Global equities, commodities and tech stocks are some of the sectors where being in the ‘right’ fund is making a significant difference to returns in 2025, Trustnet research suggests.

No-one needs reminding that markets have been volatile this year, after they tanked on fears around trade tariffs and an economic slowdown, only to make up lost ground when US president Donald Trump delayed the imposition of some of the higher levies.

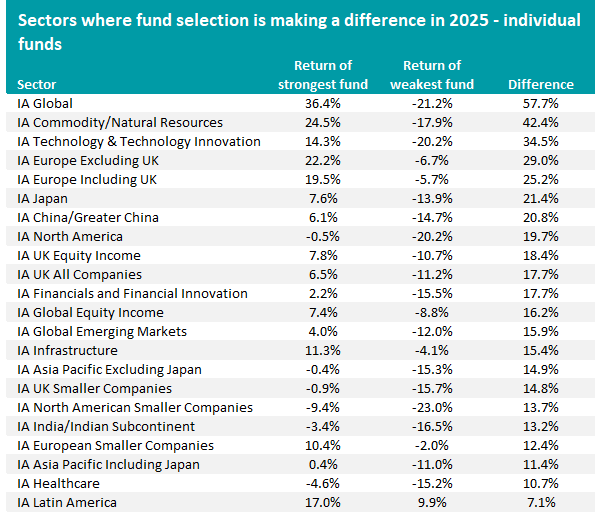

Against this uncertain backdrop, the difference between the funds with the strongest returns and those with the weakest has been stark. Trustnet therefore looked across the Investment Association’s 22 equity sectors to find out where fund selection has been particularly important this year.

Source: FE Analytics. Total return in sterling between 1 Jan and 29 Apr 2025

Starting with individual funds and it’s the IA Global sector where there has been the largest performance gap between the best and the worst of over the year to date.

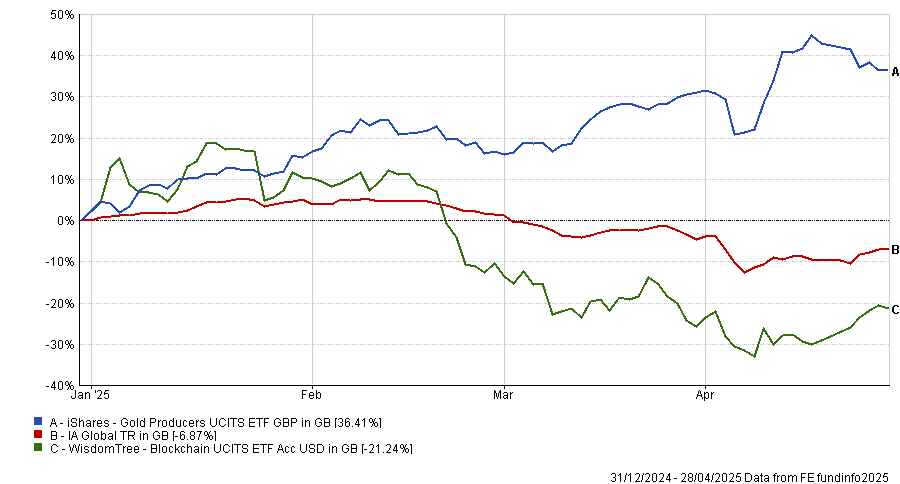

The strongest fund in the sector is also the best-performing fund of the entire Investment Association universe: iShares Gold Producers UCITS ETF, which has made a 36.4% total return since start of the year. In contrast, WisdomTree Blockchain UCITS ETF is down 21.2% – resulting in a 57.6 percentage point gap between the best and worst IA Global funds this year.

Performance of iShares Gold Producers UCITS ETF vs WisdomTree Blockchain UCITS ETF in 2025 to date

Source: FE Analytics. Total return in sterling between 1 Jan and 29 Apr 2025

The reason behind this dynamic is obvious. Gold – and by extension the funds offering exposure to it – has surged in 2025 as trade tariffs and macroeconomic worries pushed investors into safe havens. Cryptocurrencies and blockchain technology, on the other hand, have tanked as investors dropped more speculative assets.

In IA Commodity/Natural Resources, WS Charteris Gold & Precious Metals’ 24.5% gain is 42.4 percentage points ahead of GMO Resources UCITS’ 17.9% loss. This is the recent strength of gold versus weakness in energy commodities and industrial metals (where the bulk of GMO Resources’ portfolio is invested).

Over in the IA Technology & Technology Innovation sector, SSGA SPDR MSCI Europe Communication Services UCITS ETF is the standout winner with a 14.3% return – the only fund to make a positive return. Some of its largest holdings, such as Spotify Technology, Orange and Telefonica have gained around 30% this year.

WisdomTree Artificial Intelligence UCITS ETF is the worst performer, some 34.5 percentage points behind the best fund. It has lost 20.2% this year, as investors fled from artificial intelligence stocks on concerns over over-valuation and competition from cheaper Chinese models.

