Last week US stocks entered into a brief technical bear market after US president Donald Trump’s ‘Liberation Day’ tariffs sent markets spiralling. With a pause later announced, markets have recovered somewhat but investors looking for good news may also need to hold their enthusiasm, as we are not out of the woods.

A US-China trade war, the resumption of tariffs after the 90-day pause and a failure to get deals done with the US government are all real risks that could cause more uncertainty in the coming months and drag markets lower.

As such, Trustnet looked at where in the equity market investors may wish to put their cash should the current turmoil continue.

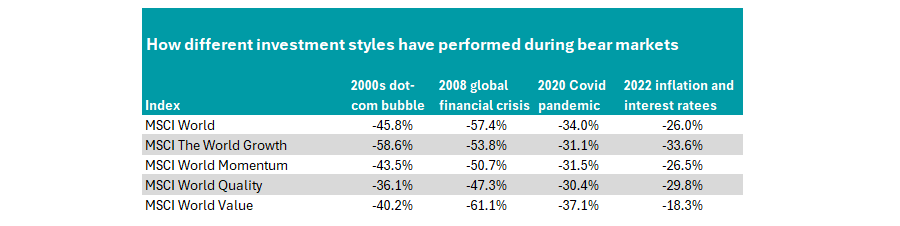

There have been four major bear markets since the turn of the century: the dot-com bubble, the financial crisis, the Covid slump and the inflation-inspired sell-off in 2022.

We compared different equity investment styles during all of these periods. There were growth, momentum, value and quality. We also included the broad MSCI World index as a comparable benchmark.

In all bar one of these periods, the best place investors could have put their cash was in quality stocks, as the below table shows.

The only exception was in 2022, when rapid interest rate hikes by central banks forced by rocketing inflation meant value stocks were the place to be. This bucket includes a lot of energy and mining companies, as well as banks and other financials. The former benefited from rising prices while the latter bounced due to increasing rates.

Source: FE Analytics. To get these figures we have compared the performance of the MSCI World indices in US dollar terms as currency fluctuations impact the results heavily if converted to sterling terms. The trends remain the same, however.

Sam Buckingham, founder of Buckingham Research and former investment manager at Aberdeen, said: “To understand why quality stocks tend to perform well during bear markets it helps to look at how they’re defined. MSCI, for example, identifies three key metrics: (1) low earnings variability; (2) high return on equity; and (3) low debt to equity.

“Low earnings variability means the company’s income stream is stable and less exposed to external shocks, e.g. swings in commodity prices or shifts in the economic cycle. This often leads quality indices to lean more heavily into sectors such as consumer staples and healthcare, which tend to be more resilient when the economy slows.”

Peter Toogood, chief investment officer at adviser centre research, agreed, but noted that companies with strong balance sheets and repeatable, predictable earnings could also apply to companies such as tobacco stocks and defence businesses.

“It also favours large companies as they tend to have more diversified businesses and access to capital even in tough times,” he said.

Is now the time to tilt to quality?

Buckingham said most bear markets are either caused by a recession or by fears that one is on the way. Data from the Bank of America’s fund manager survey yesterday revealed a net 42% of investors now expect a global recession, which is the most since June 2023 and the fourth highest level of the past 20 years.

In these conditions, cyclical sectors such as energy or mining typically underperform, while more stable, predictable businesses tend to hold up better.

“The other two metrics (high return on equity and low debt) are also crucial. In bear market conditions, companies with strong profitability and cleaner balance sheets are more likely to ride out the storm, which reassures investors and helps support their share prices,” he said.

“If you think there is a material probability we are heading for a bear market, then increasing your exposure to quality within your equity exposure would be sensible.”

Jason Hollands, managing director at Bestinvest, said we could be entering into a period when the performance of funds focused on quality companies improves.

These funds have been out of favour as they have largely missed the artificial intelligence (AI) boom of the past two years and therefore have not participated in surging commodity markets.

If markets wobble, these stocks could prove to be havens in tough times, as they have not shot the lights out in recent years (so valuations may be less stretched than other areas), which could attract nervous investors.

However, it is not completely cut and dry. He added that it is too early to be “definitive” about this given “ongoing uncertainties about the end state for US tariffs”.

“Quality-focused managers often have high weightings to branded consumer goods companies, which might be adversely impacted by tariffs, whereas funds with higher exposure to services rather than goods are going to be less directly exposed to tariffs,” he said.

The experts’ favourite quality funds

Toogood said the likes of Nick Train and Terry Smith – two of the most well-known quality-growth managers in the UK fund management industry who run Lindsell Train Global Equity and Fundsmith Equity respectively – “will tend to outperform the market as investors avoid all things cyclical”.

But he said they are just two names among global funds that would do well. He also highlighted JOHCM Global Opportunities and Fidelity Global Dividend.

“James Thomson on the Rathbone Global Opportunities fund has defended his growth portfolio well by raising the weighting to ‘growth’ stalwarts while Orbis Global Equity remains the differentiated relative value play at this point,” he added.

Buckingham said he “would not focus solely on Train and Smith”, as there are “plenty of strong funds out there that provide exposure to high-quality stocks.

Evenlode was his pick, with the firm offering both the Global Income and Global Equity options for investors who either do (or do not) need dividends.

For Hollands, Evenlode Global Income also stood out, as did Brown Advisory Global Leaders and Morgan Stanley Global Quality.