Several fund managers expect inflation to be structurally higher and more volatile going forward compared to the past couple of decades, which means bonds and equities are likely to become more closely correlated.

The correlation between equities and bonds tends to become positive – or at the very least, unstable – when inflation is above 2.5%, said Luke Hyde-Smith, co-head of multi-asset strategies at Waverton Investment Management. The 2.5% inflation figure is not a hard and fast rule, but it is based on three-year correlations of US equities and 10-year treasuries since the 1960s.

Equities and bonds were permanently negatively correlated for the 20-year period ending in 2022 – “a substantial part of market participants’ investing careers”, he continued. However, data from Yale University professor Robert Shiller going back to 1871 shows that, over the longer term, the relationship between equities and bonds has been unstable and variable.

“That has some pretty major implications for the 60/40 portfolio,” Hyde-Smith observed. “We are much less certain that the government bond element of investors’ portfolios will always be that diversifying stable asset that will protect when equity markets fall.”

Zara Nokes, global market analyst at J.P. Morgan Asset Management, said investors need to equip their portfolios to deal with both growth and inflation shocks.

“When it is growth weakness that is the central concern, bonds play a critical role as a diversifier. When it is inflation that is the problem, alternatives, particularly real assets, offer investors a clear portfolio diversification solution,” she explained.

Below, Trustnet asked fund managers how investors should prepare their portfolios for an environment of volatile inflation, with periods when bonds and equities move in tandem.

Fidelity: Look beyond bonds for protection

Ian Samson, multi-asset portfolio manager at Fidelity International, expects persistent inflation and rising debt to challenge the defensive characteristics of government bonds.

“Multi-asset investors can respond by adding shorter-dated or floating-rate credit to generate returns, being highly selective in their government bond exposures and considering other means of portfolio protection including currencies, options and alternatives,” he suggested.

He prefers shorter-dated government bonds to “hedge the tail risk of a severe near-term growth shock, without exacerbating the risk of both equities and bonds selling off together due to inflation and fiscal fears”.

Samson also believes investors should expand their horizons to include other asset classes for diversification. Last year, he tactically used the US dollar as a portfolio diversifier because it was negatively correlated to both equities and bonds.

“We have allocated away from nominal US treasuries, preferring both inflation-linked debt and non-US government bonds from Europe to New Zealand,” he added.

Investors could also look at options strategies, absolute return funds, trend-following strategies, private credit and alternative investments that have inflation-linked returns such as infrastructure, real estate and commodities, including gold, he said.

Waverton: Incorporate real assets and absolute return strategies

Hyde-Smith believes inflation is “in the foothills of a second wave”. “It could rise quite substantially and, in that environment, government bonds would perform quite poorly,” he warned.

Therefore he thinks investors, especially those with lower risk appetites, should incorporate alternative assets into their portfolios to generate value when government bonds underperform.

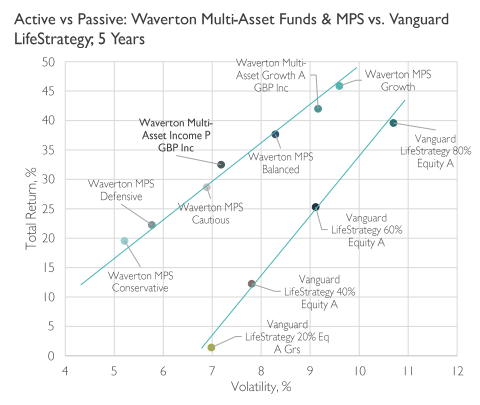

Waverton’s multi-asset funds use real assets and absolute return strategies, which Hyde-Smith said has contributed to their outperformance compared to portfolios built from passive bonds and equities alone.

Performance of Waverton multi-asset funds and model portfolios vs Vanguard LifeStrategy

Sources: Waverton, Morningstar, data to 31 Dec 2024

Real assets such as property, infrastructure, renewables, lending and commodities have some equity characteristics so are not uncorrelated to stock markets, but in a higher inflation regime they deliver rising returns, he said.

