Investors are always trying to find opportunities to make money and ‘buying the dip’ is an established behaviour for many. As Warren Buffett said: “Be greedy when others are fearful”.

After Trump’s announcement of ‘reciprocal’ tariffs on 2 April sparked market turmoil, interactive investor recorded its highest-ever trading volumes on Monday 7 April, with more buys than sells over the course of the seven days (61% of trades were purchases, 39% sales).

This suggests investors are viewing the dip as a buying opportunity rather than heading for the exit, according to Myron Jobson, senior personal finance analyst at interactive investor.

“Despite the market jitters sparked by Trump’s tariff threats, our customers have remained net buyers, looking past the short-term noise and viewing recent market weakness as a buying opportunity rather than a reason to retreat,” he said.

However, not every ‘dip’ justifies greed, according to Dmitry Solomakhin, manager of the Fidelity FAST Global fund.

“Buying the dip is ingrained particularly in retail investors and this is may not always be correct. In fact, it probably won’t be correct,” he said.

“The fact that the share price has declined a lot is not necessarily a good reason to buy a stock. We need to do proper fundamental research and work out what the intrinsic value of the business is in different economic scenarios and only then consider investing. The famous saying goes ‘a stock that has declined 90% can always decline another 90%’.”

For example, investors were bullish on renewable energy names not too long ago. If they had invested in US-listed solar installer Sunnova in 2021, they would have paid around $35 per share. If they decided to buy the dip in 2022, they would have paid $20 per share; if they bought the further dip in 2024 it would have been at $5 per share. Today, they would own a penny stock “most likely going bankrupt”, according to Solomakhin.

“Buying the dip without doing proper fundamental work is a bad idea, and in a worst-case scenario, you can lose everything. You want to buy the dip for a good reason. If you’re doing it because you refreshed your assumptions, by all means buy the dip, but you must accept that you might be sitting on this dip for a long time,” he explained.

This is what happened in 2008, which was the last ‘proper’ bear market, according to Simon Evan-Cook, manager of the Downing funds-of-funds range.

“In the bear market of 2008, which lasted for almost two years, there were plenty of opportunities to ‘buy the dip’. Doing so looked right for a short period of time as markets rallied back, but they were then met with even more severe sell offs,” he said.

This resulted in what the manager called “dip-buying fatigue”, meaning that when the last dip finally did arrive, few had the appetite to have another go at it.

“If you are doing it, perhaps consider pound-cost averaging in and be mentally prepared for this not bouncing straight back in the way it has over the past 15 years,” Evan-Cook said.

Darius McDermott, managing director at Chelsea Financial Services, shares his concerns. “With uncertainty still peaking, it’s important to keep some firepower in reserve,” he said.

Given that volatility is likely to continue and markets could possibly move lower from here, Alex Watts, senior investment analyst at interactive investor, reminded investors of the well-known adage that “the best investment outcome is achieved through time in the market, not timing the market”.

For investors seeking peace of mind rather than a quick buck, Watts suggested looking at conventional defensive assets such as bonds, golds and healthcare stocks, as well as minimum volatility strategies, which have historically shown better average returns than high volatility stocks over time.

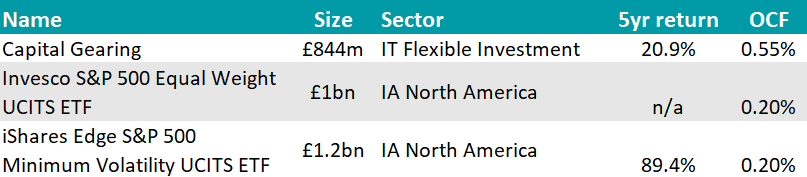

A good option in this space, he said, is the iShares Edge S&P 500 Minimum Volatility exchange-traded fund (ETF). It tracks the performance of an index composed of selected companies from S&P 500, which collectively exhibit lower volatility than the broad stock market, while maintaining characteristics such as sector and factor exposure that are similar to the S&P 500.

“If you're invested in funds that track the S&P 500 index, your portfolio may be too concentrated and greatly impacted by fluctuations in large-cap tech stocks,” he pointed out.

For this reason, he would enhance diversification and reduce concentration at both the stock and sector level through the Invesco S&P 500 Equal Weight ETF, which “offers unique core exposure to US blue-chip stocks in the S&P 500 with lesser concentration risk”.

The fund is designed to reflect the US large-cap equity market whilst taking a size-neutral approach and covers approximately 80% of the available market.

Finally, more cautious investors could consider multi-asset funds such as Capital Gearing trust, whose objective is capital preservation, Watts added.

Source: FE Analytics