The end of the financial year and ISA season are just days away, leaving many investors scrambling to make last-minute additions to their portfolios.

While investors might have a range of concerns when choosing funds for their ISAs, research from Fidelity International has found that generating more income is the primary goal for 39% of investors.

To this end, Tom Stevenson, investment director at Fidelity, said: “With the right investments, your ISA can become a powerful source of additional income, helping you meet your financial goals and secure your financial future.”

Below, he identified four income funds and trusts for income-focused investors.

M&G Corporate Bond

Stevenson explained that bonds are a common way for investors to earn income, offering predictable yields at lower levels of volatility than equities.

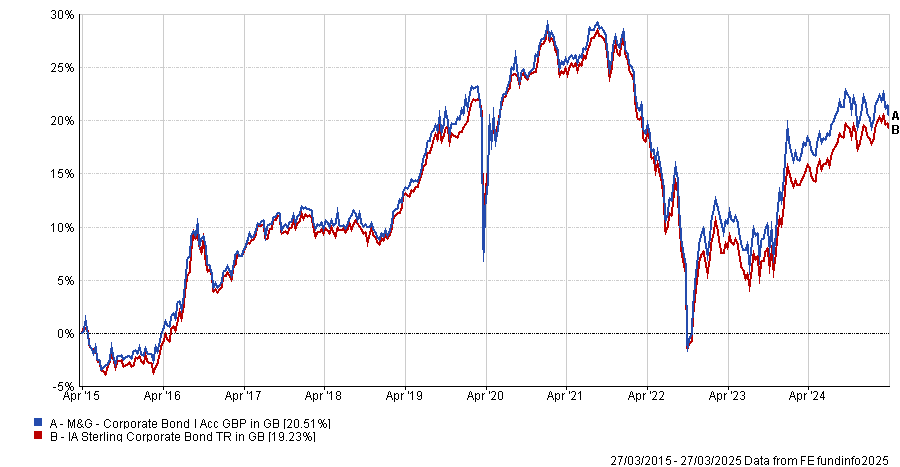

He suggested the M&G Corporate Bond fund, led by FE fundinfo Alpha Manager Richard Woolnough. Over the past decade, it is up by 20.5%, with second-quartile results over the past five and three years.

Performance of the fund vs sector over 10yrs

Source: FE Analytics

The fund primarily invests in lower-risk companies and holdings, with around 70% of the portfolio allocated to investment-grade bonds. However, Stevenson noted that the portfolio was heavily impacted by “changes in inflation and interest rate expectations”.

Indeed, over the past decade, the fast-changing market environment caused the fund to slide to the third-quartile for volatility.

Nevertheless, it remains popular amongst experts, with analysts at Square Mile highlighting Woolnough’s “skills in macroeconomic analysis and managing risk factors”, along with his stringent investment process.

Fidelity Global Dividend

Dividends are another common way for investors to garner income and although shares usually offer lower initial yields than bonds, they have more potential for both dividend growth and capital gains.

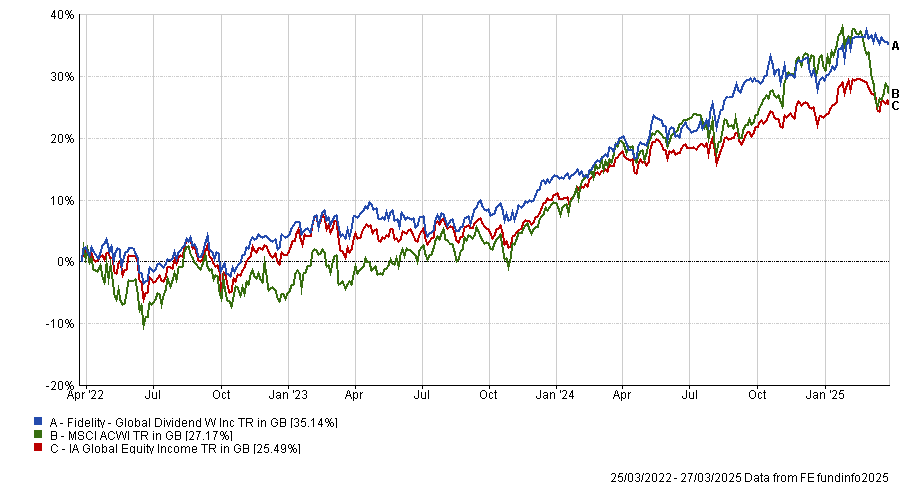

Stevenson identified the Fidelity Global Dividend fund, managed by Daniel Roberts since 2012, as a compelling option for equity income investors. It currently has a dividend yield of 2.54%, which is in the lower half of the peer group.

Over the past three years, the fund delivered a top-quartile return of 35.1%, beating the MSCI ACWI.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

“The fund has a conservative approach, focussing on stocks with predictable, consistent cash flows and simple, understandable business models,” Stevenson explained.