The IA Latin America sector is the only peer group where the gap between the best and worst funds is in single digits; it’s also the best-performing sector this year, on average. BlackRock GF Latin American has made 17% while Liontrust Latin America is down at the bottom of the table with a 9.9% loss.

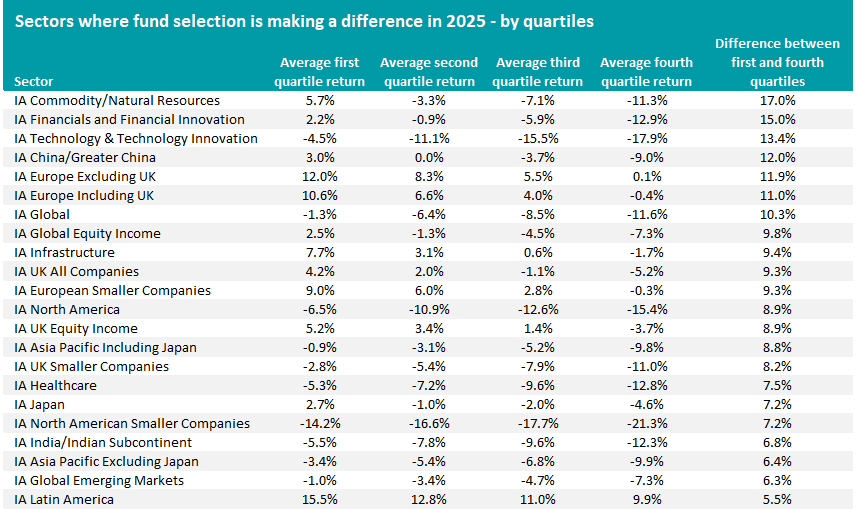

Of course, the difference between the individual best and worst funds can be skewed by particularly strong or weak outliers, so the following table shows the average performance of each quartile in the equity sectors.

Source: FE Analytics. Total return in sterling between 1 Jan and 29 Apr 2025

Looked at like this, IA Commodity/Natural Resources comes in first place as there’s a 17 percentage point gap between the average first quartile fund and the average bottom quartile fund. Joining WS Charteris Gold & Precious Metals in the first quartile are the likes of WS Amati Strategic Metals, JPM Natural Resources and BlackRock World Mining.

Only the Charteris and Amati funds have achieved total returns of more than 20%, reflecting the strength of gold. JPM Natural Resources and BlackRock World Mining are up between 2% and 3% but the other four funds in the top quartile have made small losses (2% or less).

That’s a much better picture than IA Commodity/Natural Resources’ bottom quartile, where falls range from 8.5% to 17.9%. GMO Resources UCITS, Pictet Clean Energy Transition, Pictet Timber, iShares Oil & Gas Exploration & Production UCITS ETF and iShares Global Timber & Forestry UCITS ETF are all on double-digit losses.

In the IA Financials and Financial Innovation sector, ranked second, the four funds in the top quartile are Jupiter Financial Opportunities, Jupiter Global Financial Innovation, JGF-Jupiter Financial Innovation and Janus Henderson Global Financials. They are the only funds in positive territory, returning over 2% year-to-date and tending to invest heavily in banks.

The bottom quartile, meanwhile, comprises Guinness Global Money Managers, Wellington FinTech and T. Rowe Price Future of Finance Equity. The Guinness fund concentrates on asset managers, which have struggled due to short-term market volatility as well as long-term structural trends, while the other two have more exposure to fintech stocks.

The IA Technology & Technology Innovation sector has a 13.4 percentage point difference between the average top and bottom quartile funds.

As noted earlier, only SSGA SPDR MSCI Europe Communication Services UCITS ETF is on a positive return this year. Close FTSE techMARK, SSGA SPDR MSCI Europe Technology UCITS ETF, SSGA SPDR S&P US Communication Services Select Sector UCITS ETF and Invesco Cybersecurity UCITS ETF are some of the sector's better performers with losses ranging from 4% to 7.5%.

All of the sector’s fourth quartile have fallen more than 16% with the worst performers being WisdomTree Artificial Intelligence UCITS ETF, WisdomTree Cloud Computing UCITS ETF, Liontrust Global Technology, Invesco Artificial Intelligence Enablers UCITS ETF and iShares S&P 500 Information Technology Sector UCITS ETF.

Even in some sectors where average returns are high, fund selection is proving to be important. IA Europe Excluding UK and IA Europe Including UK are some of the strongest peer groups in 2025 but it’s worth keeping in mind that while the average top-quartile fund has made 12% and 11% respectively, their bottom quartiles have been flat.

iShares EURO Dividend UCITS ETF, Artemis SmartGARP European Equity, SSGA SPDR MSCI Europe Financials UCITS ETF, Invesco EURO STOXX High Dividend Low Volatility UCITS ETF and SSGA SPDR MSCI Europe Utilities UCITS ETF are the European equity funds with the highest returns, all making 17% or more this year.

Premier Miton European Opportunities, New Capital Dynamic European Equity, BlackRock Continental European, Allianz Europe Equity Growth Select and Comgest Growth Europe Opportunities, however, are at the bottom of the table and have all made losses.