Wealth manager Killik & Co is shifting its attention to emerging markets and China, where depressed prices offer an entry point even in the face of uncertainty, according to Andrius Makin, senior portfolio manager at the firm.

“The Chinese market as a whole is on such a low valuation and its companies are growing so quickly that they don’t need to execute perfectly. We don’t need perfect earnings delivery to get good returns,” he said.

“The valuations are just so compelling that it makes sense to be overweight”.

This view, which is specific to Killik's discretionary fund portfolios, reflects both current opportunities in the country and broader concerns around concentration risk elsewhere, particularly the US, he explained.

Positive momentum and currency opportunities

The mood around Chinese equities tends to shift rapidly, Makin argued, with structural positives such as growing earnings and favourable demographics often overlooked during moments of political intervention or market fear.

In these cases, investors “dump the market” and valuations fall to very low levels. Then, “you just see the cycle repeating”.

For much of the first part of this decade Chinese stocks were under severe pressure, with the IA China/Greater China sector falling 70% between January 2021 and January 2024.

Over the past five years, only two funds have made investors money and some emerging market managers were keeping their distance.

But recent investor interest suggests sentiment may be shifting again and momentum could be building.

“With lots of political risk, China is very divisive but it’s one we’ve been asked about a lot recently,” the manager said. “People are starting to get interested again.”

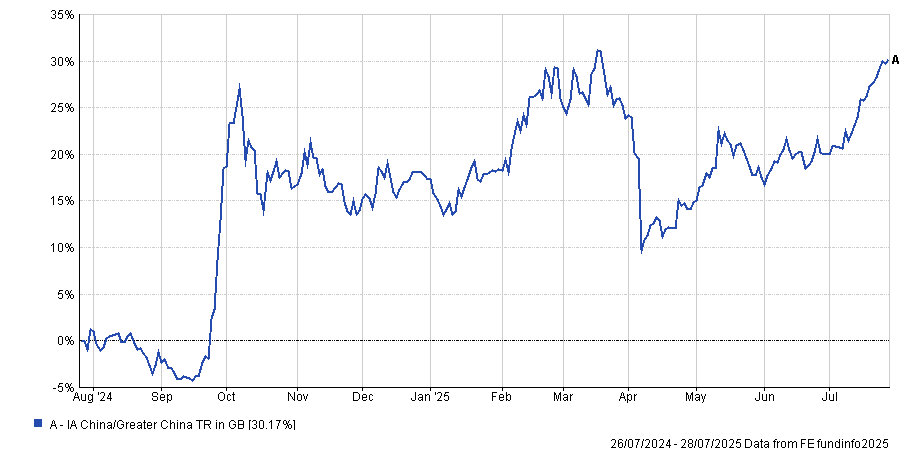

This year the sector jumped 30%, as the chart below shows, with some managers getting back into the market. For example, the Lazard Emerging Markets fund went overweight China for the first time in almost 30 years.

Performance of sector over 1yr

Source: FE Analytics

Killik’s interest in emerging markets is also informed by macro positioning, as a weak dollar is going to be positive for emerging markets generally. While not the sole driver of allocations, currency shifts are one of several tailwinds.

Diversification opportunities

Beyond macroeconomic factors, Makin emphasised the need for more deliberate portfolio construction in a market still dominated by US equities and where investors don’t realise how concentrated their portfolios are in stocks such as the Magnificent Seven.

While US equities have dominated returns in recent years, the manager said this isn’t necessarily going to be enough anymore.

Killik has been underweight the US for a while (for example by cutting its allocation to Fundsmith Equity, as he recently told Trustnet). It has been “a very painful decision for a long time, but one that has paid off a bit now” and has allowed Makin to build a more granular geographical approach.

“Historically, a lot of portfolios – even in the wealth space – just had a global allocation, with a bit of emerging markets and a bit of UK. What we’re doing now is being much more transparent about our geographical splits, with separate allocations to emerging markets, Asia Pacific and Japan, because valuations will move around a lot.”

Europe, Asia Pacific and emerging markets are all showing signs of relative strength in 2025. “Europe’s having a very good year to date. Asia Pacific as well. Emerging markets too – for the first time in a while, there are some really strong tailwinds.”

Portfolio construction and fund selection

The core of Killik’s portfolios remains anchored in low-cost exposure but the team will allocate to more expensive structures if the benefits are clear. That is the case with Fidelity China Special Situations.

“It’s a more expensive fund but it has unlisted exposure and gearing to justify that. Over short periods those things can lead to sell-offs or difficult markets but, over the long term, gearing and unlisted exposure will usually add value when markets go up,” he said.

The fund is held in high regard by many industry experts and has been highlighted on Trustnet before as a fund to diversify your portfolio away from mega-cap tech.

Makin stressed a fund such as this would sit next to the core part of one’s portfolio, which should be “low-cost and close to the index”.

“With a real, unique selling point that isn’t repeatable and is structurally embedded, we’re happy to allocate even if the costs are higher.”