RIT Capital Partners has disclosed a new position in SpaceX, initiated in the second half of 2024, in its full-year results released this morning.

The investment trust noted in the 12 months to the end of December, the net asset value (NAV) rose 7.7% (9.4% including dividends), underpinned by positive results in all the three main areas represented in the portfolio – quoted equities (up 15.8% fuelled by small-caps, China and Japan holdings), private investments (4.8%) and uncorrelated strategies (4.5%).

The strong results have led the company to propose a 10.3% dividend increase for this year, potentially making 2025 the 12th successive year of dividend growth.

Sir James Leigh-Pemberton who is to retire from his current role as chairman at the forthcoming annual general meeting in May, said: "All three of our investment pillars saw positive performance, led by the quoted equities portfolio which had another good year. In 2024, we carefully reduced our exposure to private investments to a third of net asset value and our emphasis on returns to shareholders continues through a progressive dividend policy and share buybacks."

QuotedData analyst Richard Williams added the trust’s “selective approach” and focus on undervalued small- and mid-cap stocks has “come to the fore and could continue to pay off handsomely going forward, with an expected broadening of technology ‘winners’ and a portfolio aligned with other global megatrends it has identified, such as medical advances”.

“The unique ability of the manager to access investment opportunities that others should not be underestimated. The investment in SpaceX is particularly exciting and these types of investments could be a source of superior returns for the trust for years to come”.

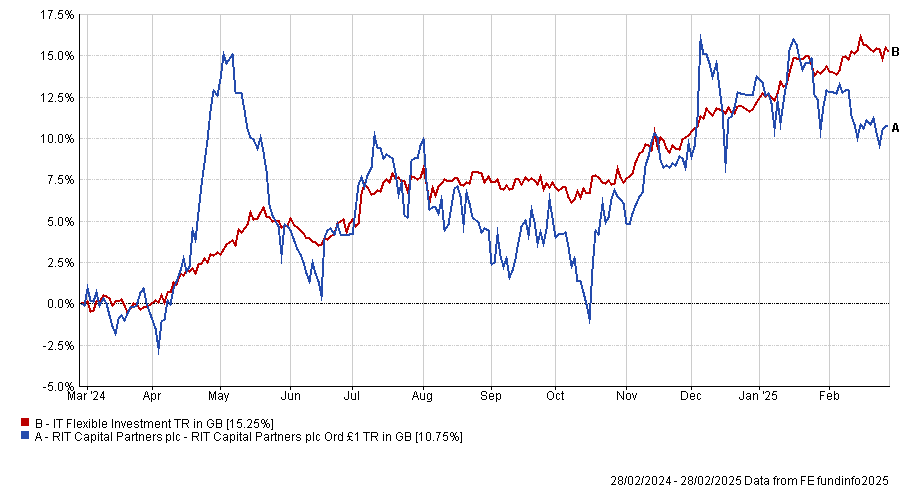

Performance of fund against index and sector over 1yr

Source: FE Analytics

Although the trust seems to have bounced back from a disappointing recent history (it three- and five-year figures relegate it to the fourth quartile of its peers), the discount widened to 24% in 2024 and continued downwards in the first two months of 2025 to 28%. However, this presents an opportunity for investors to buy shares in the company at an extremely attractive entry price, according to Williams.

Ewan Lovett-Turner, head of investment companies research at Deutsche Numis, agreed and was also grabbed by the trust’s improved disclosure about the approach and exposures, including a clearer breakdown of private asset sectors and key positions.

“Disclosure has meaningfully improved in recent years and we expect the drive to increase openness with the market to continue. Many of the key concerns that caused a derating in 2022 have been addressed, including resilient private performance and reduced headwinds from cost disclosures,” he said.

“Downside to the shares is limited by share buybacks and the discount offers an attractive entry point for a multi-asset portfolio with the potential to deliver an attractive risk/return from exposures that are hard for investors to replicate, including Thrive and Iconiq funds, and an eclectic mix of direct private investments, such as Motive and Epic Systems, as well as specialist credit/absolute return funds.”