Investment trusts are the premier way to invest in smaller companies in the UK, according to Richard Staveley, manager of the Rockwood Strategic Trust.

As a way of gaining exposure to UK small caps, trusts are a “much more appropriate structure” and will generally work out better for investors over the long-term.

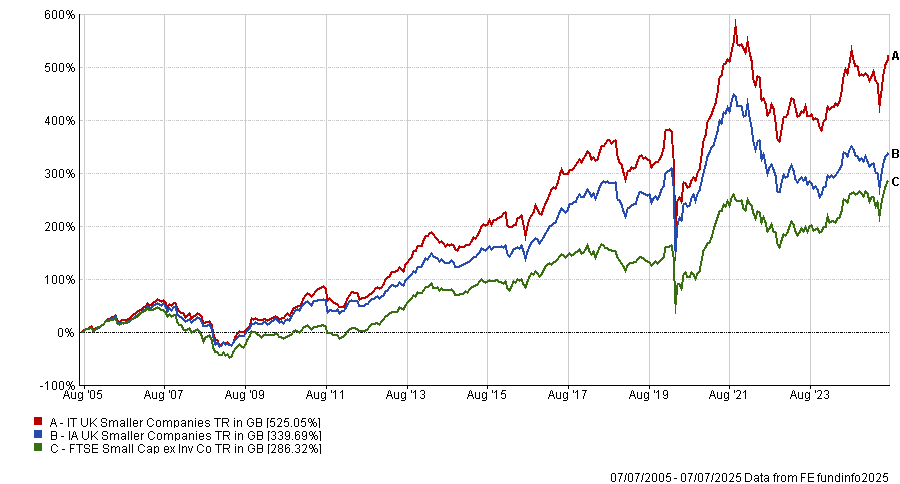

Indeed, the average strategy in the IT UK Smaller Companies Sector outperformed its open-ended counterpart by almost 190 percentage points over the past 20 years, as seen in the chart below.

Performance of indices over the past 20 years

Source: FE Analytics

This is primarily an issue of liquidity, Staveley explained. Because a trust is closed-ended, investors trade shares on the stock exchange rather than withdrawing money from the trust itself. This allows the manager to hold less liquid assets, such as smaller companies, without being forced to sell to meet redemptions during periods of volatility.

As a result, trusts can take more long-term, high-conviction positions in companies that may take several years to grow. There is a “size effect” in investing, where the bottom 2% of the market outperforms the bottom 10%, which in turn beats mid-caps and so on, because these companies are growing from a smaller base. However, investors will only notice this if they can take a genuinely long-term approach, he said.

By contrast, modern open-ended investment companies (OEICs) have become “very dependent on liquidity management” partially due to investors' desire to be able to “pull out their money at a second’s notice”. OEICs can often become “forced sellers” as a result, needing to reduce positions they still believe in, to be able to pay sudden redemptions.

“If a manager is worried that in their first year or two, they’ll be asked to take the cash out of the fund due to short term instability, they’ll get very worried about supporting a company, putting a lot of money in and seeing the benefits, which can take several years to play out”.

This “dependence” on liquidity also means that larger asset managers often struggle to run small-cap funds and trusts effectively, he argued.

Small-cap strategies with more assets under management generally only invest in small companies further up the market capitalisation scale, perceived to be “safer and less problematic investments”, missing out on the interesting recovery opportunities further down the market-cap spectrum.

For example, he pointed to Capita PLC, a former member of the FTSE 100 that slid to a market capitalisation of less than £200m following accounting scandals, an indebted balance sheet and too many acquisitions. Most larger asset managers “do not give it a second glance” as a result, despite greatly improved fundamentals, a more solid balance sheet and the share price rising by around 60% so far this year.

These are the kind of interesting opportunities you can take in a trust compared to a fund, he explained.

