Investment giants such as Fidelity and BlackRock think now is a necessary time to diversify portfolios but the uncertain market backdrop leaves investors spilt on the best way to do that.

In its latest global asset allocation report, Fidelity’s multi-asset team argued that uncertainty around policy issues – such as the Trump administration’s flurry of executive orders and the imposition of tariffs on its biggest trading partners – should remind investors of the importance of diversification.

“Fundamentals are still robust so it would be a mistake to sit out of the market,” it said. “However, uncertainty is high, particularly around US policy, making us somewhat more cautious this month. Now is a good time to think about adding diversification to increase the resilience of portfolios.”

Fidelity’s multi-asset team is overweight US stocks, arguing they remain “the best relative growth option in equity markets”.

However, it has just upgraded UK and European equities from underweight to neutral. Despite still seeing some structural headwinds, Fidelity cited greater potential for fiscal expansion in Germany, a possible ceasefire in Ukraine and sterling weakness as short-term tailwinds.

The group also suggested that emerging market equities are “becoming more attractive”, thanks to signs that the Chinese government is increasingly willing to use policy stimulus to bolster the domestic economy.

BlackRock is another investment major that is overweight the US but sees the need to be nimble in the near term. At the end of February, the group upgraded European equities from underweight to neutral.

In a new note, BlackRock Investment Institute portfolio strategist Devan Nathwani said the “unusually uncertain policy environment” requires different views across horizons. Specifically, the firm likes US stocks now and private markets in the medium term.

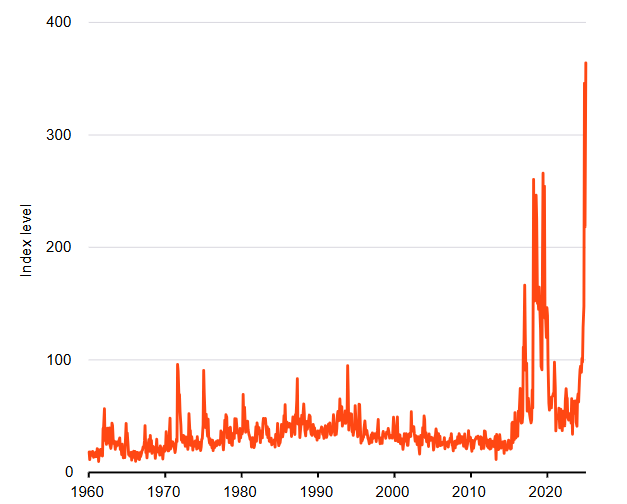

US trade policy uncertainty index, 1960-2025

Source: BlackRock Investment Institute, with data from Matteo Iacoviello/Haver Analytics, Feb 2025

“We see a mega forces-driven economic transformation that could keep shifting the long-term trend. That limits conviction in long-term valuation signals because it’s difficult to determine what’s a fair valuation during an economic transformation, in our view,” he said.

“That long-term uncertainty is being compounded this year by near-term policy uncertainty: trade policy uncertainty has soared to its highest in at least 65 years, reflecting US tariff headlines.

“How to respond? We allocate a greater share of portfolio risk to our six- to 12-month tactical views, allowing us to be nimble. Our baseline scenario: US corporate profits stay strong and broaden alongside AI beneficiaries. Yet we’re ready to pivot – especially as we get more policy implementation details.”

Not all investment majors are bullish on the US, however. One year ago, Invesco global head of asset allocation research Paul Jackson was downbeat about US stocks because of their high valuations; he has seen nothing in the 12 months since to change his views.

