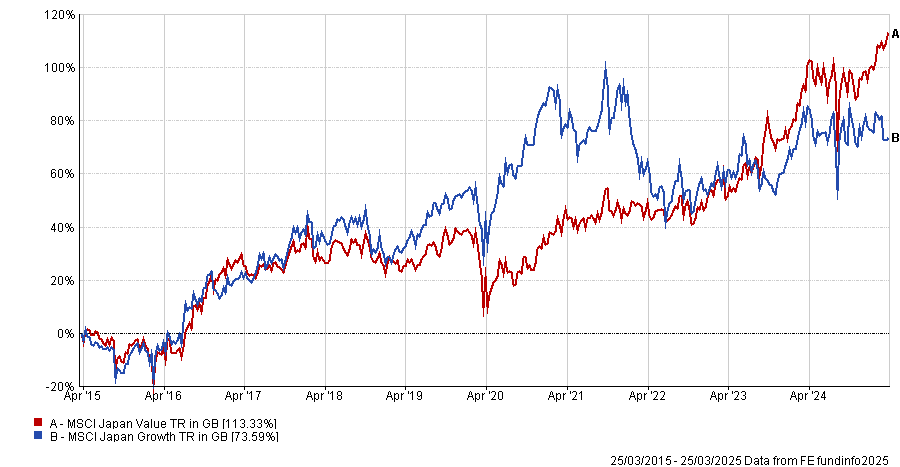

The Japanese equity market has seen dramatic swings in style-based performance in recent years, with times when growth stocks have become far too expensive and value stocks have been too cheap.

This is because growth is rare in Japan so investors pay too much for it, said David Mitchinson, chief investment officer of Zennor Asset Management. And until the recent corporate governance revolution, the market lacked a mechanism for “keeping cheap stocks in line”.

That has changed recently; now companies are buying back shares in meaningful amounts, orchestrating management buyouts or being spurred into action by activist shareholders.

Japanese growth vs value stocks over 10yrs

Source: FE Analytics

Asset allocators have typically coped with style rotation by pairing growth and value funds together but Zennor is attempting to provide a middle ground by pragmatically investing in the best opportunities regardless of style and seeking to capitalise upon corporate action.

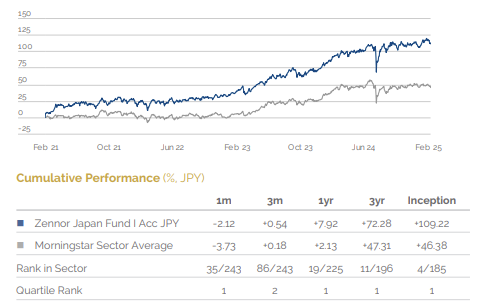

Zennor’s approach of investing in mispriced businesses where there are catalysts for change is working so far. The $737m Zennor Japan fund was the fourth-best performer out of 185 Japanese equity funds since inception on 8 February 2021 through to 28 February 2025.

Performance of trust vs sector since inception

Source: Zennor Asset Management, Morningstar

Below, Mitchinson explains why merger and acquisition (M&A) activity is increasing in Japan and why it is often wise to sell out of an underperforming stock before it falls further.

Describe your investment strategy

Zennor was founded to exploit what we thought would be a profound change in how Japanese companies were organised and run, due to Japan’s corporate governance revolution.

We place a heavy emphasis on governance change, for instance restructuring balance sheets that are far too big for the operating entity, and we’re looking for management teams who are ready and willing to take on the challenge of becoming more efficient.

Zennor co-founder James Salter and I analyse how much an operating business and its balance sheet are worth, then we calculate what an industrial buyer might pay for those assets.

Where we find a big gap between what we think a business might be worth and where the market is, that’s when we start to engage with companies about taking up growth opportunities, reinvesting in the business or buying assets from an inferior operator at a discount to their fair value.

We are looking for companies on a meaningful discount to their intrinsic value with a pathway to realising that value.

What is driving M&A activity and corporate restructuring in Japan?

Many Japanese companies have a core business that is great and a lot of non-core businesses they hold for historical reasons that are rubbish. It’s not the assets or the people that are at fault, it’s just not what the company is good at. Is a software services company the right operator to run a hotel and a golf club? Probably not. There’s a phrase in Japan that encapsulates this point – ‘the best owner’.

Selling off non-core businesses is a long process that will take decades although it is being accelerated by succession planning because inheritance tax is very high in Japan.

An example of corporate restructuring is the Toyota Group, which historically had controlling positions in several companies in its supply chain and those companies also invested in each other. A lot of those positions have been unwound, which is freeing up enormous amounts of capital for these companies to invest and return to shareholders.

Panasonic has a number of outstanding businesses but the last time I looked, it had 32 core business operating units and many more below it. The management team cannot possibly spend a day a month on each major business segment. How can they judge the capital allocation needs of each of those different segments and balance their competing requirements?

In Japan, profits generated by a core businesses often get lost in other parts of the company. This misalignment is why Japanese companies are rewarded by shareholders not for what they have on the balance sheet, but for what they do.

Until companies show they’re going to be good stewards of capital, investors apply a relatively high discount rate to balance sheets because they are worried management teams will do something really stupid with the money.

Frankly, the world is a tough place and you can’t be flabby and unfit with a bloated balance sheet any longer. You’ve got to be lean, mean and focused.

What has been your best-performing stock over the past year?

In our Zennor Japan Equity Income fund, we held a company called Alps Logistics. It was incredibly cheap when we bought it and the balance sheet was very strong.

The company was acquired last year after a series of bidding rounds, which pushed the share price up to ¥5,600 to ¥5,700 by the middle of 2024, from ¥1,600 at the end of 2023.

This illustrates the massive gap between what acquirers think they can generate from assets and what companies themselves have historically delivered. It’s quite clear that the people buying Alps Logistics had a completely different concept of how that business could be run, which meant they were willing to spend a very large amount of money to buy it.

And your worst investment?

That was Skymark Airlines, which is the only low-cost carrier with meaningful capacity at Haneda Airport in Tokyo. You can fly into Haneda from anywhere in Japan and fly out to everywhere globally and a lot of Japanese people traveling to and from Tokyo use Skymark.

What we underestimated was that airlines are machines for burning dollars. Plane parts, maintenance and fuel are all priced in dollars and as the Japanese yen weakened, Skymark’s cost base got worse and worse, and its margins were squeezed.

Its revenues are in yen because it’s a domestic airline. If the yen were ever to significantly strengthen, Skymark would be a massive winner, but we didn't want to try to forecast the yen so we sold it.

The thing we did right was not doubling down because it has fallen further since then. One of my old bosses used to walk around the office singing ‘the first cut is the cheapest’. I think his point was: if it's not working, stop doing it. Do more of what is working instead.

What do you enjoy doing outside of investing?

I’ve rashly signed up to a two-day race in Slovenia in May, which will involve running about 60km each day.