Committing to ISAs early in the tax year to give assets the maximum time to deliver is an ingrained habit amongst ISA millionaires, regardless of what direction the stock market is headed. Indeed, almost a third of Hargreaves Lansdown’s ISA millionaire clients topped up their ISAs in the first two weeks of the tax year, despite the ‘Liberation Day’ market sell-off.

Victoria Hasler, head of fund research at Hargreaves Lansdown, said: “ISA millionaires know the importance of compounding. They have heard and understood that old investing adage that it’s not timing the market, but time in the market that matters. When they got their new ISA allowance at the start of the year, many took advantage of it straight away.”

Nevertheless, she conceded that the amount of ISA millionaires committed in the first two weeks of the tax year had fallen by 4% compared to 2024/2025.

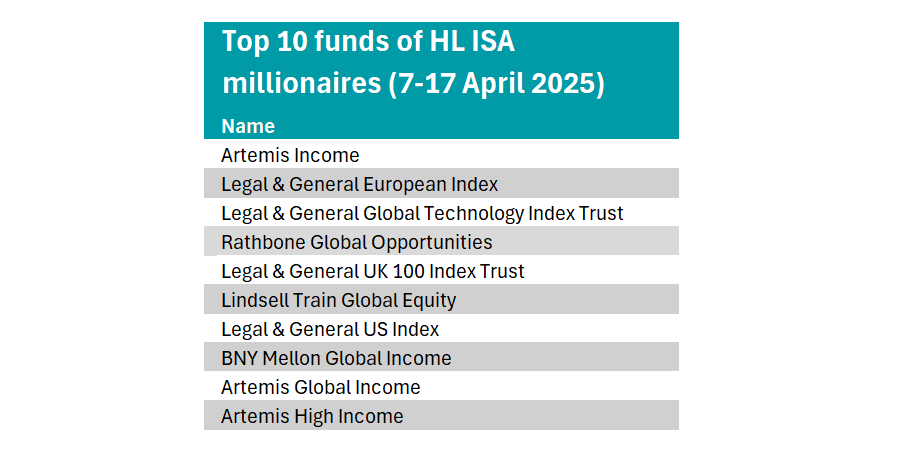

Actively managed funds were ISA millionaires’ preferred destination, comprising six of the top 10 funds purchased by early birds this month.

Three of the top 10 funds were equity income strategies (Artemis Income, Artemis Global Income and BNY Mellon Global Income), complemented by Artemis High Income – a bond fund that can invest up to 20% in shares.

Artemis Income is managed by FE fundinfo Alpha Manager Adrian Frost and has delivered top-quartile results over the past one, three and five years, never ranking outside of the top 10 strategies in the IA UK Equity Income sector during these periods.

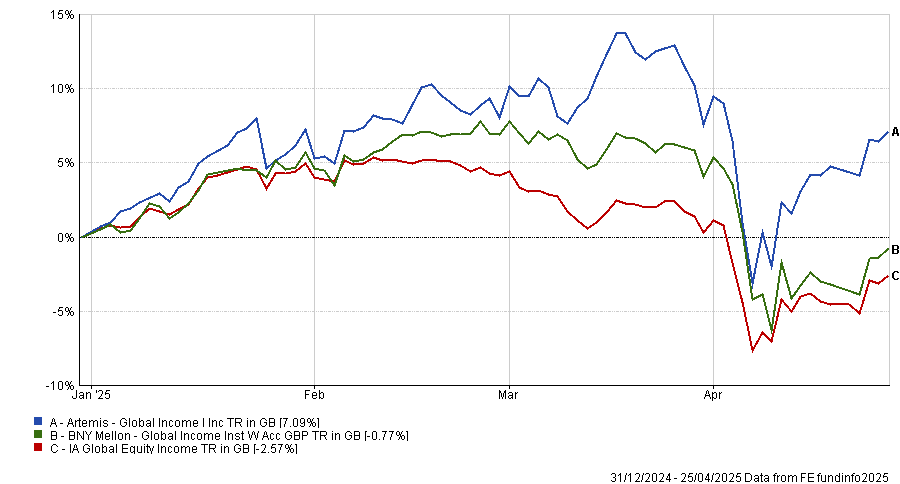

In the IA Global sector, Artemis Global Income and BNY Mellon Global income have delivered first and second-quartile results respectively over the past one, three and five years. Year-to-date, both have beaten the average peer in the IA Global Equity Income sector, however the BNY strategy has slid 0.8%.

Performance of funds vs sector year-to-date

Source: FE Analytics

ISA millionaires chose another two actively managed global equity strategies: Rathbone Global Opportunities, managed by Alpha Manager James Thomson, and Lindsell Train Global Equity, led by veteran manager Nick Train.

Source: Hargreaves Lansdown

Two of the top 10 were UK equity strategies: Artemis Income and the Legal and General UK 100 Index Trust. “Maybe ISA millionaires can now see value in the UK market,” Hasler said.

Additionally, high-yielding UK stocks such as AstraZeneca, Shell and BP were some of the most popular purchases for ISA millionaires who invest in shares directly.

Source: Hargreaves Lansdown