It is a volatile time in global markets, as investors are being forced to navigate trade uncertainty, recession fears and cracks in the dominance of artificial intelligence stocks.

As Jason Hollands, managing director at Bestinvest, explained: “risk appetite has pulled back enormously over the past month with the correction in the S&P 500 since its peak on 19 February”.

However, as the end of the financial year approaches, investors looking to maximise their £20,000 ISA allowance might benefit from being more adventurous, he said.

“It is impossible to guess whether the market will (or already has) reached a trough, but history suggests that long-term investors can do well by being brave and putting new cash to work when markets are falling.”

Below, experts identified funds in asset classes such as smaller companies and gold which are poised to do well in an uncertain market environment, while offering something substantially different compared to the average global equity fund.

IFSL Marlborough Global Innovation

Darius McDermott, managing director at FundCalibre, pointed to IFSL Marlborough Global Innovation as an adventurous play on the global market.

Manager Guy Feld focuses on fast-growing smaller companies, with around 50% of the fund invested in small-caps, particularly technology. “You are not buying Nvidia, but rather the company that supplies the company that supplies Nvidia,” McDermott said.

While smaller companies have been out of favour recently, “history suggests they tend to outperform over the long term”, he said. However, investors need to be comfortable with volatility because smaller companies have much higher risks because of their potential for greater rewards, he pointed out.

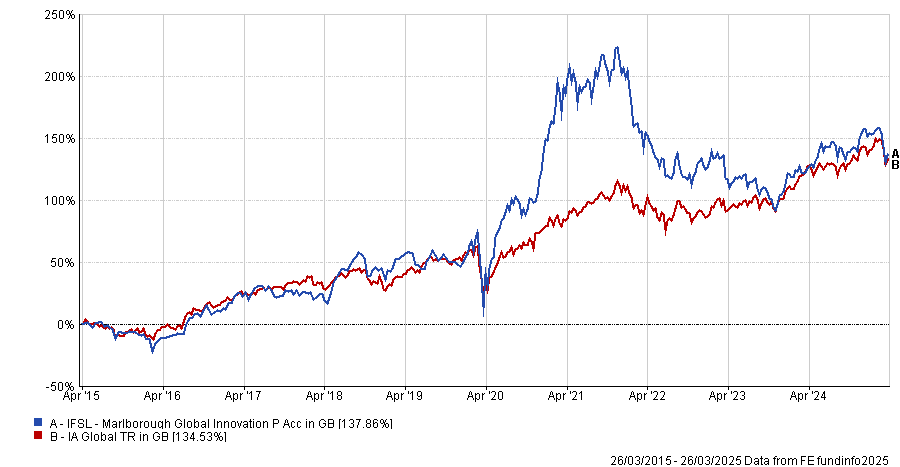

Over the past decade, the fund is up 137.9%, a third-quartile result. It delivered another third-quartile performance over five years but slid into the bottom 25% of the sector over three years.

Performance of fund vs sector over 10yrs

Source: FE Analytics

However, when volatility was high, the fund came into its own and posted top 10 results in the IA Global sector in 2018 and 2020, when trade wars and the pandemic shook investor confidence.

McDermott concluded that its adventurous approach made for an excellent satellite holding and an appealing last-minute addition to investors' ISA.

WS Gresham House UK Smaller Companies

Paul Angell, head of investment research at AJ Bell, identified the WS Gresham House UK Smaller Companies fund as an interesting option.

“Gresham House might be less well known in the IA UK Smaller Companies sector than some of its larger peers, but the performance of this fund since its inception in 2019 has started to attract more interest,” he said

