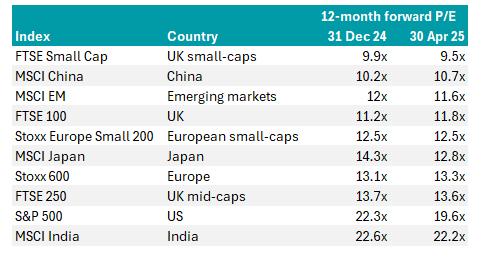

Small UK companies are even cheaper than Chinese stocks, while UK large-caps are the cheapest of any developed market.

Despite the FTSE 100’s strong performance this year, its 12-month forward price-to-earnings (P/E) ratio of 11.8x was only just above emerging market stocks (11.6x) as of 30 April 2025, data from AJ Bell reveals.

Valuations of major stock markets, Apr 2025 vs Dec 2024

Source: AJ Bell, LSEG

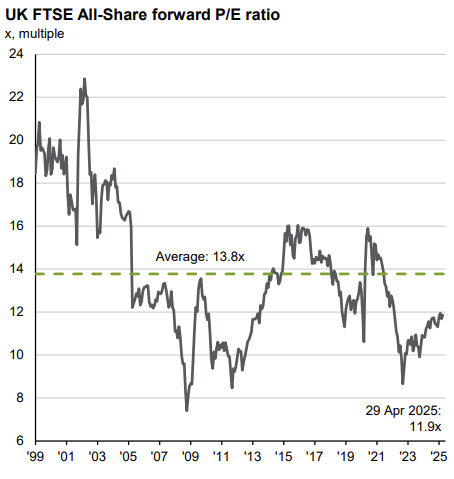

The UK is still cheap relative to its own history as well, as the chart below illustrates.

Source: FTSE, IBES, LSEG Datastream, J.P. Morgan Asset Management. Forward P/E ratio is price to 12-month forward earnings, calculated using IBES earnings estimates. Shiller cyclically adjusted P/E (CAPE) is price-to-earnings ratio adjusted using trailing 10-year average inflation-adjusted earnings. P/B ratio is price-to-book ratio.

William Lough, a global equity portfolio manager at River Global, is particularly excited about the opportunity in “de-rated, high-quality small and mid-caps”.

“While much of the focus can often be on the very cheapest companies (so-called ‘deep value’) or the attention-grabbing high-growth companies, the best bang for your buck today is in companies such as Howden Joinery, with unassailable competitive advantages and trading at trough valuation multiples compared to the past decade,” he said.

The FTSE 100 is currently enjoying a revival. At the time of writing on Friday 2 May, it was on track to achieve a three-week unbroken run of gains, according to Neil Wilson, UK investor strategist at Saxo Markets.

Valuations tend to mean revert over the long term although it is hard to predict when that will happen or to pinpoint a catalyst, said James Klempster, deputy head of multi-asset at Liontrust. The UK has been cheap for some time, so he was confident valuations would adjust eventually.

Ultimately, what the UK equity market needed to spark a rally was more buyers than sellers, he continued. As investors have moved out of the US and sought a new home for their money, the UK has been a beneficiary.

The land of the rising sun

Yet the UK does not have a monopoly on cheapness and fund managers are finding attractive valuations in several other countries.

Liontrust gives regions a score out of five based on their valuations as well as other quantitative and qualitative metrics and the UK has a four, but so do Japan, Asia ex-Japan and the emerging markets.

In fact, Arun Sai, senior multi-asset strategist at Pictet Asset Management, argues that the world’s cheapest developed market is not the UK at all, but Japan.

