China was the dominating force in February, with the country's stock market flying far higher than others in the shortest month of the year.

This follows a strong 2024 for the Chinese market, when it was among the best performers of the year. But its high volatility means it remains a boom-or-bust proposition for investors.

George Efstathopoulos, multi-asset portfolio manager at Fidelity International, said China's economic data is improving after the stimulus late last year, with the consumer responding to the government’s measures.

“Clearly more needs to happen to make it sustainable (and China has said more will come), but it also answers the question many had on whether fiscal policies would work at all given the low China consumer confidence levels,” he said.

Meanwhile, “green shoots” in the property sector and Chinese artificial intelligence (AI) models hitting the mainstream has helped inspire confidence in the market.

“We believe that these all make up important differences when thinking about the current rally. With China AI perhaps the most important one as it reflects improving fundamentals and helps form a new narrative. Essentially hope is taking a back seat while fundamentals are in the driving seat,” he said.

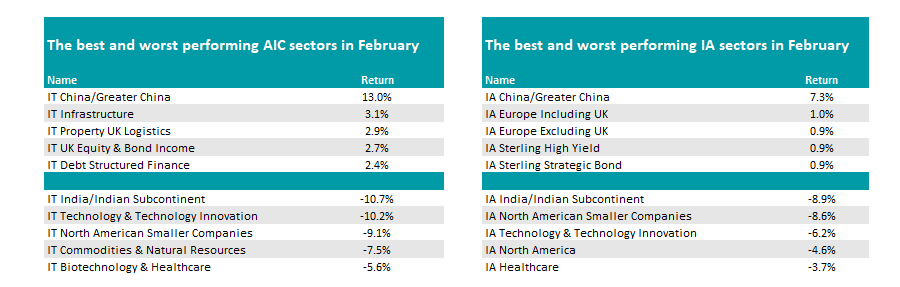

Following this renewed enthusiasm, the average fund in the IA China/Greater China sector rose 7.3% last month, while the average IT China/Greater China trust was even better, up 13%. These were significantly higher than any other peer group.

Source: FE Analytics

Ben Yearsley, director at Fairview Investing, said: “China-invested funds were by far and away the best performing last month and there was nothing else to really write home about. The next 21 sectors were flat to up 1%. It was not the most thrilling month.”

In the Investment Association (IA) universe, Europe (both including and excluding the UK) was the second-best place to be invested, followed by sterling bond funds.

In the Association of Investment Companies (AIC) space, China was followed by infrastructure, property and UK income.

Turning to the foot of the table, India continued to struggle, with IT India/Indian Subcontinent and IA India/Indian Subcontinent leading the way down in their respective universes last month.

“India’s recent bear market is continuing with the average fund falling another 8.9% in February bringing 2025 losses to 13.6% now,” said Yearsley.

Technology and US smaller companies were also key themes among the worst-performing asset classes last month as the froth began to come off the US market. A patchy earnings season meant some of the Magnificent Seven names were hit last month, while weak underlying economic data in the US caused concern for the prospects of more domestic-focused minnows.

“Consumer sentiment is key to most economies. The US consumer is arguably the most important but in a sign of possible trouble ahead they now owe a record $1.2trn on their credit cards up 7% on a year earlier. President Trump’s mooted tax cuts might be needed to prop the consumer up. At the same time as record debt, the cost of servicing that debt has now reached an average 20%,” Yearsley added, suggesting pulling the necessary levers may be more difficult than it has been in the past.

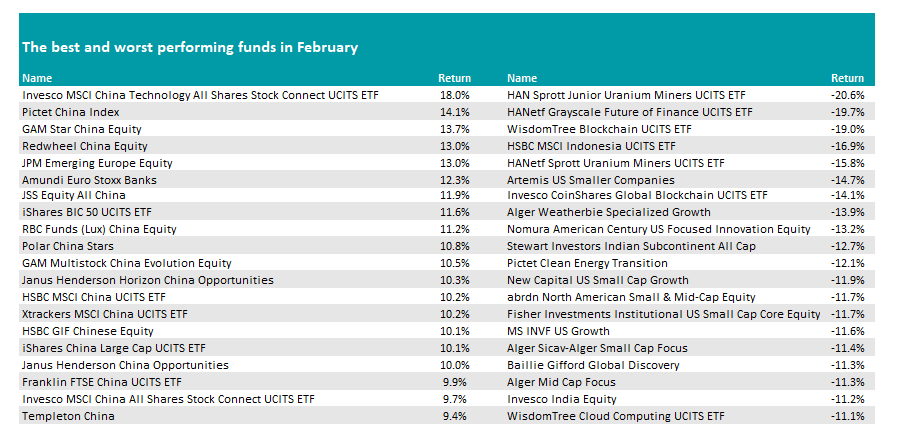

Turning to individual funds and China funds dominated the top of the tables, with eight of the top 10 best-performing funds investing in the country and 18 of the top 20 names. Invesco MSCI China Technology All Shares Stock Connect UCITS ETF topped the list, up 18%, while the best active fund was GAM Star China Equity, which made 13.7%.

The JPM Emerging Europe Equity fund, which has performed well on the back of a potential end to Russian warfare in Ukraine, was one outlier. However an end to the war may have been set back by last week’s public disagreement between president Donald Trump and Volodymyr Zelenskyy. Amundi Euro Stoxx Banks was the other non-China fund among the top 10.

Source: FE Analytics

At the foot of the table, specialist exchange-traded funds dominated including those tracking blockchain and uranium markets. Artemis US Smaller Companies was the worst-performing active fund, down 14.7%.

“As well as US growth and US smaller companies, clean energy stocks are still taking a bashing with Pictet Clean Energy Transition having torrid time falling 12.1% – the ascendancy of Trump has led to more emphasis on carbon and less on carbon capture. To be fair this is an acceleration of the same trend of the past 18 months or so,” noted Yearsley.

Away from funds, it was a busy month from an economic and political standpoint. The Bank of England chopped 0.25 percentage points from the UK base rate in February and halved the growth forecast for the year.

Figures last month showed the UK economy grew in the fourth quarter of 2024 by 0.1%, with overall growth for the year at 0.9%.

Yearsley said: “The harbinger of doom, the OBR [Office for Budget Responsibility] has given the chancellor a bit of a headache before this month’s spring statement (that may well turn into a tax-raising Budget) by downgrading growth and saying there is no spare cash.”

Whilst growth has been weak, inflation has been going the other way rising to 3% on the latest reading. The same is true in the US, where prices have also gone up 3%. “If that’s the direction of travel, the Fed could start cutting rates more aggressively,” Yearsley said.