Large-cap growth companies have propelled global funds over the past five years and there has been little competition, according to the latest study by Trustnet.

Global funds are often the cornerstones of investors’ portfolios, but with so many options available, investors might find it challenging to decide which ones are worth their money. As such, we examined how market capitalisation impacted returns, which investment styles outperformed and compared active funds to their passive rivals in an effort to determine the best way to invest in each market since 2020.

Previously, we have looked at the UK and Europe; today we turn to global equities.

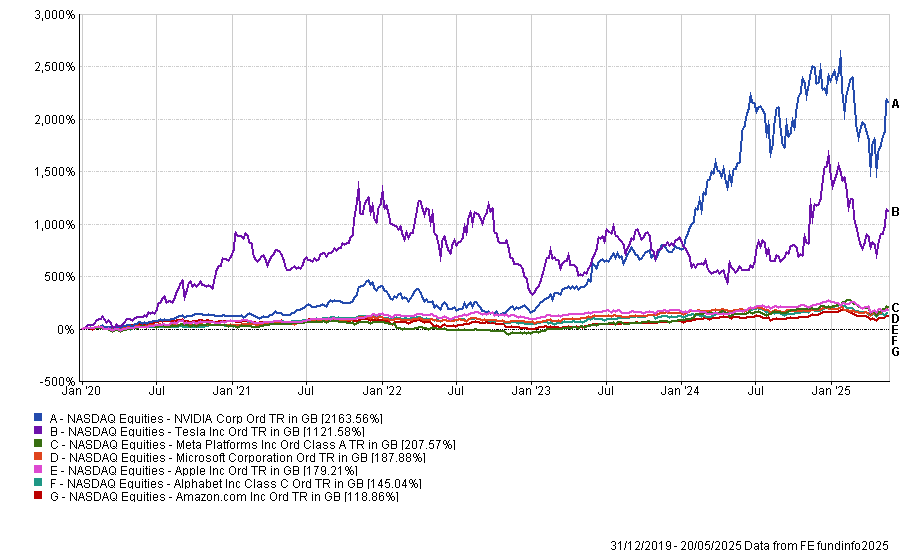

The main story within global markets over the past five years has surrounded the ‘Magnificent Seven’ (Apple, Nvidia, Microsoft, Tesla, Alphabet, Amazon and Meta). These mega-cap tech stocks represent almost 30% of the global index and have delivered exceptional returns, as demonstrated by the chart below.

Performance of the Magnificent Seven since 2020

Source: FE Analytics

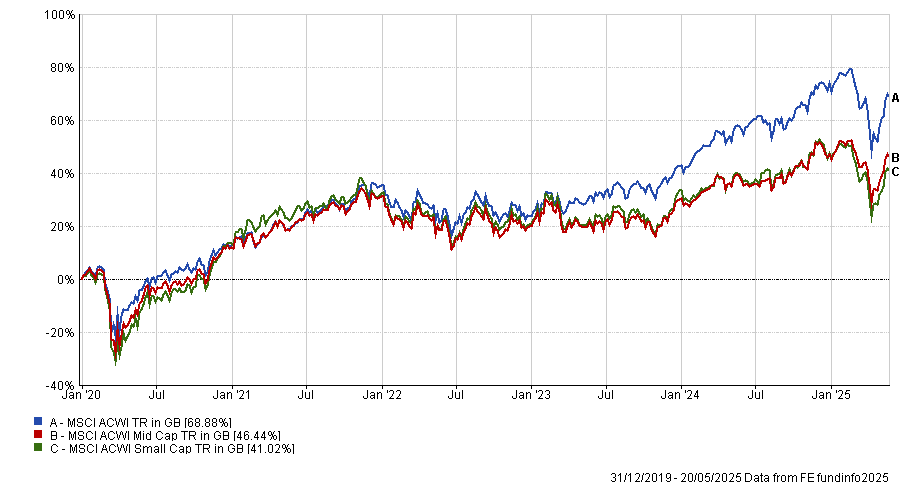

Their dominance has helped the MSCI ACWI to rise 68.9% since the start of 2020, giving it a clear edge over other indices focused further down the market capitalisation spectrum and making large-caps the clear place to invest over the past five years. Indeed, the MSCI ACWI mid and small-cap indices are trailing by 24 and 27 percentage points, respectively, as the below chart shows.

Performance of indices since 2020

Source: FE Analytics

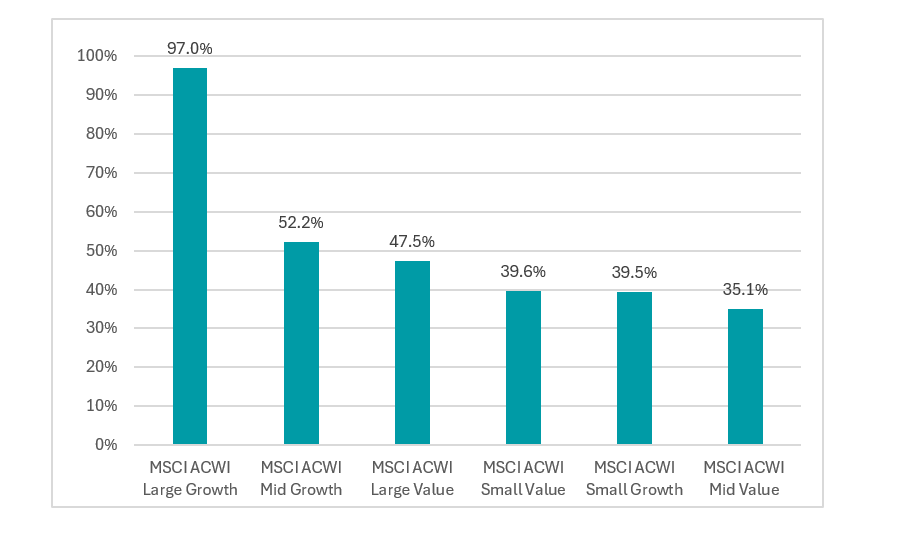

The Magnificent Seven have also heavily skewed investment style analysis, with the MSCI ACWI Large-Cap Growth index, which includes the US tech giants, surging 97.5% since 2020 – far ahead of other strategies.

