Columbia Threadneedle Investments’ Nish Patel has made a raft of changes to the Global Smaller Companies Trust since taking over as lead manager in May 2024, when predecessor Peter Ewins retired. He has in-sourced the Japanese equity allocation, reduced the number of stocks in the portfolio and scaled up the trust’s share buyback programme.

Patel has taken charge at an interesting time for global small-caps – an asset class that has been deeply out of favour but where valuations are attractive relative to large-caps and compared to smaller companies’ own history.

Small-caps globally are trading at a discount of 3.2% compared to their 10-year average 12-month forward price-to-earnings (P/E) ratio, according to Aberdeen. Large-caps, by comparison, are trading at a 20% premium.

The Global Smaller Companies Trust has a market value of £706m and a discount of 11.6% as of 31 January 2025, giving investors a cheap entry point into an undervalued market.

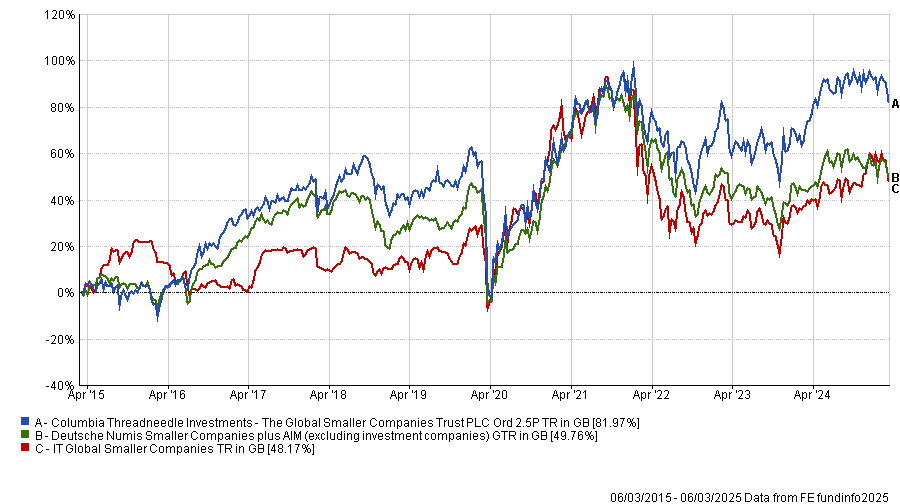

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

Below, Patel explains why this is a buying opportunity for small-caps and why the trust has 20% of its assets in the UK.

What’s your outlook for global small-caps?

Small-caps tend to outperform large-caps over the long term but the asset class has been under severe pressure for quite an extended period. We think that is cyclical.

The relative valuations of smaller versus larger companies are very low and are consistent with great buying opportunities in the past, such as the early 1970s and early 2000s. Small-caps outperformed large-caps for a decade after both of those periods.

We are seeing more merger and acquisition activity within smaller companies and more share buyback activity, particularly in the UK and Europe.

Interest rate cuts have historically been good for smaller companies because they have lower levels of capital availability and more of them are on floating rate debt.

Finally, if you look at the earnings growth trajectory of smaller companies this year, it is an improvement on 2024 whereas the largest companies in the world are seeing a slower growth rate.

Please describe your investment philosophy and process

Small companies are inherently faster growing because they start from a lower base. They tend not to be well known by the investment community initially but as they become more widely recognized, their valuations re-rate.

The problem with smaller companies is they are riskier. What we're trying to offer our clients is the faster growth rate of small-caps, but with lower levels of risk.

We do that by focusing on better quality companies and buying them when they are out of favour, at a significant discount to what they're intrinsically worth. This gives us a margin of safety.

What changes have you made since taking over from Peter Ewins?

We had been using third-party funds to manage our Japanese exposure but Columbia Threadneedle, which acquired our predecessor firm BMO Global Asset Management in November 2021, has a successful Japan team with a good long-term track record.

We insourced half the allocation initially, maintaining Eastspring Investments for the remainder. Our team did a great job so we insourced all our Japan exposure in December 2024.

This move gives our investors access to a very experienced team with a sound investment process and it also lowers costs.

We have also reduced the number of holdings to concentrate on the best opportunities. We think 190 to 200 is about right for a global smaller companies fund, from a universe of more than 8,000 companies. At the end of December we had 199 holdings, down from at least 220 when I took over the trust.

What have been your best and worst performers in the past year?

Boot Barn Holdings, which is the largest retailer of cowboy boots and Western wear in the US, was one of our best performers last year. It offers a far wider selection of products that its mom-and-pop-shop competitors and it stocks private label products as well. Because of its scale, it is able to buy items from suppliers at lower prices. It also invests in loyalty programs and customer relationship systems and has a high degree of customer loyalty.

It is growing its store base throughout the US at about 15% a year and is seeing increased spending from its current customers. There’s scope for profit margins to improve through better pricing and volume discounts from suppliers.

Performance of stock over 5yrs

Source: Google Finance

In Europe we own Accelleron Industries, a Swiss business that manufactures turbocharger units, which reduce the fuel consumption of engines. We bought the shares in 2022 when it was spun off from ABB. As investors subsequently started to recognise the standalone merits of this company, its shares rerated and the multiple expanded.

Performance of stock since spin-off

Source: Google Finance

In terms of poorer performers, we had a position in LKQ Euro Car Parts, which supplies components for recreational vehicles as well as cars. There has been a downturn in the US recreational vehicle market, following the pandemic boom. We've also seen insurance-related repairs slow down. People aren't having their cars repaired because they're worried their insurance premiums would go up.

What regions do you currently favour?

We have almost 20% in the UK, where there are a lot of high quality but very undervalued companies. Meanwhile, in Europe, economic growth may be a bit sluggish but interest rates are being cut and there are some good valuation opportunities.

We are also overweight Japan, where we think corporate governance reform is improving the quality of many businesses. Companies are becoming more shareholder friendly and are returning capital through share buybacks.

Why have you ramped up the share buyback programme?

I wasn't happy with the 17% discount early last year. We had been buying back 5% of shares a year but we have increased that to 10% and the discount has come in. We have a responsibility to our shareholders to get to a 5% target discount, so we're going to carry on with the buyback policy.

What you enjoy doing outside of investing?

Working in investing is quite relentless so you need to find a way to relax. I do a lot of exercise and some meditation. My family and I like to travel and we love trying different foods when we’re abroad.