemis Income and Royal London UK Equity Income funds,” he said.

Track record

Both funds have produced “respectable” returns on a consistent basis, but Artemis’ returns were “superior”, according to Shah. To him, this was due to the team’s ability to identify quality companies with a reasonable yield, but most importantly an attractive growth rate that is not fully appreciated by the market.

Artemis was ahead of Royal London over the past one year (as the chart above shows), but also over three (by 1.7 percentage points), five (2 percentage points) and 10 years (0.9 percentage points).

“As previously mentioned, both funds are well regarded by us on several fronts, however we believe the Artemis Income fund has the edge in several key areas and would be our preferred choice,” Shah concluded.