Semiconductor manufacturer Nvidia has been a favourite for investors for several years now, spearheading the artificial intelligence (AI) megatrend that has dominated global markets.

Investors last year wondered what it might take to knock Nvidia off its perch, but for AJ Bell investment analyst Daniel Coatsworth, the end of Nvidia’s dominance is closer than we think.

“We are at a major turning point in the Nvidia story”, he said.

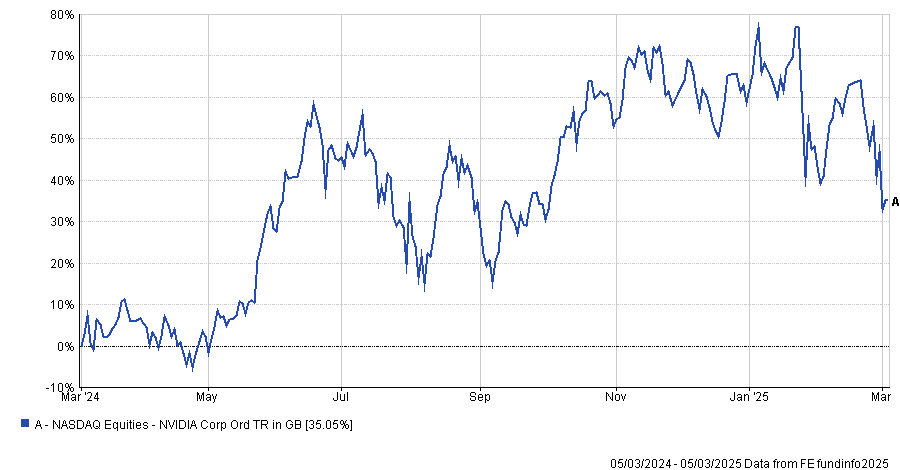

Despite beating earnings expectations nine quarters in a row, its recent results have not impressed investors with the share price sliding 15% year-to-date. He added this was not an unexpected development, arguing that Nvidia has been trading in a range, not surging in value since at least June last year.

Performance of Nvidia over the past 12 months

Source: FE Analytics

“People talk about Nvidia leading the market – It has not led the market in months”, Coatsworth said.

The rise of AI has driven companies that were Nvidia’s primary customers to start creating their own AI chips, while its competitors have continued to make enhancements. Elsewhere, unexpected challengers such as DeepSeek emerged, demonstrating that a cheaper way of producing AI is possible.

These developments are challenging Nvidia’s competitive advantages and is causing investors to question whether they need Nvidia as much as they once thought. “Everyone knows AI is a big thing. But if you are buying Nvidia now, who is selling it to you? It’s the people who are cashing out”, Coatsworth added.

He said Nvidia is following a typical hype cycle: an explosion of interest, followed by a wobble and a crash back to earth. “Right now, Nvidia is at the wobble”, he argued.

Coatsworth compared Nvidia to bakery chain Greggs. A few years ago, as it expanded into more vegan products, growth expectations began growing enormously but these did not pan out in quarterly earnings. As a result, the share price “temporarily tanked” and Coatsworth said Nvidia could be approaching a similar moment.

While he conceded that Nvidia could rise again in the future, current underperformance is an indication that the rotation away from Nvidia and US mega-caps more widely may be in progress. “Nvidia has been the one ‘driving’ the market. If it starts to fall, it might also become what drags the market down”, Coatsworth concluded.