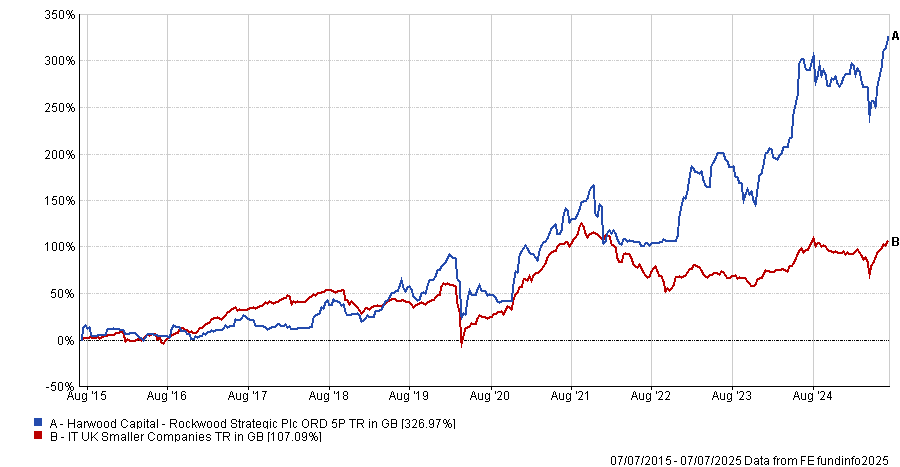

The data indicates that this approach has been successful for Rockwood Strategic, which is the top-performing fund in the IT UK Smaller Companies sector over the past decade.

Performance of the trust vs the sector over the past 10yrs

Source: FE Analytics. Total return in Sterling.

While trusts may allow managers to take more long-term stakes, this does not mean they are always the best choice for investors, according to Abby Glennie, manager of the Aberdeen UK Smaller Companies fund (the largest IA UK Smaller Companies fund) and the Aberdeen UK Smaller Companies Growth Trust (the sixth-largest IT UK Smaller Companies Trust). This is because trusts face challenges that OEICs don’t.

First, there an issue with demand. The lack of liquidity prevents investors from wanting to get involved in investment trusts at all, particularly when it is investing in an already less liquid part of the market.

“The challenge with trusts, particularly smaller trusts, is that a lot of the market is starting to see them as irrelevant.” She argued this is demonstrated in the consolidation and purchases of investment trusts this year, with a 17% decline in the number of trusts on the market compared to 2022.

Trust also have “an additional source of underperformance”: the discount to net asset value. In recent years, as investors became more pessimistic about UK equities, the discounts on investment trusts have widened significantly across the sector, which is a further risk factor that OEICs lack.

As a result, while investment trusts can certainly be a compelling way to invest in smaller companies, it can turn off investors, she concluded.

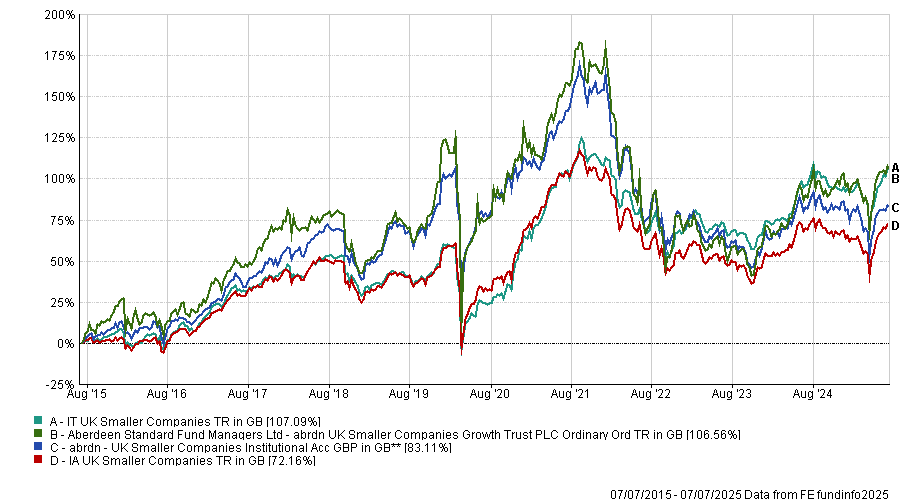

Performance of Aberdeen Smaller Companies fund and trust over 10yrs

Source: FE Analytics. Total return in sterling