Despite the popularity of large fund houses, they are far from bulletproof, according to Simon Edelsten, former fund manager at Artemis, who said they can often conflict with their managers, while the need to justify costs and performance has made it challenging for managers to “stick to their knitting” compared to smaller boutiques.

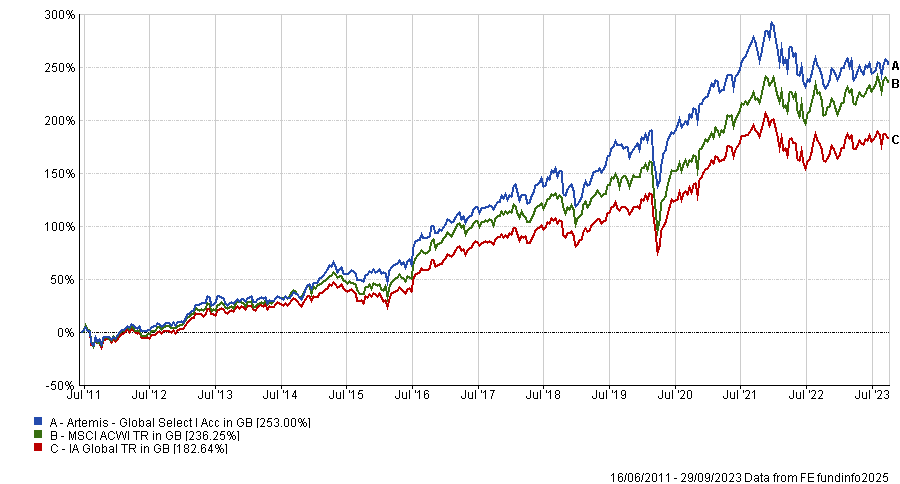

Last year, Edelsten joined four other industry veterans as co-manager of the £81m Goshawk Global fund at the boutique asset management firm, having delivered a 253% return under his 12-year tenure on the Artemis Global Select fund, a performance that beat the MSCI ACWI by more than 15 percentage points.

Performance of the fund during the manager's tenure

Source: FE Analytics

Below, Edelsten tells Trustnet about the benefits of working in a boutique and why the obsession with growth and value investing has pushed fund houses into a corner.

What is your investment process?

The objective of the Goshawk Global fund is to be the best-performing global equity fund in the unconstrained category after costs.

We hope to achieve that by investing in companies that are in control of their destinies on sensible valuations and in a balanced way. The point is we do not think the index is balanced, so we take a more independent view of how to invest money.

What differentiates the fund?

The fact that we are a boutique lets us be more pragmatic than many peers. We have our own money in the fund and get to make our own definitions of things like risk instead of judging it based on how similar we are to the index.

No one else has the kind of expertise we do, with the team having, on average, 32 years of experience. We all have long memories and we recognise that the hardest thing in the market currently is knowing where your place of safety is.

People think you can do this job successfully with a 50-person research department, but you can’t. The boss can stand up at a large fund house and say, ‘We are selling Microsoft where do we put the money?’ but then you have 50 people making different suggestions that you must choose between.

Could you explain your thoughts on growth and value investing?

Consultants have become convinced that you need to be either a growth or a value manager but, to my mind, the public never asked for this and it is the wrong way to run money.

Consultants used to tell me, ‘Make up your mind are you a growth manager or a value manager?’ but sometimes you need to be one, and sometimes you need to be the other. It is not style drift, it’s common sense.

Fund houses and managers have pushed themselves into a corner about their style and made strange decisions about how to run the public’s money. They think that people who have chosen a growth fund want to be in a growth fund even when stocks are expensive but I do not believe that is the case.

What are the challenges of working in big fund houses?

I think the place to start is that most active fund managers have not done a very good job over the past five years and the public has unsurprisingly pivoted towards passives.

Costs have swelled for big firms, so when they see outflows from their funds in favour of passives they start to worry and put their managers under pressure. I have a lot of sympathy for that but in active management you need to underperform if you want to eventually outperform and to do that you need to stick to your knitting.

It is very hard to do that in a big management company because, if you underperform and a stock rises by 50%, someone will tap you on the shoulder and tell you to buy it even though it might be at its peak. Commercial pressures work against fund managers trying to do good jobs.

What was your best call last year?

Spotify and Rolls-Royce were crackers for us, doubling over the past year. Spotify has branched out significantly as a business and is now used a lot by customers for things such as podcasts. It has finally figured out which podcasts do well and stopped wasting money on underperformers, so cashflow is now through the roof.

Rolls-Royce is a classic example of a turnaround story. The company was poorly run and struggled to profit but the new management has done an extraordinary job. It is now a big defence contractor benefiting from events in Europe.

And your worst?

Medtech company Philipps disappointed us last year. It is a good business, but when you look at it historically, it never made that much money. If you go into an NHS hospital it is full of Phillips’ kit but it is all X-ray machines and old-fashioned scanners. It looks clever to us, but it is not high margin, because around 12 other companies do the same thing.

What do you do outside of fund management?

I play quite a lot of bridge. I am always surprised by the amount of other city fund managers I meet on the London bridge circuit.