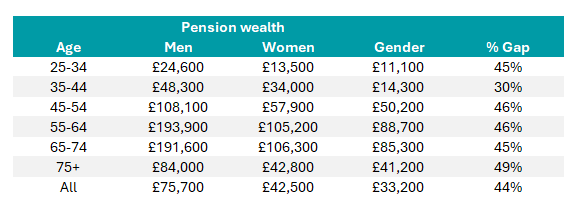

Women aged between 55 and 64 have £89,000 less in their pensions than men, on average, which represents a colossal 46% gender pension gap. This has widened dramatically over the past decade from just 25% in 2016.

The disparity in pension savings between genders is relatively consistent throughout people’s careers, indicating that younger as well as middle-aged women are struggling to save.

Women aged 25-34 have 45% less money than men in their pensions, according to interactive investor’s analysis of data from the Office of National Statistics (ONS).

Median pension wealth among pension savers between 2020 and 2022

Sources: ONS, interactive investor

Camilla Esmund, senior manager at interactive investor, said: “Women are more likely to work part-time or take time out of the workplace to care for loved ones, leading to a lifetime of lower contributions and the potential for a smaller pension pot in retirement.”

One in three women still have no pension at all, compared to one in four men, according to interactive investor. Put another way, 8.7 million women and 6.5 million men are not saving for retirement, despite rising levels of pension participation since auto-enrolment was introduced in 2012.

However, there are several steps women can take to store up wealth for retirement; contributing more and starting young are two of the most important. Even a small increase in contributions can make a huge difference, according to Scottish Widows.

A woman who contributed slightly more into her pension from the age of 22, putting in 9.15% rather than 8% of her salary (which could be a mix of employer and employee contributions) would save enough to wipe out the impact of a five-year career break in her early thirties, according to Scottish Widows.

Somebody saving 8% and taking no career breaks would build a retirement fund worth £178,109 by the time they retired at 68 (assuming a starting salary of £25,000, real wage growth of 1%, investment growth of 5% and charges of 0.5%.)

If she took a five-year career break between the ages of 30 and 34, perhaps to raise a family, but still contributed 8% every year she worked, her pension would ultimately be worth £156,452.

Increasing contributions by just 1.15% – a figure chosen to mark the 115th anniversary of International Women’s Day on 8 March – would mitigate the impact of the career break.

Somebody saving 9.15% but taking a five-year break would eventually amass £178,942 – even more than somebody contributing 8% and taking no breaks.

Jackie Leiper, managing director at Scottish Widows, said: “Simple calculations like this show women the power of the possible. Education can do as much as policy reform in closing the gender pensions gap.”

Myron Jobson, senior personal finance analyst at interactive investor, gave another example to illustrate the impact of a modest increase in pension contributions.

“Increasing your pension contributions by £50 a month – which would cost you £40 if you are a basic rate taxpayer or £30 if you are a higher rate taxpayer due to pension tax relief – could grow to £29,292 over 25 years, assuming a 5% return net of fees,” he stated.

“This is because, in addition to investment growth, you also benefit from tax relief, meaning the government effectively boosts your contributions.”

Leiper urged women not to pause their contributions, which would mean “missing out on valuable employer contributions and the power of compound interest”.

People who have worked for several companies and may have misplaced pensions can find them up using the government’s online tracking service, a pension provider’s consolidation service or by contacting previous employers.

“If consolidating, make sure you don't lose valuable guarantees attached to older pension schemes, such as guaranteed growth rates or annuity rates: where those guarantees exist it might be worth retaining that pot,” Leiper said.

Esmund added: “To avoid pensions going astray in the future, consider merging several into a single plan, which you can do within a Self-Invested Personal Pension (SIPP). This can make things easier to manage and reduce your fees.”

She also suggested getting a state pension forecast as people need 35 qualifying years to receive the full amount. “This is particularly important if you’ve taken time out of the workforce to care for young children and/or elderly parents, for example,” she said.

It pays to plan ahead for maternity leave, Leiper said, as some employers will continue pension contributions during this time. “It's not mandatory, so find out their policy before you start preparing,” she noted.

Leiper also believes women should supplement their retirement planning by saving into additional vehicles. Research conducted by Scottish Widows found that only 38% of women invest outside of their pensions, compared to 55% of men, further exacerbating the disparity in wealth between the genders.

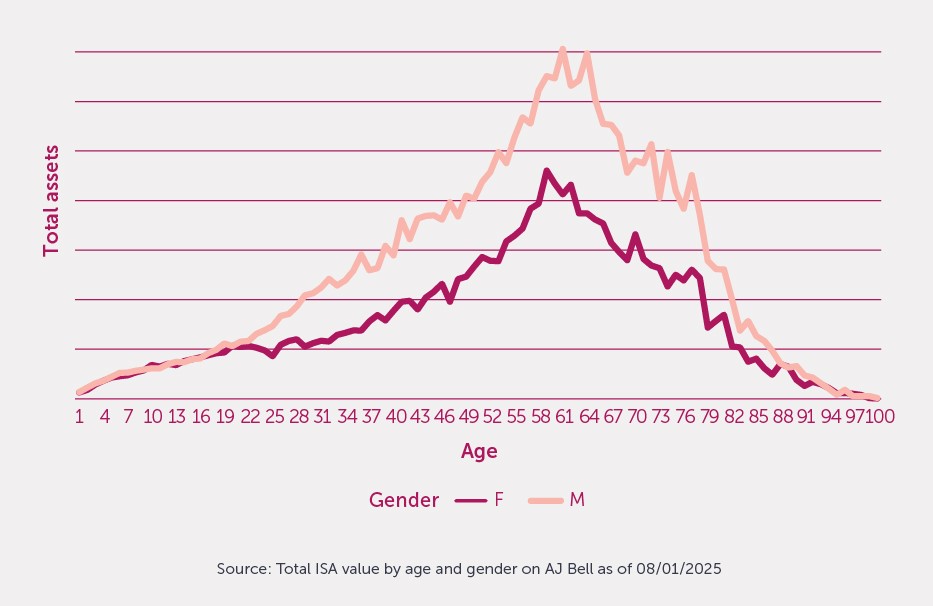

On top of the pensions gap and the gender pay gap (13%, which narrows to 7% for people working full time), there is also a gender ISA gap of £6.6bn, according to AJ Bell.

Amongst AJ Bell’s clients, women in their thirties – the decade most likely to coincide with motherhood and career breaks – have 46% less money than men in ISAs. On the other hand, over a million more women hold cash ISAs than men, according to HMRC.

The gender ISA gap

Source: AJ Bell

Baroness Helena Morrissey, founding ambassador of AJ Bell Money Matters, said: “It’s unfortunately no surprise that the gender ISA gap exists. Cash ISAs are considered a safe haven by women in the UK, potentially protecting wealth during market downturns but with pitiful growth in the long term compared with the average returns seen from investing.

“Encouragingly, when women do invest, they are strategic, engaged, and even outpace men in average Stocks and Shares ISA subscriptions each month on the AJ Bell platform. The challenge is to ensure more women take that first step toward investing.”