As geopolitical tensions escalate, European defence stocks have surged into the spotlight. The STOXX Europe Total Market Aerospace & Defence index is up 45% over the year to date (shown in the chart below), fuelled by renewed military budgets and investor momentum.

Governments across the old continent are pledging higher defence expenditure, with major firms such as Rheinmetall, BAE Systems and Thales seeing order books swell and valuations rerate significantly.

Investor appetite has been just as rapacious. The WisdomTree Europe Defence UCITS ETF, launched at the beginning of March, has already gathered €2.5bn in assets in just over three months.

But the sector isn’t tempting for Will James, co-manager of the Guinness European Equity Income fund.

“We missed it, but we are very relaxed about,” he said. “We missed it because defence companies don’t meet our quality criteria, as they are pretty cyclical and don’t cover their cost of capital.”

Performance of index over the year to date

Source: STOXX

A key part of his hesitation lies in the patchy fiscal commitment of European governments to military spending, particularly the further west you go from Russia.

“Poland is going to spend 5% of GDP on defence – I’m not surprised, they don’t want Russia coming at their border,” James said. “But Spain, France and Italy have all said they’re happy below 2%, because they’re so far away from Russia they don’t really care.”

The manager also pointed to the stop-start nature of defence industry returns, shaped by government procurement cycles and shifting priorities.

“These companies have moments in the sun – three, four, five years of high returns when defence spending goes up – and then they fall out again,” he said. “Because what are they dependent on? Governments, convoluted procurement processes and fiscal constraints.”

Even where defence budgets are growing, delivery remains slow and politically constrained. “The roadmap for growth is well underpinned but returns aren’t going to happen overnight.”

The off-and-on-again nature of the space has been reflected in fundamentals. Over the long term most defence companies have struggled to deliver consistent cashflow or cover their cost of capital – and Guinness’s process screens them out on that basis.

“We’re not index investors. Owning Thales or Rheinmetall would have been fantastic. But has it completely impacted our performance over the past 10 years? No, it has not.”

For James, recent investor enthusiasm has pushed expectations ahead of fundamentals. “You look at the valuations of these companies and think: hold on a second – they are now discounting cashflow returns they’ve never, ever delivered, even in the good old days.”

The rally they have enjoyed recently has been driven more by flows than any structural change. “There’s a momentum argument but we aren’t weight-of-money or momentum guys,” he said.

The fund’s process instead emphasises consistency. Guinness applies a strict quality filter that focuses on companies with high, sustained returns on invested capital. Defence names, historically, have not made the cut.

“If a company is in and then it’s out, and then it’s in, and then it’s out – that tells you something. For example, the last time utilities appeared in our universe was in 2009 – the next year, they fell out.”

James pointed to internal research showing how companies with sustained returns tend to remain in the universe. “If you do a back test on companies that delivered 8% over the past eight years, the probability of that company staying in our universe the next year is 93%. Over three years, it’s over 80%.”

That consistency matters more to Guinness than catching short-term themes. “You’ve got to be very, very careful with businesses that promise but are ultimately dependent on fiscally constrained governments,” he said.

“Would we prefer to allocate capital to a business that will grow just as well, but do it sustainably and generate productive cash flow? Absolutely.”

The door isn’t closed entirely – if a defence stock met the process requirements, it would be considered. In fact, historically, Thales was a part of the Guinness European Equity Income portfolio – initially bought in 2020, the position was then sold out of in 2022.

But James said the team’s track record shows that sticking to a quality discipline has been the right call.

“Our general concern about European defence is: yes, that’s great, but there are only so many companies you could buy. And our quality threshold tells us not to. Over time this has actually been the right thing to do.”

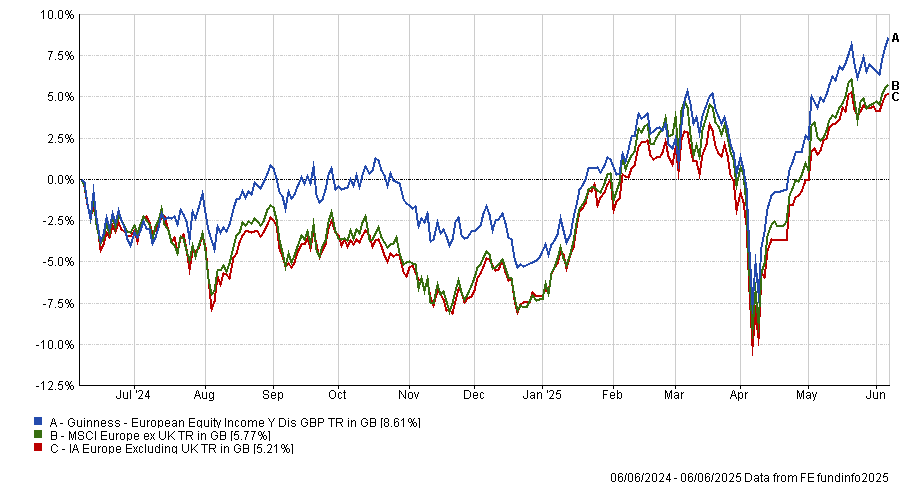

Performance of fund against index and sector over 1yr

Source: FE Analytics