There have been more compelling UK opportunities in recent months than he has over the past half a decade, according to Clive Beagles, manager of the JOHCM UK Equity Income fund, who has taken the recent volatility to add new positions to his portfolio.

The market is experiencing a "natural evolution" this year, with a range of new opportunities entering the value manager's radar, after years of stocks being “stuck” at quite high valuations.

Stocks that used to be considered too expensive have re-rated downwards, while previously underperforming businesses have begun to stage a comeback.

Beagles said: “We’ve probably had more ideas in the past three or four months than we have had in the past four or five years. That is a healthy dynamic.”

One of the stocks to recently enter the portfolio is supermarket giant Sainsburys. The business has experienced wobbles in recent days with investors getting concerned over a potential price war with Asda.

However, Beagles explained that even before this the stock was being underestimated by investors and trading significantly below its actual value. With a price-to-earnings (P/E) ratio of around 15x, the stock is on a 64% discount, according to recent data from IG.

This is “well below the value of its real estate”, meaning that by purchasing Sainsbury’s shares investors can gain access to the whole supermarket franchise at a fraction of it’s actual cost.

“It feels like you are not paying very much for a strong business,” Beagles said. “We think it has had a great few years and is still priced very modestly."

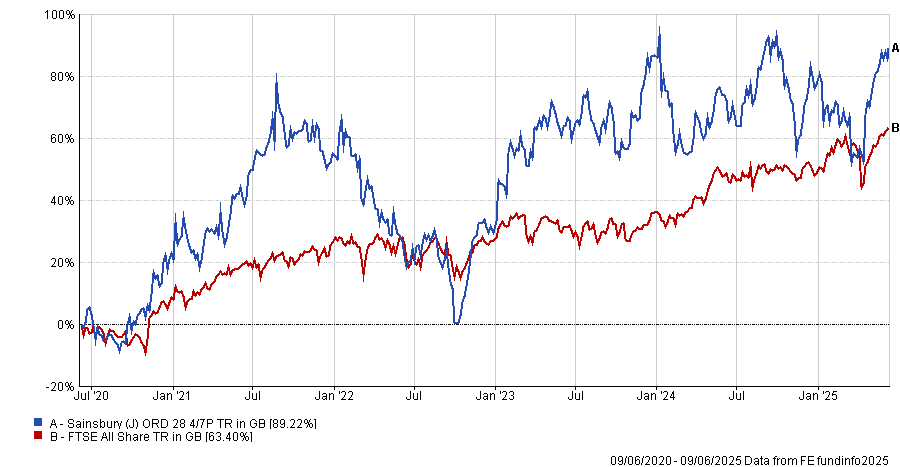

Shares are up 89.2% over the past five years, beating the FTSE All Share by 25 percentage points, as demonstrated by the chart below.

Performance of stock vs market over the past 5yrs

Source: FE Analytics

Chris Beauchamp, chief market analyst at IG, said: “This is a classic case of strong performance being ignored by the wider market. Sainsbury’s is not cheap because it has struggled – it is cheap despite delivering.”

Chemicals company Johnson Matthey is another recent addition to the JOHCM UK Equity Income fund, although Beagles has been considering buying it throughout 2025 so far.

