New investors are coming into the world of investing at a difficult time, with markets wobbling on the back of US president Donald Trump’s trade policy, outbreaks of war across the world and a general unease that valuations have become too high. Things are not much better in the world of bonds, where markets have been equally volatile.

One thing most advisers agree on is that it is a good time to diversify, but this can be particularly challenging for a first-time investor, who may not know where to start.

For Ben Seager-Scott, chief investment officer at Forvis Mazars, anyone new to investing should consider something simple and well-balanced by adopting a variation on the traditional 60/40 portfolio, which splits between 60% in global equities and 40% in bonds.

Instead, he suggested 60% in equities, 30% in bonds and 10% in alternatives – namely gold.

This offers the maximum amount of sector, regional and asset class diversification in the smallest amount of funds possible, which should feel less overwhelming to new investors. However, he noted that it is still best to take a long-term approach, preferably around 10 years.

In this way, the portfolio can then be built over time as risk tolerance changes, offering a solid foundation for a first-time investor to hold over the long term, he explained.

Because global equities should drive long-term returns, this should also be the largest allocation within the portfolio, he explained, even if the current environment seems as though markets are struggling at present.

“If you are looking for true diversification, you need to cover as many names in your portfolio as possible. Broad index-based approaches are probably the best way of doing this in equities and bonds,” he said.

As such, he would put 50% in a global equity tracker, such as the SPDR MSCI All Country World UCITS ETF. This ensures most of the portfolio is invested in a wide set of markets and names, avoiding high-conviction stockpickers introducing stock-specific risks. Picking a tracker also gives exposure to those top-performing mega-cap stocks in the US that have dominated the past decade and could continue to do so – although there are no guarantees.

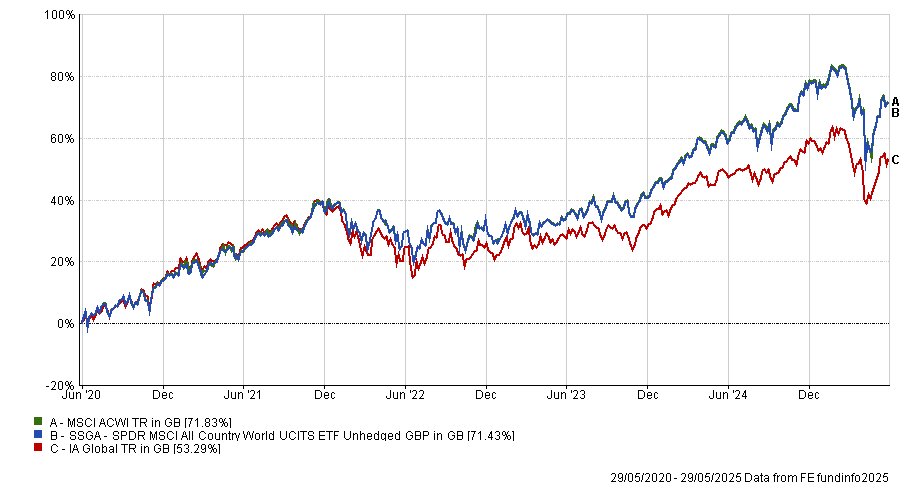

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

While this is a great start, an overexposure to large-cap stocks and a high US weighting mean “you will get a lot of tech in your tracker,” he said. This has been “great for returns” in the past but “not so much for diversification”.

As a result, a UK tracker such as the iShares Core FTSE 100 UCITS ETF is a good addition to a diversified portfolio, he explained.

The UK market is led by a very different set of companies to the US (which dominates the global market). For example, the FTSE 100 has much lower weighting to tech (4.6%) than the global index and instead is led by banks (14%), healthcare (12.9%) and industrials (11.8%).

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

These funds provide the stock market foundation for a diversified portfolio, but first-time investors should also aim to have a wide variety of names in their fixed-income allocation.

Seager-Scott said: “You cannot just rely on government bonds for your fixed income returns.” As such, a 20% allocation towards a global bond fund, such as the Vanguard Global Aggregate Bond UCITS ETF, would give investors “access to the range of underlying fixed-income asset classes and markets”.