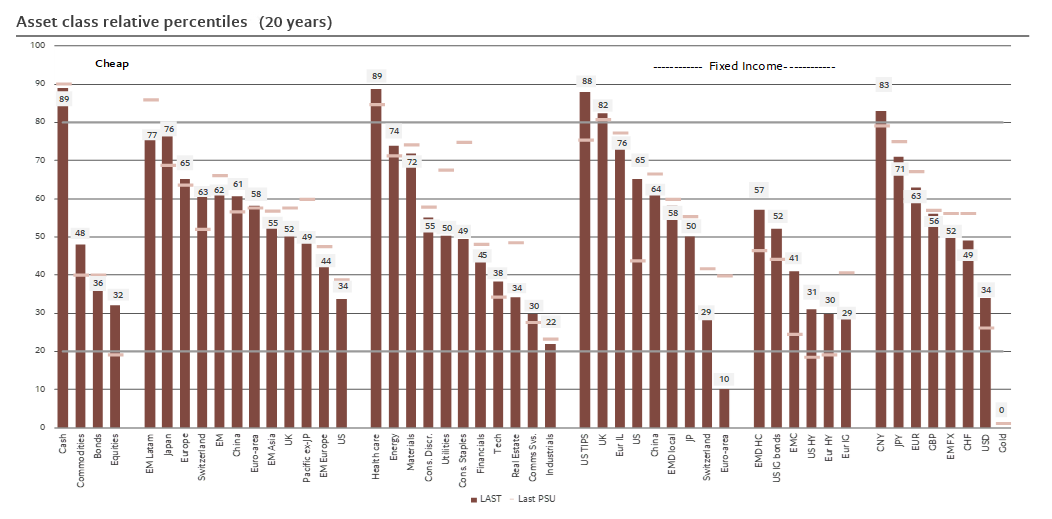

Pictet uses a relative valuation framework to ascertain whether regions usually trade more expensively relative to other markets than they are currently doing. The framework has a 75% weighting to fundamentals (an average of price-to-book, 12-month P/E, P/E on trend earnings, price to sales, P/E to growth ratio and equity risk premium) then 25% consists of a tactical deviation-from-trend measure. These factors are tracked over a 20-year window and expressed as a percentile.

Japan has traded more expensively relative to other markets on the above measures for 76% of the time in the past 20 years, so it has a score of 76. The only region with a higher score – indicating it is even cheaper – is Latin America.

Relative valuation scores for asset classes and regions

Source: Refinitiv DataStream, Pictet Asset Management, as at 24 Apr 2025

Ben Seager-Scott, chief investment officer at Forvis Mazars, said Japan is the first place he would hunt for value.

“Japan is looking particularly cheap on a valuations basis and having endured several lost decades, does show signs of sustained (needed) inflation and economic growth, which really kick-started after the Covid-19 pandemic,” he explained.

Lough agreed: “We like the opportunity in Japanese equities, particularly cash-rich smaller companies. Japan is home to many companies which dominate under-the-radar niches, allowing them to earn attractive margins.

“We think the catalyst of corporate change, driven by the Tokyo Stock Exchange, will be long-lasting and valuations look particularly enticing following the tariff carnage, for those with a long-term perspective.”

Europe’s renaissance

Closer to home, Pictet believes Europe is attractively valued. “Continental Europe trades on a 30% discount to US peers after adjusting for sector composition differences,” Sai said.

“The key takeaway from the policy uncertainty in the US today is that global capital is incentivised to stay domestic and this should lead to a gradual re-rating of non-US assets, including European equities.”

Gabrielle Boyle, manager of the Trojan Global Equity fund, is seeing a lot of compelling value opportunities across her portfolio but “they don’t neatly fit into a regional pattern”. Even so, she has found several opportunities in Europe.

“As US markets soared in 2023 and 2024, we were finding more European opportunities in the form of companies such as LSEG and Amadeus IT. There has been a subsequent re-rating for some of these companies so far this year, but we believe the likes of LVMH, Heineken and Roche continue to offer excellent value for investors prepared to take a longer-term view,” she explained.

China is still attractively valued even after its rally

Elsewhere, Pictet recently upgraded China to an overweight position. “Valuation remains reasonably attractive despite the strong rally so far,” Sai said.

“Tariff uncertainty notwithstanding, we are confident that the economy is on the right path – consumption is recovering and the property market is stabilising. The fiscal headroom is large enough to act as a mitigating factor to any tariff-related weakness.”

Some managers are even finding opportunities in the US

In aggregate, US equity valuations are still elevated but there are pockets of value even here, especially after the recent sell-off.

Boyle said several of Trojan Global Equity’s large US technology businesses have de-rated this year and “now trade at historically low valuations”.

“Alphabet and Adobe are examples of companies where there is a widening disconnect between their resilient, high-quality growth and how they are perceived by investors. We have taken the opportunity to add to them,” she explained.

Mark Ellis, manager of the Nutshell Growth fund, believes US tech has become attractively valued following the recent sell-off. His fund had 72% in the US as of 25 April, up from an all-time low of 54% in January. Technology now accounts for more than half the fund (51.6%) and Microsoft has just become its largest position.

“Outside of tech, Novo Nordisk also stands out,” he continued. “It could arguably be considered a value stock now, with its projected price/earnings-to-growth (PEG) ratio falling below one.”