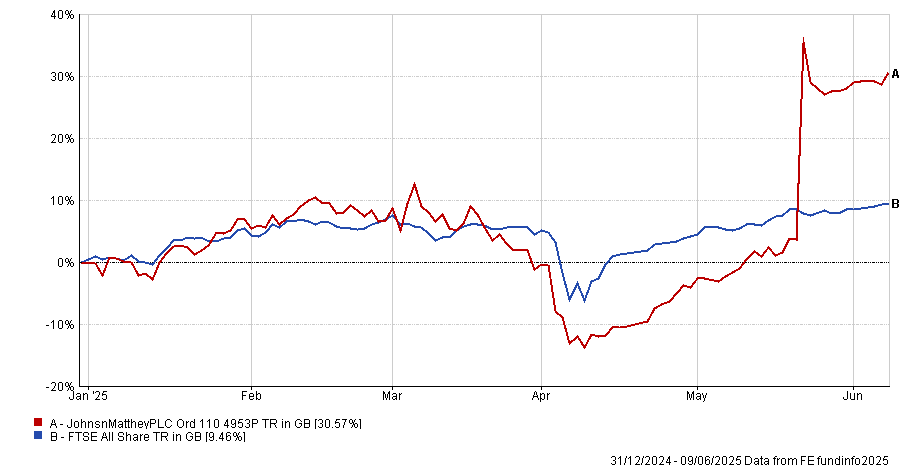

Its decision to recently sell its catalyst business for £1.8bn has caused shares to surge 30.6% year to date, outperforming the UK market by more than 20 percentage points.

Performance of stock vs market over YTD

Source: FE Analytics

While Beagles conceded it is disappointing that the fund did not own the stock during its surge, “it is important to look forwards, not backwards”.

The FTSE 250 chemicals company has plenty of room left to run, especially if it achieves its 2027 targets of a cashflow yield of 18%, as well as a return of 13% to shareholders through dividends and buybacks.

Additionally, it is set to return £1.4bn of the recent sale to shareholders through a one-off special dividend, which should cause the market to view it much more favourably, according to Beagles.

“For its market-leading positions and embedded growth optionality, [its price-to-earnings ratio of 8x] is materially too cheap.”

Whitbread, the hotel and restaurant company that owns Premier Inn, is another brand new holding in the fund.

Hotels have been out of favour in the UK in recent months, contributing to “sluggish revenue trends” at home for the hospitality giant. With the business also attempting to kickstart a German branch earlier this year, there has been significant internal investment.

This has weighed heavily on the stock, with the share price dropping from £35 to close to £25 in recent months as investors have “got bored of waiting for Premier Inn to recover, and bored waiting for the German business to become profitable”.

However, the business has performed solidly over the long term and remains a compelling opportunity that is valued “far below its actual offering”, according to Beagles.

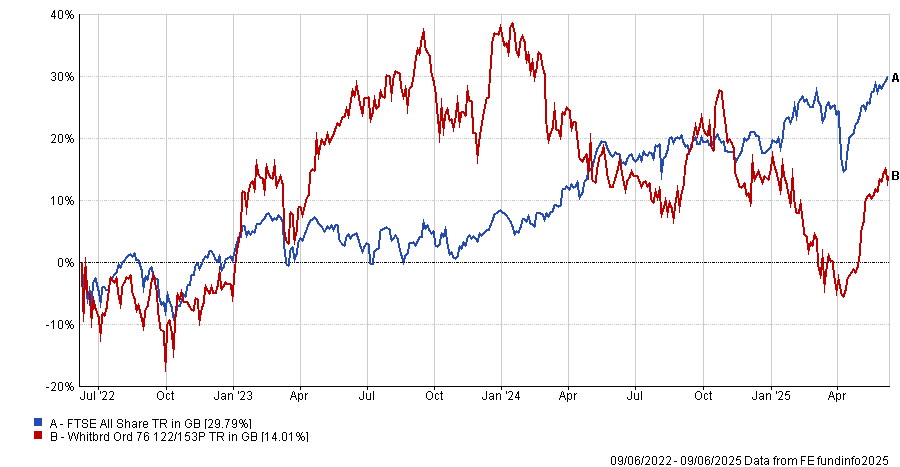

Performance of stock vs market over the past 3yrs

Source: FE Analytics

Over the past three years, the hospitality company climbed 29.7%, almost double the performance of the UK market and it still has room to run, he explained. If the UK economy recovers and the German business further matures, the stock will gain "further momentum" and remain an “attractive opportunity".

“There is a lot of self-help going on at Whitbread, which means earnings could as much as double in the next four to five years, all at a very modest (13x) multiple,” said Beagles.

If the management successfully delivers its plans to return £2bn to shareholders by 2030, it should continue to grow even further, he added.

Finally, earlier this year, asset manager Schroders was added to the portfolio for the first time, with the manager citing the low valuation and the new management team, which he is confident will mark a turnaround.