Waverton’s absolute return portfolio has three strands: specialist fixed income; trend-following systematic strategies such as MontLake DUNN and Brevan Howard’s funds, which have historically delivered positive returns during weak equity markets; and structured opportunities, such as protected equity or a strategy extracting risk premia from commodities markets.

The premise of absolute return investments is to deliver positive returns on a 12-month rolling basis irrespective of market environments and Waverton has achieved this about 76% of the time. In 2022, the absolute return strategies lost 1%, which was quickly recuperated, he said.

Invesco: There are still plenty of levers to pull within a 60/40 portfolio

David Aujla, lead manager of Invesco’s risk-targeted Summit multi-asset funds, thinks alternatives are no silver bullet. Investors are unlikely to put 40% of their portfolios in alternatives, so bonds and equities need to do the heavy lifting, he said.

And now is a good time for that. Bonds are paying investors a decent income while they wait for the insurance policy of diversification during equity downturns or the potential for capital gains if interest rates fall, he said.

Aujla said 60/40 can mean so many different things and over-emphasising the asset allocation misses the point.

“What's going to be really important going forward is what you do within those asset classes, at least as much as how much of those asset classes you have,” he said.

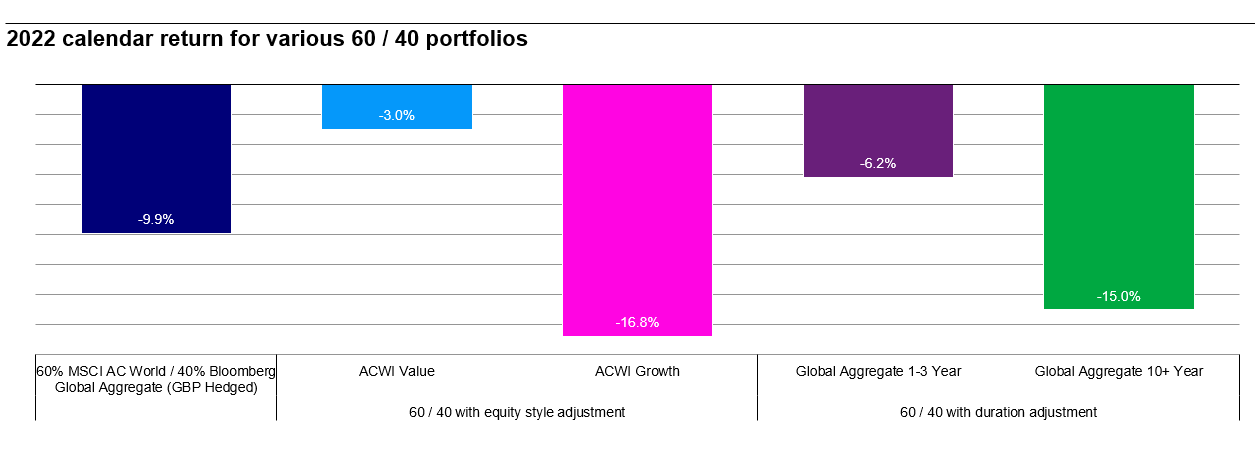

Taking 2022 as an extreme example, changing one factor within a standard 60/40 portfolio would have made a massive difference to returns, as the chart below shows.

The starting point is a portfolio with 60% in the MSCI All Country World index and 40% in the Bloomberg Global Aggregate bond index, hedged back to sterling. It would have made a thumping 9.9% loss in 2022, in sterling terms.

Switch the equity exposure into value and the losses shrink to 3%; or into growth stocks and losses for the overall portfolio extend to 16.8%.

The story is similar for the duration of the bond piece. Had the 40% allocation to fixed income been kept in short duration bonds, losses would have been a more manageable 6.2%. But a portfolio with 60% in the MSCI ACWI and 40% in the Bloomberg Global Aggregate 10+ year index would have lost 15%.

Sources: Invesco, Bloomberg, returns are for calendar year 2022 in sterling terms

“We've just changed one thing at a time and there's loads of other things you could have done. We could have added emerging market debt. We could have had much more exposure outside the US,” Aujla said.