Stock market volatility is causing Schroders’ value managers to find opportunities in areas of the market they have not touched in years.

For many years, luxury brands such as LVMH and Gucci were excluded from the team’s investable universe, as they tended to be popular stocks on high starting valuations.

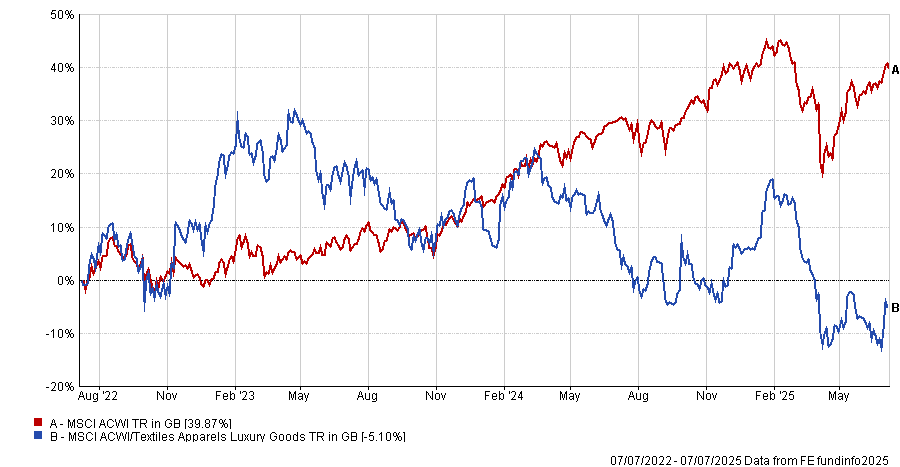

However, the fortunes of luxury good stocks have taken a turn for the worse, with the MSCI ACWI/Textiles Apparels and Luxury Goods index down by 5.1% over the past three years, significantly underperforming the broader MSCI AC World.

Performance of indices over 3yrs

Source: FE Analytics. Total return in sterling.

This underperformance has continued to build, with luxury good brands threatened by US president Donald Trump’s tariff announcement in April. Combined with poor sector earnings, luxury goods giants such as LVMH fell as much as 30% this year.

Share price performance of LVMH over 1yr

Source: Google Finance

However, Andrew Williams, investment director in Schroder’s global value team, said the declining valuation of these stocks in recent years is a signal that the “market often gets ahead of itself”. As a result, the value team is now finding that luxury goods are back on the radar due to newly distressed valuations.

“For the first time in all the years I’ve been doing this, we’re looking at luxury stocks again,” he added.

For example, the Schroder Recovery fund – one of the most “pure reflections” of the team’s approach – has a prominent position in UK fashion giant Burberry, which has experienced some very challenging recent years.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said earlier this year: “Burberry is dealing with difficult conditions in the mid-market luxury sector. It doesn’t have the same pull as its ultra-luxe rivals and aspirational shoppers are more cautious, without the deep pockets of wealth to keep them insulated.”

The share price has therefore been volatile in recent years, with the stock experiencing major downturns in early 2024 and 2025. However, Schroders’s position in the stock is paying off this year, with Burberry introducing a large-scale cost-cutting strategy under the new chief executive and delivering earnings above expectations.

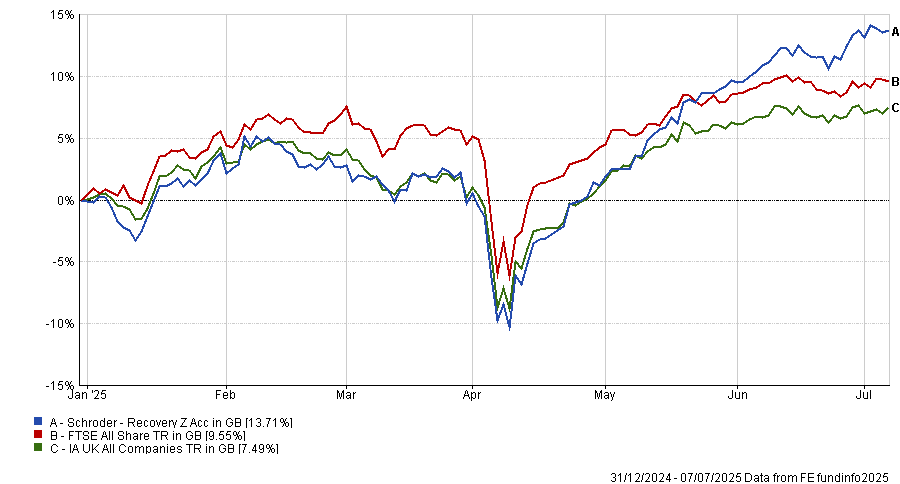

So far this year Schroder Recovery is up 13.7%, the eighth-best result in the IA UK All Companies sector. This is also a better return than the FTSE All Share, in part due to many of the strategies' recovery situations building momentum in their turnarounds.

