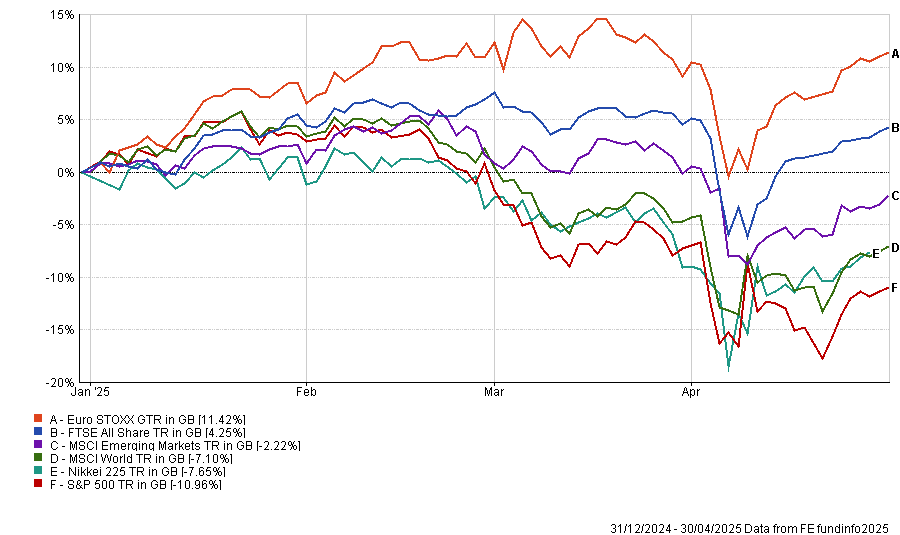

Volatility is becoming a familiar part of stock markets in 2025. While Donald Trump’s announcement of tariffs on most trading partners on 2 April was a pivotal moment, it has been a tough year for stock markets more broadly.

While markets are regaining momentum after the announcement of a 90-day pause on tariffs, investor uncertainty remains high. Indeed, indices such as the MSCI World and S&P 500 are posting significant losses year-to-date despite their recovery in recent days.

Performance of market indices year-to-date

Source: FE Analytics

In this clouded market environment, investors might find themselves turning safe-haven assets that can protect investors' capital over the long term and may even benefit from market volatility, or value-focused managers who attempt to bake in a margin of safety.

Below, Stuart Clark, manager of the Quilter WealthSelect managed portfolio service, highlights three managers across asset classes such as gold, US equities and global equity income, who have proved their mettle during this chaotic start to this year.

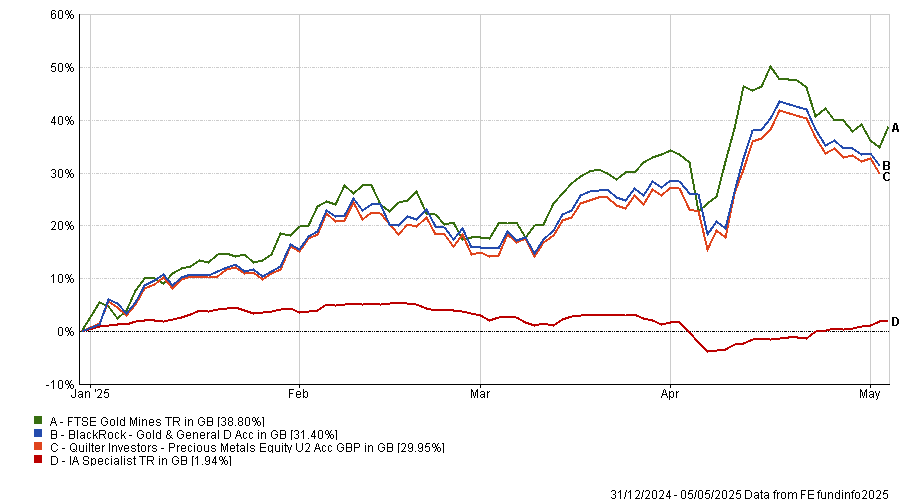

BlackRock Gold and General’s Tom Holl

One of the “obvious winners” so far is BlackRock’s Tom Holl, who manages the BlackRock Gold and General fund with Evy Hambro and the Quilter Investor Precious Metal Equity mandate for Clark’s team.

Holl’s strategies have done well this year as investors have rushed into safe-haven assets following recent volatility, making the two strategies some of the best-performing funds in 2025’s opening quarter.

As gold surged during April, peaking at more than $3,500 per ounce, Holl's strategies have continued to outperform, with the BlackRock mandate up 31.4% while the Quilter mandate surged 30%

Performance of funds vs sector and benchmark YTD

Source: FE Analytics.

However, Clark conceded that the funds did experience “some initial volatility” in the immediate aftermath of 'Liberation Day' as investors got nervous and sold out of gold in pursuit of greater liquidity.

Square Mile Investment Consulting & Research, which has given the BlackRock mandate an A rating, also praised Holl’s management.

“We believe the fund benefits from one of the most highly regarded natural resources teams in the industry,” Square Mile’s analysts said.

