After a bruising few years, small-cap investing is out of favour but not out of opportunities. In the UK, some of the best-known small-cap names have struggled, including abrdn UK Smaller Companies, Liontrust UK Smaller Companies and IFSL Marlborough UK Micro-Cap Growth.

It’s no coincidence, however, that all three adopt a growth-focused investment approach, which did well when interest rates were low but faced heavy losses and outflows as rising rates hampered growth investments in 2022.

Value-focused strategies have had better luck, but style dynamics are more nuanced the further down the market cap spectrum you go, as Darius McDermott, managing director at FundCalibre, noted.

“Even if value has outperformed recently, the majority of the returns made in small-cap investing is inherently long-term, regardless of style.”

According to Jupiter Merlin’s David Lewis, one style has stood up better than the rest: quality.

“The opportunity in small-caps was rich if you cast your mind back 20 years, when there was a lot of talk of the small-cap effect – this idea that smaller companies tend to outperform over the medium-to-long term. But over the past 10 or 15 years, that's categorically not been the case,” he said.

“Within US small-caps, it’s the quality component that has actually managed to compound outperformance by well over 2 percentage points per annum over the past 50 years.”

Matthew Read, QuotedData senior analyst, had a different view. “Despite no shortage of headlines to the contrary, we do not think that the ‘small-cap effect’ is no longer valid, it’s just been obscured by a combination of flows, fashion, and fear. But that tide may be turning,” he said.

“Valuations are now at extremes and April’s moves show that when markets turn, they can move quickly. It doesn’t take much of a reallocation from mega-caps to shift the dial.”

All three experts agreed on one thing, however – when it comes to small-cap investing, patience is key. In McDermott’s words: “Even as value has outperformed recently, the majority of the returns made in small-cap investing is inherently long-term, regardless of style.”

Below, they highlight small-cap funds suited to every investing style – with a reminder that patient, long-term compounding drives returns.

For quality-growth investors: Liontrust, Montanaro and Throgmorton

In contrast to the widespread, binary view of small-caps as either value traps or rocket ships, “quality does exist in small-caps, and it compounds over time,” Read noted.

Trusts such as Montanaro UK Smaller Companies and BlackRock Throgmorton are proof of this concept.

“Backing management teams who reinvest internally and generate cash at high rates of return in defensible niches is a winning formula,” Read said.

“It does takes patience – and a market willing to recognise long-term compounding – but that’s not dead, it’s just out of fashion.”

On the open-ended side, Liontrust UK Micro Cap is one McDermott rates “highly”. It follows a quality-driven process with a clear growth tilt.

“The team prioritises alignment with management, seeks capital-light businesses that can scale fast and makes company meetings central to the process,” he said.

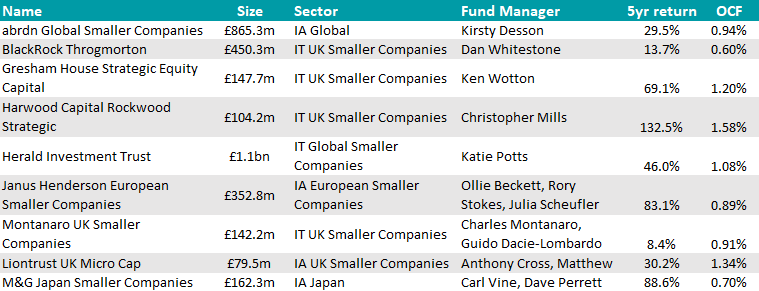

All three had decent years from 2018 to 2021, falling to a below-average performance since, but only Liontrust beat its sector over the past five years, as the chart below shows.

Performance of funds against indices and sectors over 5yrs

Source: FE Analytics

For global growth hunters: abrdn Global Smaller Companies and Herald

McDermott also highlighted abrdn Global Smaller Companies, a growth-oriented global fund that utilises Aberdeen’s proprietary screening tool: Matrix.

“Co-created by the legendary Harry Nimmo, Matrix scours the globe for smaller companies with the strongest growth potential,” he said.

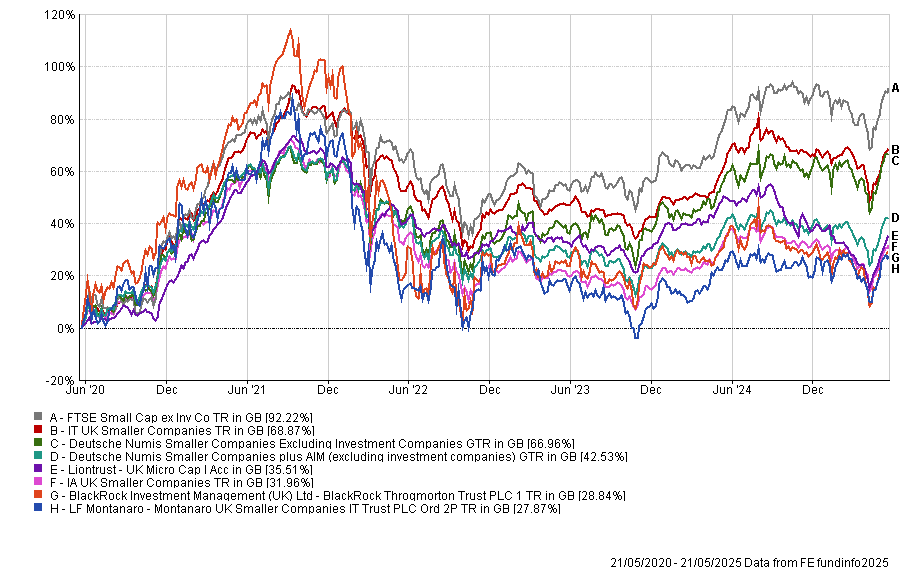

Relegated to the third and fourth quartile of the IA Global sector over the past 10, five and three years, it has a better track record in the shorter term, as shown in the chart below.