Performance of Schroder Recovery vs sector and benchmark YTD

Source: FE Analytics. Total return in sterling

Across the luxury goods market more broadly, however, there are plenty of compelling value opportunities.

Several retail conglomerates, particularly in Europe, have evolved into more focused luxury groups with high-end brands, but are being generally misjudged by the market.

“While there are risks to these [luxury stocks], such as uncertainty around tariffs and a less-than-pristine balance sheet, we believe these are more than accounted for in the current valuation,” Williams said.

The decision to add Burberry and consider buying further luxury good stocks reflects the Schroder team’s value approach. It targets just the cheapest 20% of companies on the market, based on the belief that those businesses will deliver the greatest outperformance.

Williams explained: “When you buy things when they’re cheap, it feels like the worst time to be investing. But for your financial health, it’s the period of maximum opportunity.”

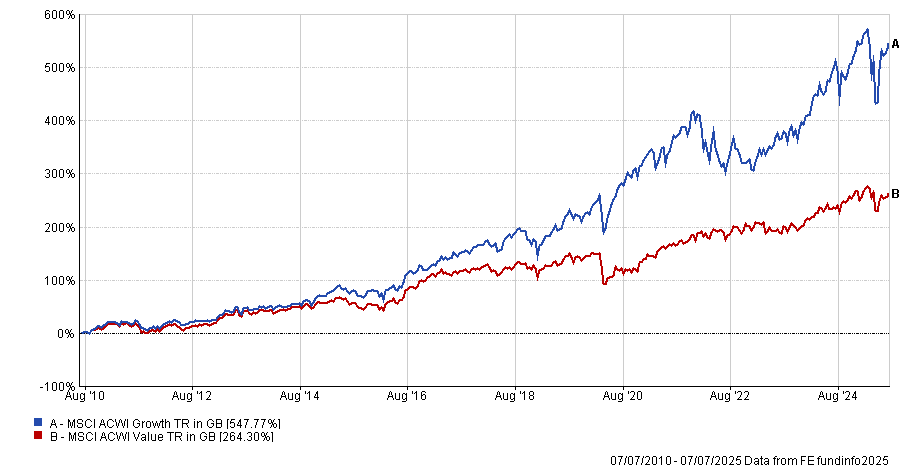

It should be noted that value investing has been out of favour in recent years, due to the spectacular returns that investors would have gotten by pursuing growth. “Between 2013 and 2020, until Covid really, there was not enough volatility in the stock market” for value investors to find mispriced opportunities, the investment director said.

Indeed, looking at the performance of the two indices over the past 15 years to include this, the MSCI ACWI Growth index is up 547.8%, almost double the performance of its value counterpart, as demonstrated by the chart below.

Performance of indices over the past 15yrs

Source: FE Analytics.

However, Williams argued that because growth investing has outperformed recently does not mean investors should ignore the value opportunities in areas such as luxury.

“As people, we get too greedy when stocks go up and we buy at very high prices, and we get too fearful when stocks go down and we sell off, irrespective of what is going on,” he argued.

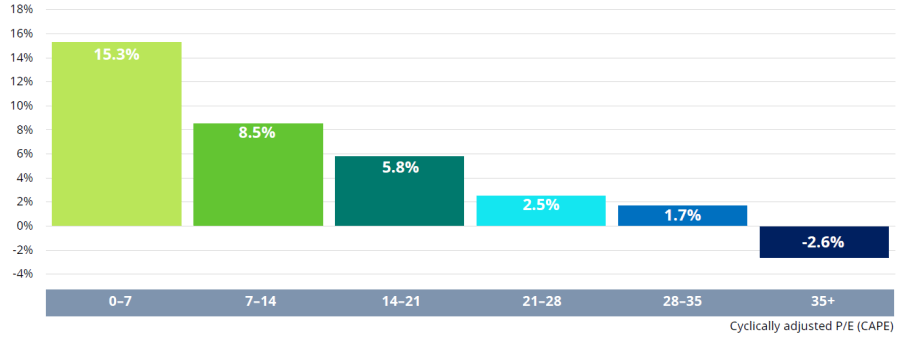

But currently top-performing stocks are unlikely to outperform forever, he said. Meanwhile, over 150 years of market developments, including the computer, world wars and financial crisis, buying the cheapest companies on the market generally leads to better returns, as seen in the chart below.

10-year annualised return from different starting P/E’s

Source: Schroders. Data based on US equity market since 1871.

“While the questions of what happens next can be important, the most crucial question is simple,” Williams finished. “You need to ask how much the business is worth. That will determine your future returns.”