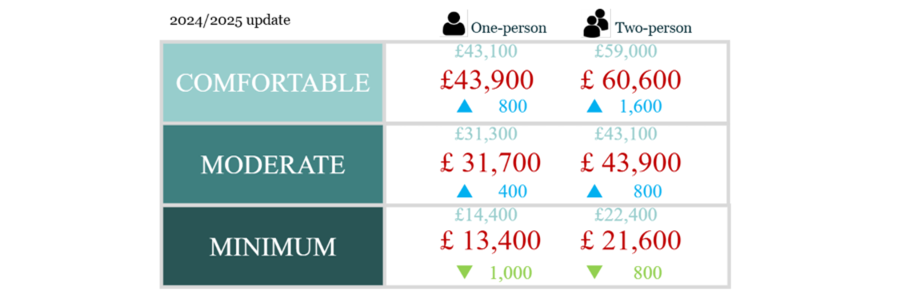

Retired couples will need £1,600 a year more than they required in 2024 to live a comfortable retirement, according to the latest figures from the Pensions and Lifetime Savings Association (PLSA).

Two people living together will need to amass £60,600 per year to live comfortably, up from £59,000 last year. For more moderate retirees, the figure stands at £43,900, around £800 more than a year ago.

Those on their own will require £43,900 (or £800 more than in 2024) for a comfortable life and £31,700 (£400 more) for a moderate retirement.

How much annual income is required for different retirement levels

Source: PLSA

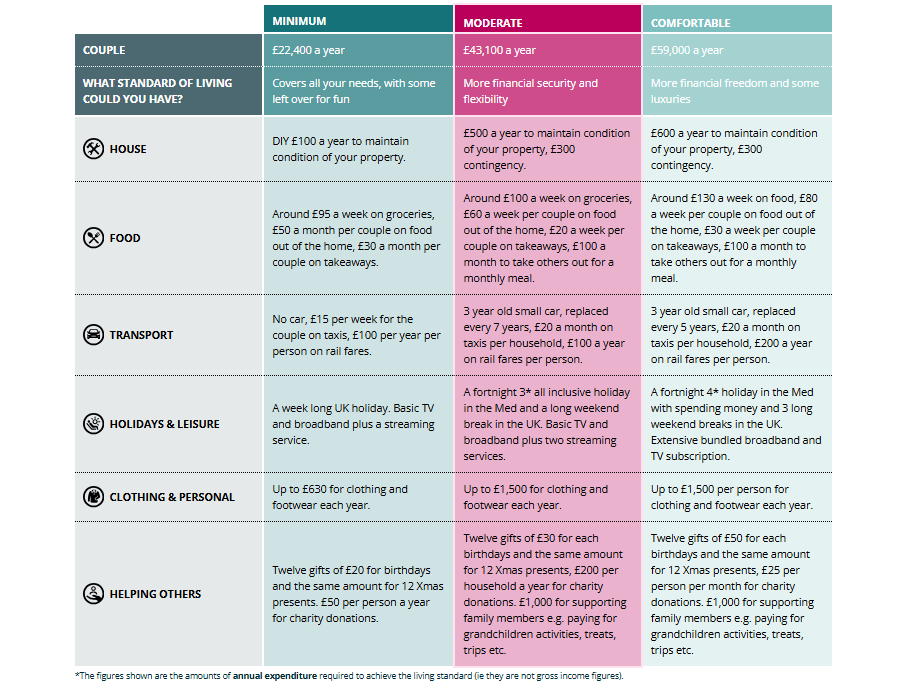

A moderate retirement assumes retirees have one foreign holiday a year and eat out a few times a month. A comfortable retirement includes subscriptions to streaming services, regular beauty treatments, a foreign holiday and several UK minibreaks a year.

However, the minimum needed to survive retirement has dropped £800 from £22,400 in 2024 to £21,600 this year. This can be covered by two people receiving the state pension, which pays £11,975 each.

This level of retirement is the most basic, including one UK holiday per year, eating out about once a month and affordable leisure activities about twice a week. It also excludes car payments, which are only included in the higher brackets. The below table shows the full breakdown of each category for couples.

The criteria for a minimum, moderate and comfortable retirement

Source: PLSA

The minimum has also dropped for single people, with the total now standing at £13,400, down £1,000 from last year, although some additional savings will be required as the state pension will not cover the entire cost of living.

