India has been one of the standout performers in global equity markets over the past five years, delivering consistent returns and attracting growing investor interest. But after a long winning streak, the past 12 months have brought a change in tone.

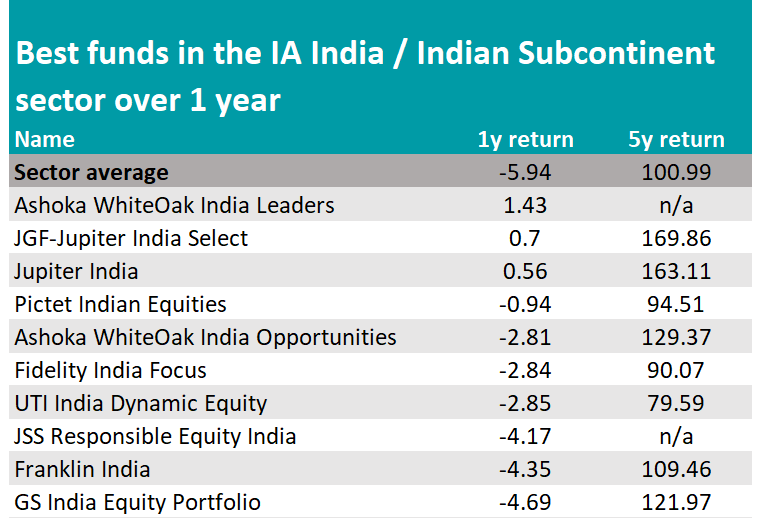

The IA India/India Subcontinent sector is up 100% over the past five years, but lost 5.9% over 12 months as valuations became stretched and global sentiment turned more cautious. Many investors who had previously chased India’s growth story were caught off guard by the sector’s recent pullback.

Yet a handful of funds managed to stay afloat despite the broader downturn, standing out for recent resilience and strong returns across market cycles.

Data from FE Analytics shows that just three funds in the IA India/India Subcontinent sector have posted a positive return over the past year: Ashoka WhiteOak India Leaders, and the two Jupiter strategies India and India Select.

Source: FE Analytics

Ashoka India Leaders: the top outperformer

The top performer by some distance was Ashoka WhiteOak India Leaders, with a 1.4% return. While much smaller than the Jupiter strategies, with just $24.7m of assets under management (AUM), and less widely known, the fund’s ability to deliver positive returns during a sector downturn was noteworthy.

It forms part of a growing range of Ashoka vehicles focused on Indian equities, which also includes investment trusts. The team – led by Prashant Khemka – has been gaining popularity among investors and its India trusts were highlighted last week as worth paying a premium for.

The manager uses a bottom-up process to select companies in India or that derive most of their revenues from the region.

With an overweight to small-caps, the largest sector exposure is financials, which make up 31.3% of the fund (an overweight of 3 percentage points against its benchmark, the MSCI India IMI index), followed by industrials (15.2%) and communications (8.8%).

The Jupiter funds: the most consistent and most researched

The second fund to remain in the black over the past year, posting a 0.7% return, was Jupiter India Select, which has consistently alternated with the flagship Jupiter India fund as the sector’s top performer over the one-, three- and five-year periods.