“Whilst Hambro's responsibilities stretch far beyond this fund, we take considerable comfort that the fund is run on a co-manager basis, with Holl very capably working in this capacity.”

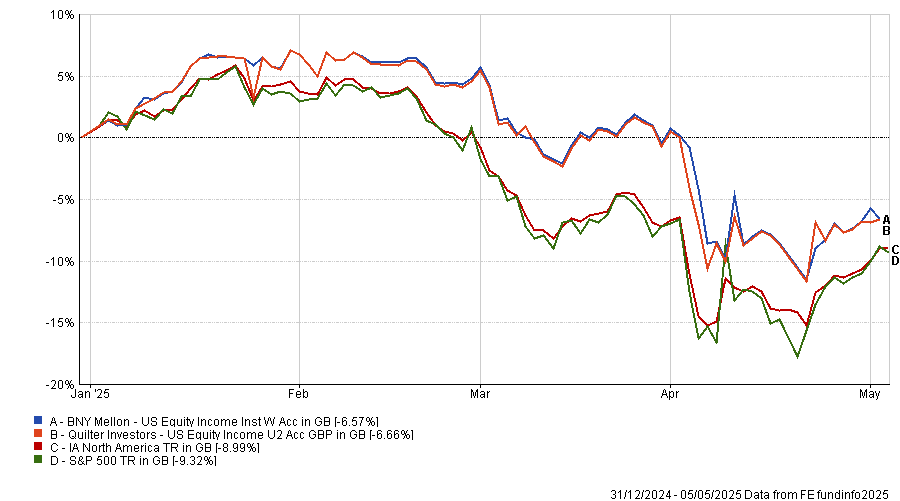

BNY Mellon US Equity Income’s John Bailer

Despite the fact all IA North America funds have made a loss year-to-date in sterling terms, Clark argued that some US equity funds have still managed to differentiate themselves.

For example, he identified John Bailer, manager of the BNY Mellon US Equity Income fund and the Quilter Investors US Equity Income fund, as a standout US manager this year.

“The way [Bailer and his team] think about portfolio construction, the discipline they have when identifying companies and being comfortable to stick to their philosophy even when value or income is underperforming, is attractive,” he said.

While these strategies have slid since ‘Liberation Day’, Clark argued that “in a reversal, Bailer’s focus on value and quality is a comparative outperformer this year”. Indeed, while Bailer’s funds are down more than 7.7% since 2 April , this is four percentage points better than the average IA North American fund and the S&P 500.

Performance of funds vs sector and benchmark YTD

Source: FE Analytics

Bailer’s funds have delivered first-quartile results in the IA North America sector over five years, further increasing Clark’s conviction in the manager and his approach.

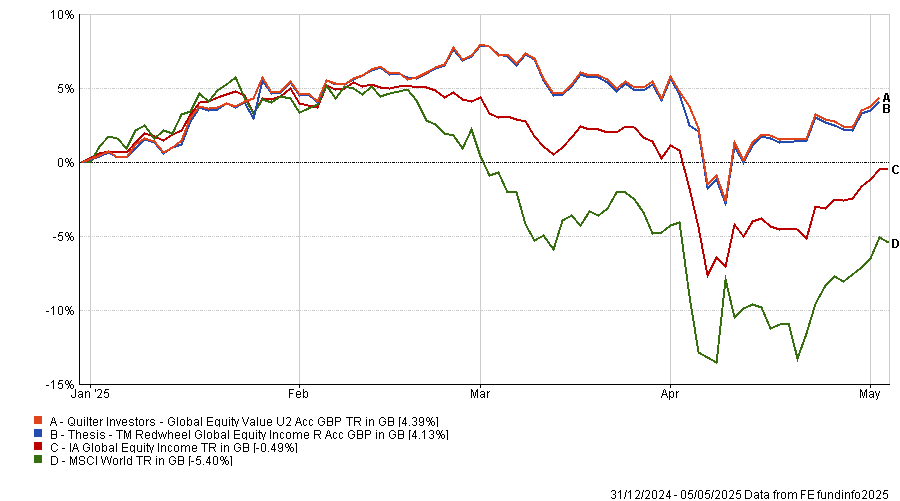

Redwheel Global Equity Income’s Nick Clay

Finally, Clark pointed to Nick Clay and his team at Redwheel as another great choice during the recent market volatility.

Clay runs the Redwheel Global Equity Income fund and its Quilter variant, the Quilter Global Equity Value fund, which are down 0.3% since ‘Liberation Day’. However, these are strong results compared to the IA Global Equity Income sector, which slid 1.4% in the same period.

Indeed, Clay’s strategies are two of just 23 funds in the peer group to deliver a positive return this year as of 6 May

Performance of funds vs sector and benchmark YTD

Source: FE Analytics

“To be honest, it has been a tougher set of years for Clay recently due to being underweight the Magnificent Seven,” Clark conceded.

However, this underweight has paid off in 2025 as some of these tech giants have struggled. "By sticking to his philosophy and process, we have seen a strong relative performance [from Clay] while this drawdown has been happening," Clark said.

His proven ability to outperform during stock market drawdowns makes Clay’s approach a “key winner” this year, Clark concluded.