This decrease is “primarily due to a substantial reduction in energy costs and some small spending adjustments made to the living standard by research participants”, the Retirement Living Standards report found.

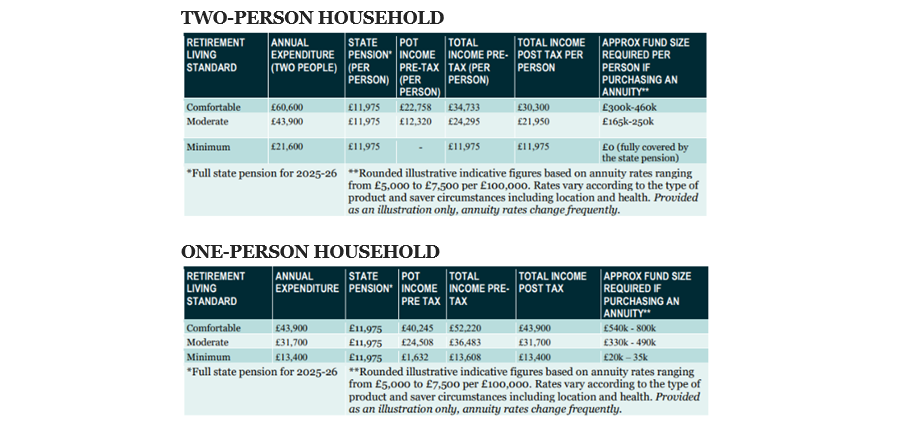

In terms of pot size, those in couples will require £300,000 to £460,000 for a comfortable income, £165,000-£250,000 for a moderate life and no savings for the minimum. These figures are based on an annuity paying 5 to 7.5%.

Single people will need much more. For the minimum standard of living a pot of £20,000 to £35,000 is needed, but this jumps to £330,000 to £490,000 for a moderate life – broadly the same as a couple requires for a comfortable retirement. To live comfortably, lone retirees will need between £540,000 and £800,000.

Total size required for different retirement levels

Source: PLSA

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said there were some key takeaways from the report. Firstly, the state pension is vital and “will get you a long way towards achieving a minimum standard of living in retirement”. Secondly, it is harder for single people, who are unable to share costs with a partner.

Renters will struggle, she added, as these figures do not consider rental costs, which will “really push up your living costs”.

Alexandra Loydon, group advice director at St. James’s Place, said the figures should “serve as a wake-up call” for savers across the country to start thinking seriously about their pension and building up their retirement pot.

“When comparing today’s PLSA figures to our recent financial health research, which found that one in five (23%) UK adults believe they’ll only need a total retirement pot of £50,000 to live moderately well in retirement, it’s worrying that many people are underestimating their retirement needs,” she said,

“While it’s encouraging to see that the amount someone needs in retirement to secure a minimum standard of living in retirement has fallen from £14,400 to £13,400, it’s important to understand that this only covers your basic needs in retirement.”

AJ Bell director of public policy Tom Selby said there was some good news for savers, as rocketing inflation is now easing, which is represented by the drop in the minimum retirement and the slowing of increases for those looking for moderate or comfortable retirements.

“This is clearly a positive development although the nature of inflation means living costs for everyone, including retirees, will almost certainly be permanently higher in the future,” he said.

“And there is no getting away from the fact that the pension pot sizes needed to achieve the moderate or comfortable living standards, particularly for a one-person household, are staggeringly high.”

Zoe Alexander, director of policy and advocacy at the PLSA, said automatic enrolment sets pension contributions at 8%, which is a “solid starting point” – especially for those who begin early.

“But for many, saving 12% or more offers a better chance of reaching the retirement they expect. While defaults may rise in the future, it’s important for savers to consider whether 8% will be enough for their goals,” she added.

Morrissey noted these figures are not “hard and fast” and said that retirement is based on individual needs, suggesting retirees use online calculators to keep track of whether their pension will sufficiently match their lifestyle.

“This will either give you the confidence of knowing you’ve got enough or the time to put a plan in place if you haven’t. They can even be used to model the impact of boosting your contributions over time so you can see how much small changes can help you move towards your retirement goal,” she concluded.