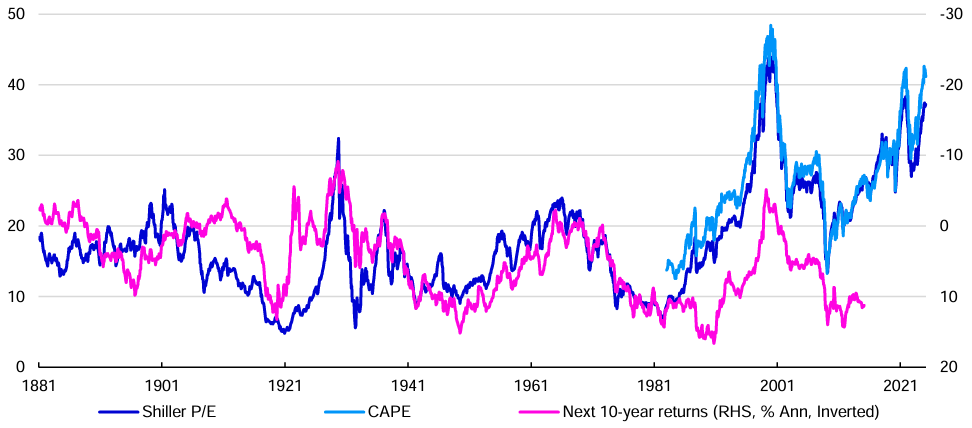

US equities’ cyclically-adjusted price/earnings (CAPE) ratio – which is Invesco’s favoured valuation measure – stood at 41.1x at the end of February 2025, while the Shiller P/E (its inflation-adjusted equivalent) was at 37.2x.

Jackson noted that these ratios were higher only during extreme market events: around the ‘tech bubble’ between 1998 and 2002 and the recent post-pandemic peak before markets corrected in 2022.

He also pointed out that the CAPE was higher only 6% of the time and the Shiller P/E 8% since January 1983, which is the first available data point.

US equities’ Shiller P/E, cyclically adjusted P/E and future returns since 1881

Source: LSEG Datastream, Robert Shiller, Invesco global market strategy office

“If I found it difficult to make the case for US equities last year, it is even more difficult now,” Jackson said. “Of course, the US stock market has defied gravity for a long time, and it may continue to do so, but I think valuations have reached levels that will be increasingly hard to ignore.”

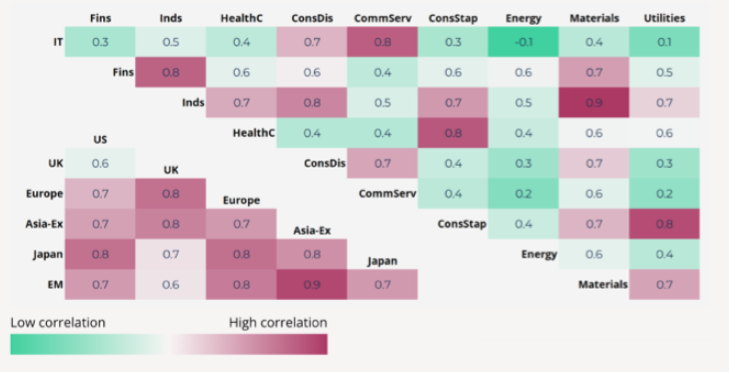

But while many investors think of geographical exposures when tweaking portfolios, research by Asset Risk Consultants Research suggests allocating by sector creates more potential for diversification in today’s market.

Shaun Le Messurier, client director at ARC Research, said factors such as globalisation, the growing dominance of US stocks (especially the Magnificent Seven) and high levels of market concentration is making tactical asset allocation by geography “increasingly problematic”.

“These factors have materially reduced the potential to add value through tactical tilts at the regional and country level,” he said. “Given these challenges to tactical asset allocation, our analysis suggests a better starting point for investors would be global sector exposure.”

24-month correlation matrix – sector vs country

Source: ARC Research, iShares, Bloomberg

Different countries have a relatively high correlation – as shown in the chart above – whereas sectors do not correlate as closely. Most geographical pairings aside from UK/US tend to have a high positive correlation but many of the sector combinations have a low correlation. The correlation between the tech and energy sectors is even inverse, which ARC Research said is “the holy grail of diversification”.

“It is time for perceptions to evolve and for sector exposure to be more carefully considered, at a minimum in parallel with geography,” Le Messurier finished.

“Thinking about global equity exposure through the lens of geography has become an increasingly binary approach, with the decision on the allocation to US shares dominating all other decisions.”