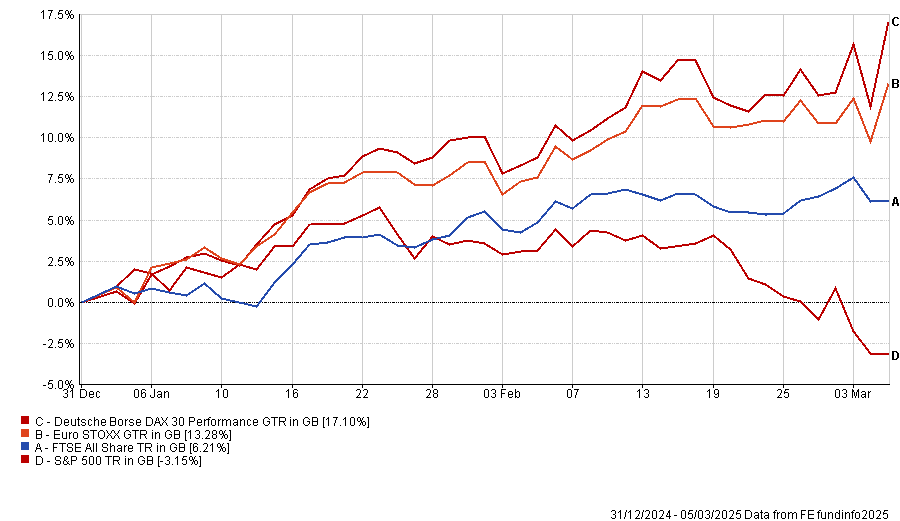

If we are seeing a market rotation away from Nvidia, Europe and the UK are the “big stories everyone is ignoring”, he said. Both markets have performed well for investors in 2025 so far, with the FTSE All Share up by 11% and the Euro Stoxx by 13.3%.

Coatsworth added that Germany was an area of particular interest, with the DAX up by 17% and solid long-term growth expectations that were “even better than the US”. Indeed, all three markets have outperformed the S&P 500 so far this year.

Performance of stock market indices YTD

Source: FE Analytics.

He said European and UK equities are leaving their American counterparts “in the rearview mirror” because of changing risk appetites amongst investors, who are beginning to “bank their profits” in these mega-cap stocks and rotating towards “boring” value businesses and cyclicals.

“The more US tech firms sell-off, the greater the chance that investors will look for alternative names offering jam today rather than jam tomorrow”, he explained.

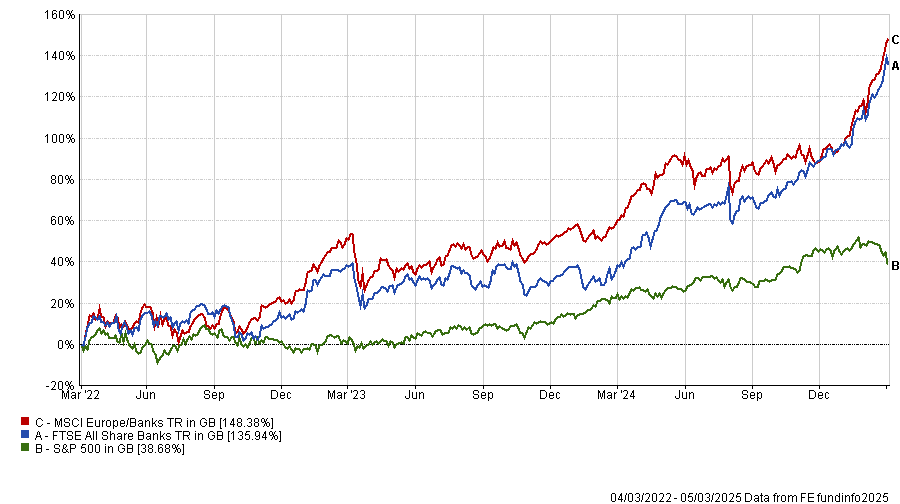

This is particularly benefiting stocks in the banking sector, which have made “unusually high returns” for investors, not just recently but over the medium term. For example, the MSCI Europe Banks and FTSE All Share Banks outperformed the S&P 500 over the past three years despite the dominance of the Magnificent Seven (Nvidia, Microsoft, Tesla, Alphabet, Apple, Amazon and Meta).

Performance of market indexes over the past 3yrs

Source: FE Analytics.

“Value stocks are enjoying their moment in the sun, whereas growth stocks have fallen out of favour”, Coatsworth said.

Defence stocks were another example. Businesses such as BAE Systems, Rolls-Royce and Rheinmetall were some of the most popular stocks on the AJ Bell investment platform in February, with the latter surging 15% earlier this week.

Analysts at Janus Henderson said this was due to recent macro developments, ongoing geopolitical tensions and US president Donald Trump’s demand that EU countries spend at least 5% of GDP on defence.

Additionally, they noted that some countries have already acted, with the UK pledging to increase defence spending to 2.5% of GDP by 2027, while the incoming German government pledged a €500bn spending project on infrastructure and defence.

Julian McManus, portfolio manager at Janus Henderson, said: “Outside the US, defence has historically been very slow growing. But as geopolitical alliances shift, we expect non-US defence revenues to accelerate, and we think markets are only beginning to catch up to this potential for faster growth”.