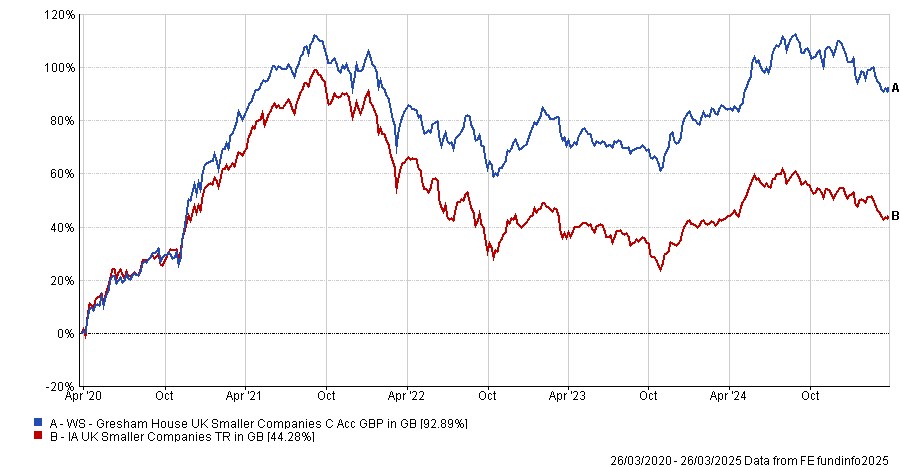

Led by Ken Wotton since 2019, the fund has delivered a top-quartile return of 92.9% over the past five years, the fifth-best result in the peer group. It has also delivered top-quartile results over the past one and three years.

Performance of fund vs sector over 5yrs

Source: FE Analytics

It was a recent addition to AJ Bell’s best buy list, with Angell praising Wotton’s private equity background as a key differentiating factor.

Wotton and his team seek to understand the “fair market value of companies” by going beyond company reports and meetings with the management teams to get a perspective that competitors may lack.

They do this by cooperating with a “large network of external contacts and analysts” who have insights into the industry that the managers cannot get alone, leading to a very differentiated and adventurous approach to stock selection, Angell said.

Ninety One Global Gold

For investors who want to diversify away from global equities, Chris Metcalfe, chief investment officer at IBOSS, found Ninety One Global Gold compelling.

Since the global financial crisis, US growth stocks have dominated at the expense of other asset classes. As a result, attempts to diversify “no matter how sensible” led to lower returns and higher volatility, he explained.

However, “we realised that at some point, momentum-driven growth markets would end”. As Trump destabilises “not just the US, but global economic policy”, central banks will continue to buy record amounts of gold as a risk-free asset, making the Ninety One fund an excellent choice for investors hoping to play on market instability, Metcalfe explained.

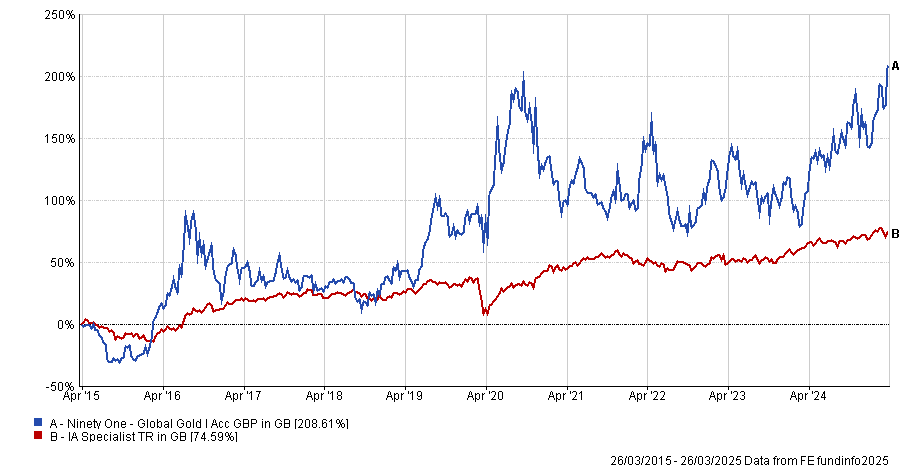

Managed by FE fundinfo Alpha Manager George Cheveley, it returned of 208.6% over the past decade.

Performance of fund vs sector over 10yrs

Source: FE Analytics

“The explicit volatility of the fund is very high and the drawdowns are extremely large compared to global equity funds”, Metcalfe warned. Indeed, the fund had a 10-year maximum drawdown of 42.6%, while the average IA Global fund had a drawdown of just 21.6% over the same period.

Despite this adventurous approach, Metcalfe argued the fund would decrease the overall volatility of investors' ISAs by providing diversification.