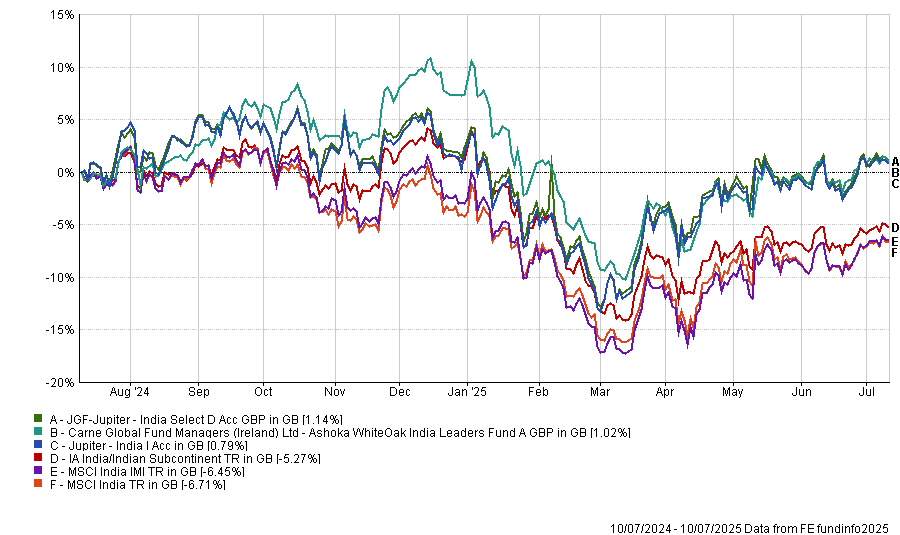

Performance of funds vs sector over 1yr

Source: FE Analytics

Managed by Avinash Vazirani, this five FE-fundinfo Crown-rated strategy offers a more concentrated portfolio and a slightly higher risk-return profile, but the core thesis remains the same: selective exposure to domestic growth via high-conviction stock picking.

Vazirani has been managing Indian equities for decades, launching the Jupiter India fund in 2011 and later adding the Select version. The former has become increasingly popular with investors, becoming the fifth most-researched fund on Trustnet last year.

It has a bias toward small- and mid-cap companies, which gives it a domestic tilt and greater exposure to India’s internal growth story. While this can make it more volatile, it also means the fund is well positioned to benefit from themes such as urbanisation, rising incomes and infrastructure expansion.

HL includes it on its Wealth Shortlist and attributes the strategy’s success to Vazirani’s “deep experience and willingness to invest in under-researched areas of the market”.

“We like the fact Jupiter India invests differently,” HL analysts said. “This gives it the potential to outperform the Indian market – though the reverse is also true.”

Both Jupiter India and India Select have proved remarkably consistent, featuring among the 69 funds across the entire IA universe to deliver top-quartile returns in each of the past three calendar years this January, navigating a very different set of conditions – from inflation shocks in 2022 to bull-market exuberance in 2024.

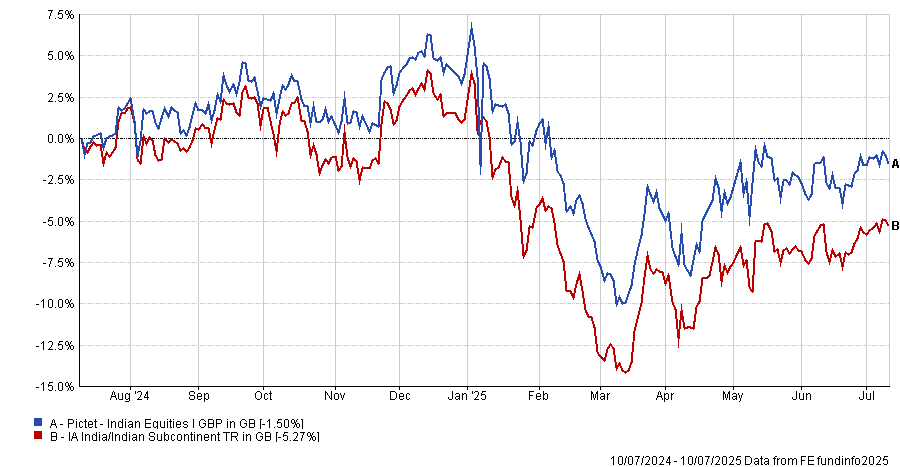

Finally, in fourth position and worth a mention was Pictet Indian Equities, which was just below positive territory, as the chart below shows.

Performance of funds vs sector over 1yr

Source: FE Analytics

The strategy, managed by Prashant Kothari, is backed by FE Investments analysts for its concentrated portfolio of high-quality companies.

The bulk of the portfolio is in liquid, large-cap stocks and the allocation to small- and mid-cap stocks fluctuates based on the opportunity set and valuation.

“This suggests the portfolio would be ideal as a core holding for those wanting exposure to India, but investors should be aware of the risks of investing in a single-country fund, notably, the currency exposure,” FE Investments analysts said.

“The fund does not hedge currency so returns can be driven by fluctuations in the Indian rupee.”

This article is part of an ongoing series analysing the best funds in the worst-performing sectors. Last week, we covered China.