Investors may be understandably nervous as president Donald Trump’s fluctuating and contradictory approach to trade has made navigating markets challenging this year.

As such, Trustnet asked three experts which funds they would pair together to weather the volatile market environment of the past few months. One strategy stood out as a clear favourite for all three: Capital Gearing Trust.

When equity markets seem particularly turbulent, Anthony Leatham, head of investment companies research at Peel Hunt, said defensive strategies such as Capital Gearing Trust that “preserve capital over the short-term and build real wealth over the long-term” become extremely compelling.

He highlighted the trust’s positioning, with 30% in risk assets, 38% in index-linked bonds and 32% in dry powder (cash, treasury bills and corporate credit).

Tom Bigley, fund analyst at interactive investor, also praised its asset allocation, in particular the emphasis on index-linked government bonds was highlighted for “offering protection when stock markets fall and providing a shield against inflation”, which makes it well suited to today’s more volatile market environment.

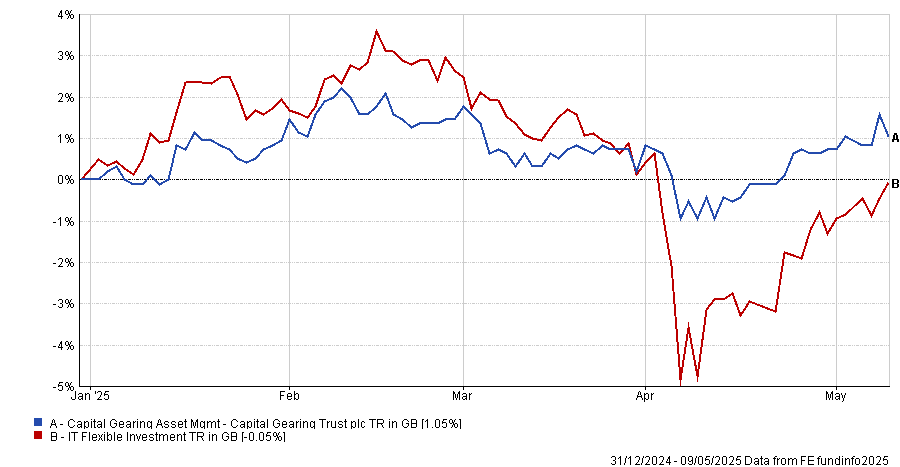

Year to date, the portfolio is up 1.1% while the IA Flexible Investment sector is down 0.1%. As shown in the chart below, it slid much less than its peers following the announcement of ‘Liberation Day’ tariffs, demonstrating its defensive characteristics.

Performance of trust vs sector and benchmark YTD

Source: FE Analytics

Matt Ennion, head of fund research at Quilter Cheviot, explained that, while it is tempting to view the strategy as an “all-in-one solution”, due to current market turbulence, the trust cannot do it all alone.

As such, Leatham, Bigley and Ennion highlighted the funds and trusts that can serve as a complement for Capital Gearing in an investor’s portfolio.

AVI Global Trust

Leatham suggested investors should pair Capital Gearing with a “differentiated, low-beta global equity portfolio”, such as AVI Global Trust.

The trust takes an “unconstrained and high conviction” approach to global equities, prioritising companies trading at a significant discount to book value. This means the portfolio favours different holdings than a traditional global equity strategy, highlighted by its 23% allocation to Japanese equities and 41% allocation to family-run companies, Leatham said.

It is up by 107.2% over the past five years, compared to the IT Global sector average of 40%, the best performance in the peer group.

Performance of trust vs sector and benchmark over the past 5yrs

Source: FE Analytics

Leatham added that while Capital Gearing and AVI Global share an emphasis on valuations and taking advantage of market volatility, AVI Global “has a much higher correlation to equities”. As a result, Capital Gearing makes a compelling “defensive counterweight” to AVI Global’s contrarian approach.

Fidelity Global Dividend

Bigley argued the best complement to Capital Gearing was another defensive fund – Fidelity Global Dividend.

The £3.4bn portfolio is managed by Daniel Roberts and targets “well-established global large-cap companies from around the world”, he said. The fund has a relatively defensive positioning, with high allocations towards financials (25.8%), consumer products (19.4%) and industrials (18.2%).

Bigley added: “The yield of 2.6% currently on offer from this fund is modest versus other income strategies. However, the focus on dividends and dividend growth can enhance stability and provide diversification in an uncertain environment.”

For example, year-to-date the fund is up 6.5%, despite ‘Liberation Day’ tariffs which caused markets to nosedive. This is ahead of the IA Global Equity Income sector, up 0.3%, and the MSCI ACWI, which has slid 4.7% following market turbulence.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

This builds on a strong medium-term record for the fund, which ranked in the first quartile of the IA Global Equity income sector over the past one and three years.

JP Morgan Global Growth and Income

Ennion also recommended an equity income strategy: The JPMorgan Global Growth and Income Trust.

Managed by FE fundinfo Alpha Managers Helge Skibeli, James Cook and Timothy Woodhouse, it aims to beat the MSCI AC World index while providing a good yield, Ennion explained.

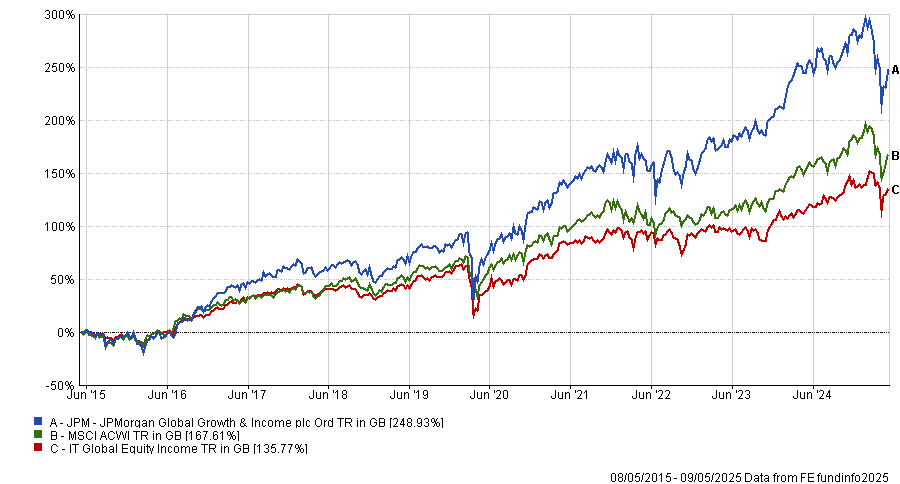

Over the past three, five and 10 years, it delivered top-quartile results in the IT Global Equity Income sector. Over the past decade, it surged 248.9%, the best return in the sector, beating the MSCI ACWI by more than 80 percentage points.

Performance of trust vs sector and benchmark over the past 10yrs

Source: FE Analytics

The trust is a high-conviction portfolio, which has been a challenge for the strategy recently, due to high allocations towards mega-cap tech stocks that have taken a hit this year. Despite this, Ennion argued the strategy remained a solid complement to Capital Gearing.

He said the emphasis on “superior earnings at reasonable valuations” as well as a 4.26% yield from both capital and income is a key selling point. “This is a combination that we believe enables the trust to achieve consistently good returns for clients," he said. Indeed, the trust has outperformed the MSCI ACWI every calendar year since 2019.

Additionally, with a 0.42% ongoing charges figure (OCF), Ennion argued it is a “relatively cheap way” for investors to access global equity markets.