Read pointed more patient investors towards the Herald investment trust, an example of a strategy with the benefit of permanent capital, thanks to its closed-ended nature.

“This has contributed to its incredibly strong long-term returns,” he noted.

The portfolio is run by Katie Potts and has rarely fallen below the second quartile for returns against the IT Global Smaller Companies sector (with the exceptions of 2015, 2018 and 2021, when it fell to the third).

Performance of funds against indices and sectors over 1yr

Source: FE Analytics

For value seekers: Strategic Equity Capital, Rockwood Strategic, M&G Japan

Value-tilted small-cap funds are rarer to come by but might be worth digging a bit deeper to find, as small-cap valuations remain at extreme levels, particularly in the UK.

Read singled out two trusts in this space – Strategic Equity Capital and Rockwood Strategic, both of which take a view on the value of businesses to a trade or private equity buyer, Read explained.

“This should do well in today’s backdrop, where either markets will correct or companies will get bought out,” he said. “The price received might still not be a fair price but is still a decent uplift.”

Here, M&G Japan Smaller Companies is also “a compelling choice” for McDermott. “This is a valuation-conscious fund run by a deeply experienced team, which delivered strong long-term returns in a challenging and often volatile market,” he said. “They use a hands-on, high-conviction approach that sets them apart.”

The fund is led by Carl Vine, who was also highlighted by FE Investments analysts for his “impressive experience and in-depth bottom-up process”.

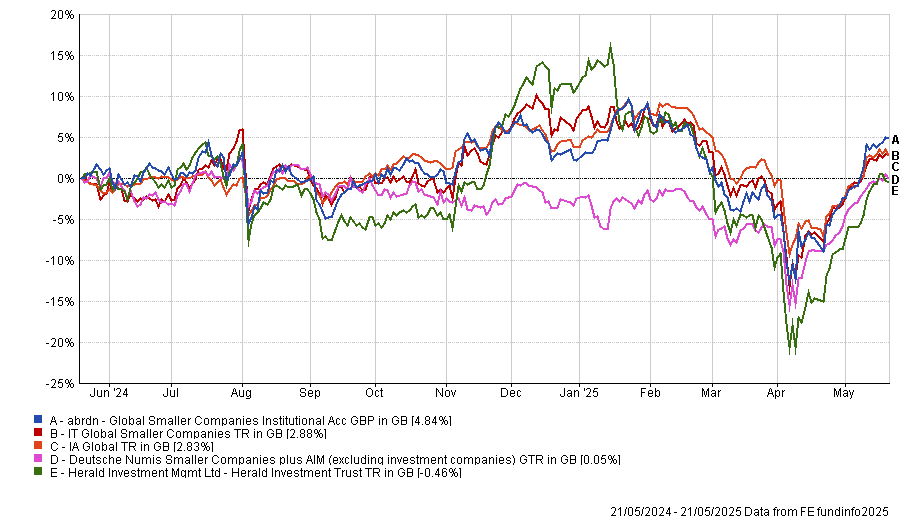

Performance of fund against indices and sectors over 1yr

Source: FE Analytics

For style-agnostic flexibility: Janus Henderson European Smaller Companies

Style-agnosticism is a growing trend among small-cap funds and the managers of the Janus Henderson European Smaller Companies fund are “willing to back growth stories at the right price but also target unloved parts of the market”, McDermott explained.

They invest across different points in the cycle, helping to diversify revenue drivers.

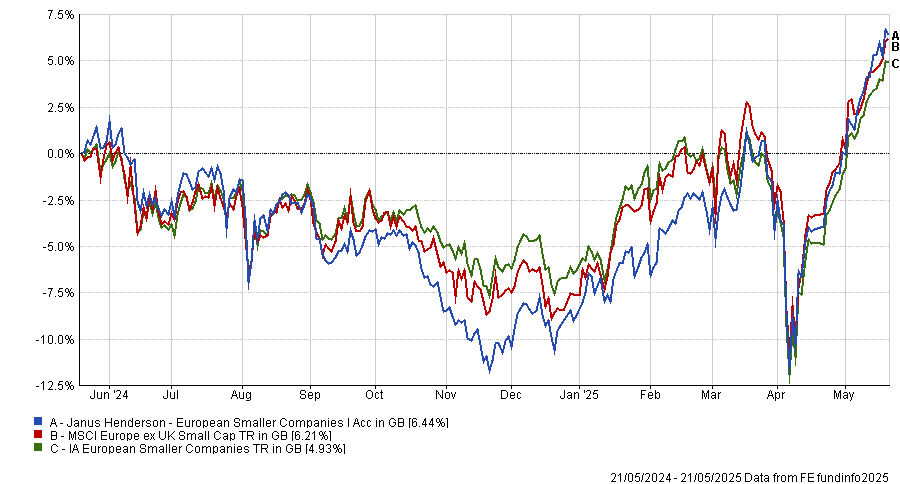

Performance of fund against indices and sectors over 1yr

Source: FE Analytics

The years 2016, 2017, 2020, and 2022 were outstanding for this strategy, which ranked within the top two positions of the whole 25-strong IA European Smaller Companies sector.