Roberts also applies a strict valuation discipline, which has led to a portfolio with extremely low turnover and less than half the volatility of the MSCI ACWI, he said. Indeed, over the past decade, it had the fourth lowest volatility in the sector at 11.7%, making it a relatively stable option.

The fund is also popular with the FE Investments team, who explained that Roberts is a high-conviction manager, willing to make large sector and country bets, which have generally paid off.

Analysts said: “Roberts' approach is not necessarily unique, but his willingness to ignore market noise and stick to his strategy has led to success”.

Ninety One Diversified Income

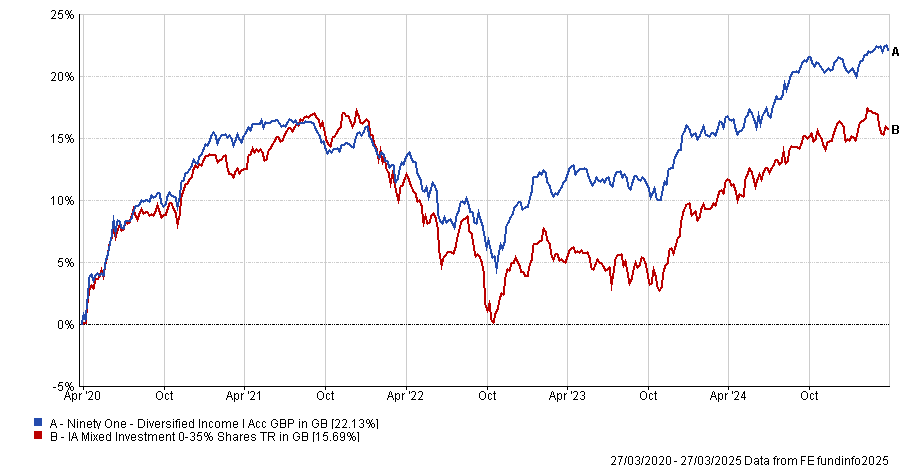

For investors who want to add a multi-asset income fund to their portfolio, Stevenson pointed to the Ninety One Diversified Income fund. It offers investors a broad mixture of bonds, dividend-paying shares, infrastructure and property assets, which makes it an effective “one-stop-shop”.

Managers Jason Borbora-Sheen and John Stopford have proven their skill over the medium term, with a return of 22.1% over five years, the 10th best performance in the peer group.

Performance of fund vs sector over 5yrs

Source: FE Analytics

The fund currently has a dividend yield of 4.25%, the sixth-highest yield in the whole sector, but it aims to keep risk to less than 50% of the FTSE All-Share. The managers have broadly achieved this goal, with an annualised volatility of around 5.6% between 2019 and 2024, making it one of the lowest-risk strategies in the sector, Stevenson said.

“The managers have successfully limited capital losses while providing a steady yet growing income”, he concluded.

International Public Partnerships

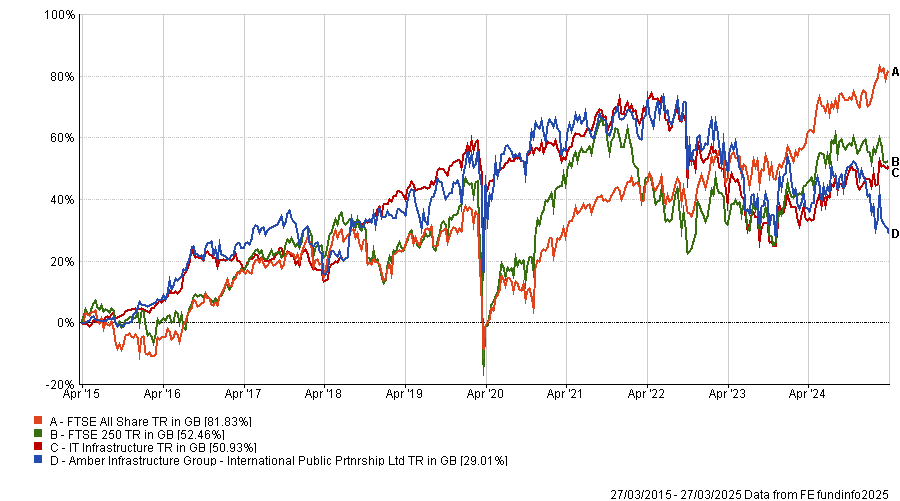

Finally, Stevenson urged investors to not forget about “less mainstream options” such as the International Public Partnerships Trust, which focuses on infrastructure-related holdings.

While its 10-year return of 29% was only a third-quartile result, it currently has a dividend yield of 7.6%, better than what investors can currently receive from bonds.

Performance of trust vs sector and benchmarks over 10yrs

Source: FE Analytics

“It owns essential, low-risk assets such as schools and hospitals, transport and renewables that tend to be held in partnership with the government and subject to long-term contractual arrangements,” he explained. As a result, cash flows tend to be highly predictable, making it a reliable income strategy for investors' portfolios.