By all appearances, equity markets are in rude health. The FTSE 100 briefly broke above the symbolic 9,000 mark for the first time, while the S&P 500 and Nasdaq are constantly setting fresh record highs.

But beneath this bullish exterior lies the obvious question: are markets now priced for perfection? The latest edition of Bank of America’s Global Fund Manager Survey gives some insight into current sentiment and what professional investors are thinking.

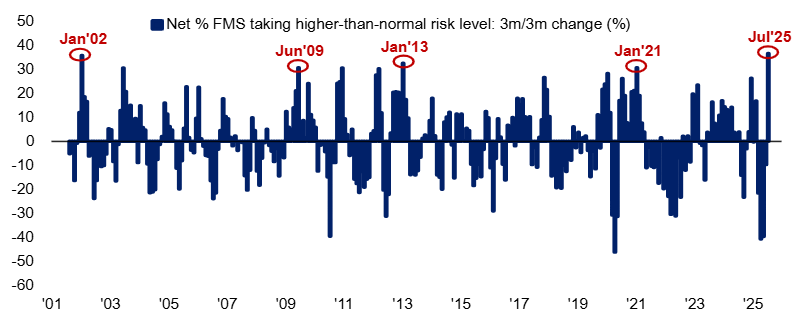

Risk appetite has just seen its largest three-month rise on record and cash levels have dropped to 3.9%, below the survey’s own ‘sell signal’ threshold. Optimism about corporate earnings has bounced back and 86% of fund managers believe in a soft or no landing scenario.

BofA’s analysts said: “Sentiment [is] getting ‘toppy’ but with equity overweight not yet extreme, bond volatility still low [and] greed always much harder to reverse than fear, investors more likely to stick to summer of hedging and rotation rather than big shorts and retreat.”

Taken individually, these indicators could just reflect confidence. Taken together, they point to a market that assumes the macro environment will remain benign, policy will turn more accommodative and earnings growth will keep pace.

% of fund managers taking higher-than-normal risk

Source: BofA Global Fund Manager Survey – Jul 2025

It’s important to remember that much of the recent rally has been underwritten by a swift reversal in macro expectations – fund managers haven’t been this confident for long.

Back in April, a majority of fund managers still saw a recession as likely. Now, nearly 60% say it’s unlikely. The soft landing is the consensus view and a full 21% expect no landing at all, implying uninterrupted growth with no slowdown.

At the same time, 42% of respondents believe Q2 earnings will beat expectations and 42% also say AI is already improving productivity, despite recently thinking this would be a 2026 or 2027 story.

These beliefs are not implausible. But they collectively raise the bar for what needs to go right.

If the soft landing fails to materialise or earnings miss the high watermark now set for them, markets might need to reprice quickly. When investors are this uniformly optimistic, news that’s merely good rather than great can still cause a negative reaction.

For current valuations to be sustained, several moving parts need to align.

First, earnings must continue to surprise to the upside and not just in technology. Financials, industrials and energy names – particularly in Europe and the UK – will need to carry some of the load if the rally is to broaden.

Second, AI optimism must begin to show tangible productivity gains outside investor presentations. So far, most of the benefit has accrued to a handful of US mega-cap names.

If AI becomes a genuine growth catalyst for a wider slice of the economy, it will validate current enthusiasm. If not, the re-rating may look premature.

Third, central banks must strike a precise balance. The market expects at least one or two rate cuts by year-end in the US and UK. But with US inflation still running at 2.7%, 3.6% in the UK and tariff-driven price pressures complicating the picture, the path to cuts is far from guaranteed.

Any surprise in the inflation data or hawkish messaging from the Federal Reserve or Bank of England could derail expectations quickly.

Fourth, the geopolitical environment must remain relatively stable. While trade tensions and US political risks are top of mind, markets appear to be treating them as background noise. That’s a fragile assumption, especially given the unpredictable direction of US trade policy so far under president Donald Trump.

A closer look at positioning reveals how much optimism is already embedded.

July’s Bank of America Global Fund Manager Survey flagged crowded trades as long US tech, short US dollar and long EU banks. These positions are now seen as the most vulnerable to a bond- or earnings-led risk-off episode. Such crowding can unwind quickly when narratives shift.

Despite the bullish rhetoric, equity allocations remain measured – only 4% overweight globally – and still underweight in US stocks. This suggests that while managers are talking bullishly, they may not be fully committed.

That gap between sentiment and actual positioning might be important: it may reflect residual caution or it may signal fragility under the surface.

It would be unfair to dismiss the bullish case entirely. Corporate balance sheets are in strong shape. The global economy continues to expand. Investor rotation into non-tech sectors, emerging markets and value strategies suggests that the rally is broadening, not narrowing. And if AI delivers even half of its promised efficiency gains, it could provide genuine tailwinds.

Moreover, monetary policy remains a tailwind. Even if rate cuts are delayed, the absence of further tightening and the return of disinflation pressures would offer support to risk assets.

So the rally in equity markets is not baseless. But it is heavily reliant on a series of favourable outcomes unfolding smoothly and simultaneously.

With sentiment so stretched, the potential for disappointment seems to be rising. Markets today are priced not just for recovery, but for near-flawless execution.

That’s a high bar. Investors and the fund managers steering billions must ask: what happens if reality doesn't measure up?

Gary Jackson is head of editorial at FE fundinfo. The views expressed above should not be taken an investment advice.