In fact, the next-closest competitor – the MSCI ACWI Mid Growth index – was more than 40 percentage points behind its large-cap cousin, while the MSCI ACWI Large-Cap Growth index almost doubled the performance of its equivalent value index.

The worst place to invest over the past five years has been in mid-cap value stocks, which have made just 35.1%, slightly behind both small-cap growth and value companies, which gained around 39.5% each.

Performance of the indices since 2020

Source: FE Analytics

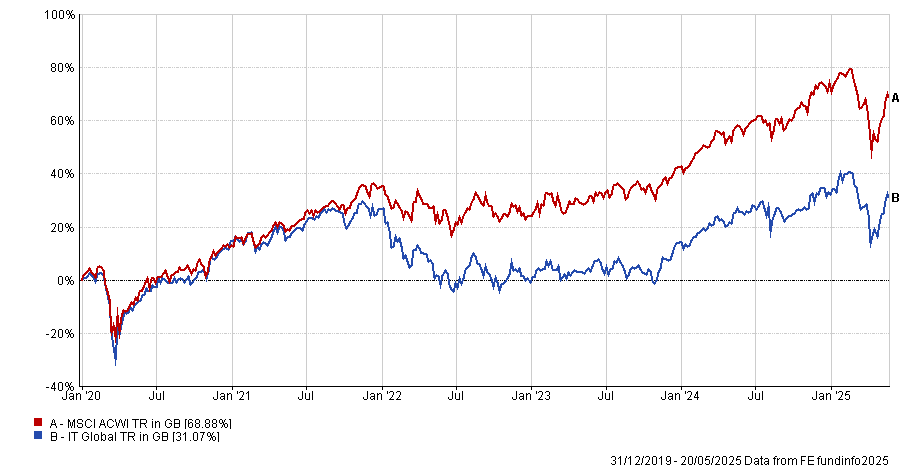

Having established that large-cap growth has been the best strategy over the past five years, next we turned to whether investors would have been better in an active fund of backing a passive strategy.

To do this we used the broader MSCI ACWI, which returned 68.9% over the past five years. This lower bar than the MSCI ACWI Large-Cap Growth index was still too much for the average fund in the IA Global sector, however, which made 52.6%.

Performance of sectors and indices since 2020

Source: FE Analytics

As analysts explained earlier this year, some of this may be due to the 5/10/40 rule of portfolio construction, which restricts the amount active funds can hold in stocks. It prevents managers from holding more than 10% of their fund in individual securities, while the total amount for holdings above 5% may not exceed 40% of the portfolio. This means they will struggle to overweight the top-performing ‘Magnificent Seven’ companies compared with an index.

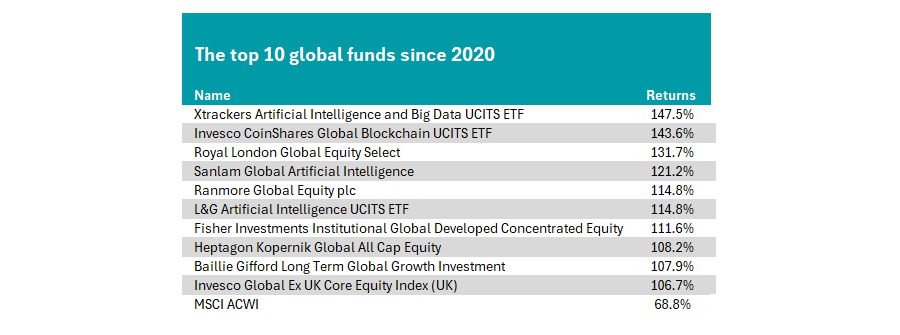

However, while not a spectacular market for active managers, some global funds still delivered. Below are the top 10 global funds in the sector since 2020, six of which were actively managed and have successfully beaten the MSCI ACWI.

Top 10 global funds since 2020

Source: FE Analytics

The best active fund in the sector has been the Royal London Global Equity Select fund, led by Francois De Bruin and Paul Schofield. It is the third best-performing strategy in the IA Global sector overall since 2020. The fund owns four of the ‘Magnificent Seven’ within its top 10 allocations.

It has delivered a top-quartile performance in every calendar year between 2020 and 2024 but its high allocation towards the US has caused it to struggle this year, as the market has grown concerned about Trump’s approach to trade. Indeed, the S&P 500 has been among the worst-performing global markets so far this year.

Sean Peche’s Ranmore Global Equity fund is up 114.8% over the whole period. Notably, Alphabet is the only member of the ‘Magnificent Seven’ to make it to its top 10, instead, it has high allocations towards UK companies such as Tesco, easyJet and Associated British Foods.

This differentiated set of holdings has been a tailwind in this year’s market volatility, with the strategy the second-best performer in the sector year to date.

Other active funds within the top 10 include: Sanlam Global Artificial Intelligence, Fisher Investments Institutional Global Developed Concentrated Equity, Heptagon Kopernik Global All Cap Equity and Baillie Gifford Long-term Global Growth Investment.