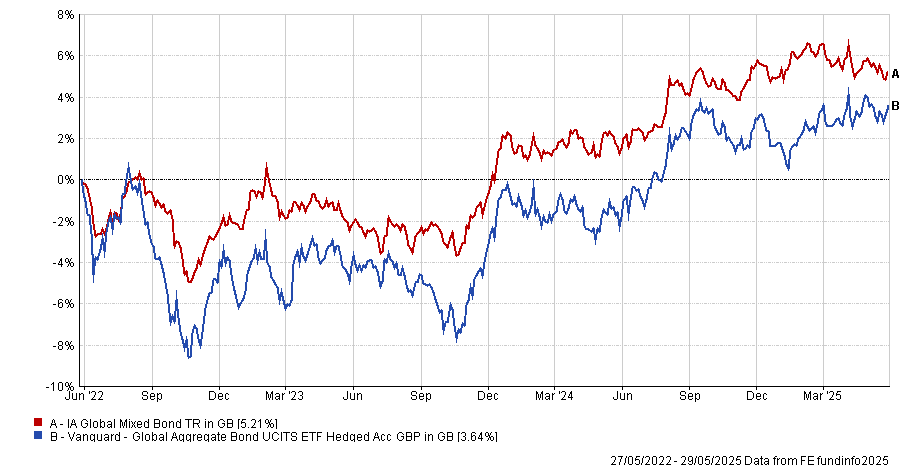

Performance of the fund vs the sector over the past 3yrs

Source: FE Analytics

However, just adding a bond fund is not enough to bring true diversification, said Seager-Scott, who suggested putting 10% in the Royal London Index Linked Bond fund, managed by Ben Nicholl and Paul Rayner.

Bonds tend to underperform when inflation rises (as interest rates tend to rise to combat higher prices, increasing yields and dropping the price). This inflation-linked bond fund should help to mitigate this and add more diversification.

Active management is preferred here to avoid having a similar duration to the index, said Seager-Scott.

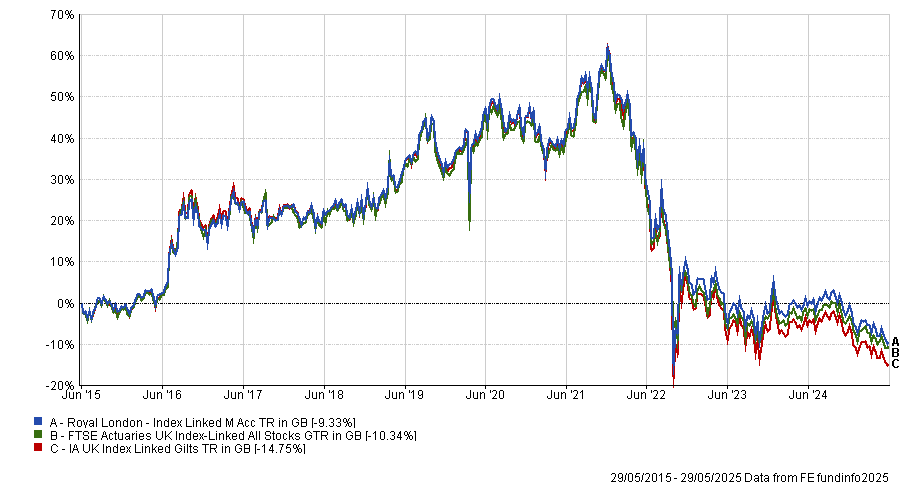

Performance of the fund vs the sector and benchmark over the past 10yrs

Source: FE Analytics

Lastly, in the alternatives bucket, he had one stand-out choice: gold. While there are numerous options, including hedge funds, private equity, infrastructure and property – to name just a few – Seager-Scott said investors are better off “keeping it simple” with a 10% allocation to iShares Physical Gold.

The precious metal is a favourite safe haven for some investors, particularly this year, as rising stock market volatility caused a surge in the gold price.

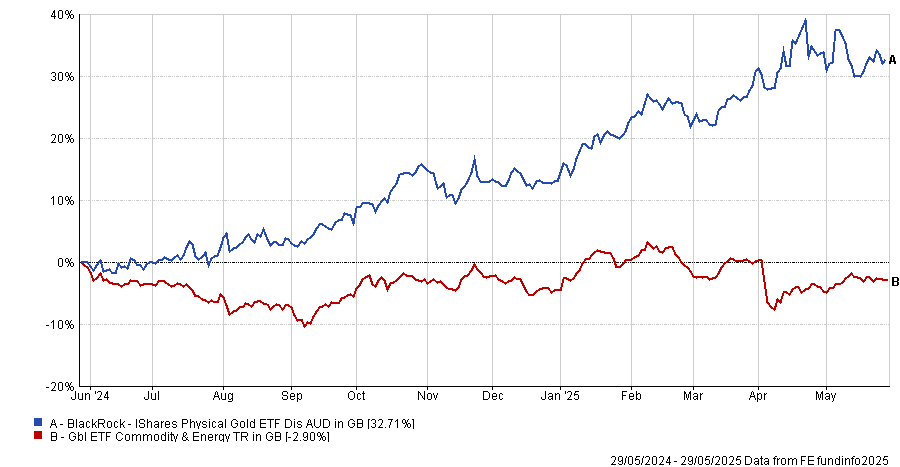

Performance of the fund vs the sector over the past year

Source: FE Analytics

“It might sound controversial, but gold is by far your easiest alternative, and you do not need to get your head around what esoteric, derivatives-based, crazy multi-asset fund someone might be trying to deliver”.