Mounting fiscal pressure, inflation and market volatility have broken the link between short- and long-term US treasury yields, with maturities over five years holding far less appeal, according to several bond managers speaking to Trustnet.

Typically, yields across the curve respond to market expectations of US Federal Reserve interest rates. But today that relationship is weakening, with fiscal uncertainty, rising debt and global market shifts pushing long-dated yields in a different direction. This has created a disconnect that has bond managers rethinking duration risk.

5yr versus 30yr bond yields as of 26 June

Source: Schroders, Macrobond, Bloomberg

As surmised by Marcus Jennings, fixed income strategist at Schroders: “We are starting to see different drivers impact 30-year bonds relative to five-year.”

One major headwind for longer-term treasuries is US president Donald Trump’s ‘big beautiful bill’, which includes deep tax cuts and heightened spend. It has bond managers concerned this could drive larger deficits and add to national debt – the latter of which soared to $36.6trn as of March 2025.

James Flintoft, head of investment solutions at AJ Bell, said: “Longer-duration bond yields in the US have moved through 5% at times but have digested the news relatively well.

“For us, the increased spending adds to the risks we see in longer duration positioning, which remains vulnerable to tail-risk events. It poses questions over the traditional long duration bond-equity correlation and, given the shape of the curve, it doesn’t make longer-dated bonds attractive in our view.”

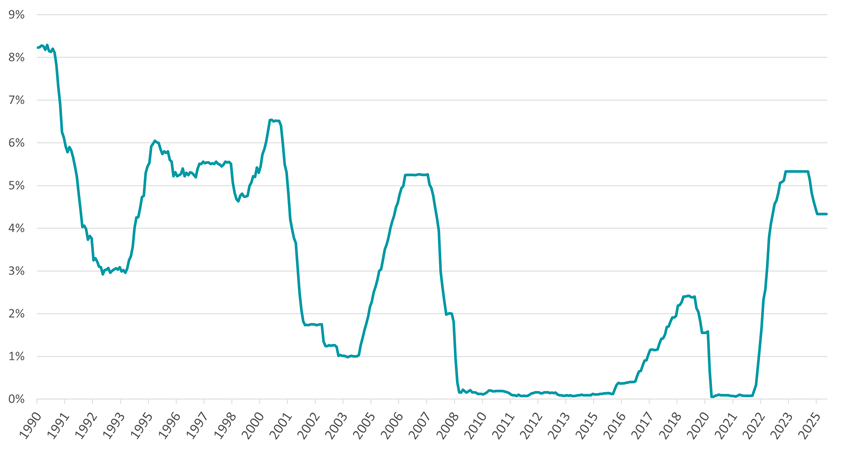

Federal funds effective rate 1990-2025

Source: Board of Governors of the Federal Reserve System via FRED

According to Mike Riddell, portfolio manager of the Fidelity Strategic Bond fund, the Fed’s decision to cut rates from 5.5% last year to 4.5% resulted in five-year treasury yields falling almost 75 basis points (bps) since April 2024 while 30-year treasury yields climbed 25 basis points higher. That divergence highlights how long-term government bond yields have become “unanchored” from Fed fund rates.

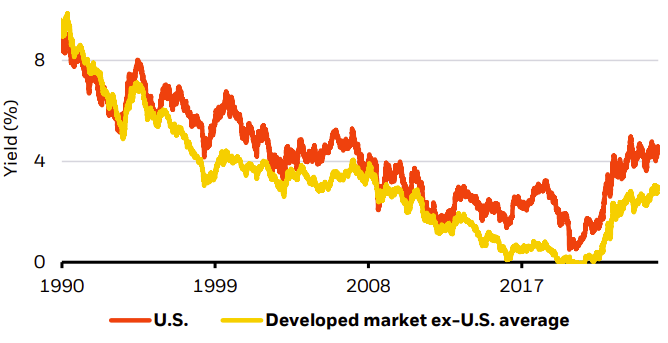

With investors demanding more term premium to hold longer-dated debt, the 10-year treasury yield increased by around 50 bps above April lows to 4.4%, as illustrated below by BlackRock Investment Institute.

10-year US yields vs ex-US developed market yields between 1990-2025

Source: BlackRock Investment Institute, with data from LSEG Datastream, May 2025

More upheaval may lie ahead, with Fed chair Jerome Powell set to exit next year.

“Trump wants lower yields, so he could select a more dovish replacement who could jawbone the market lower,” Jennings said. However, if Trump’s man is too dovish, then that could result “in an inflation problem”.

Pressure on the long end of the curve isn’t limited to US policy and fiscal decisions. Germany’s debt-to-GDP ratio is climbing, Japan’s rising long-term yields are reducing demand for US treasuries and then there is the question of whether China will offload US bonds for geopolitical reasons.

At the same time, Riddell said that global bond markets are being “flooded” with issuance and central banks “have long since stopped buying”. Indeed, the Bank of England is actively selling bonds.

In response, some bond managers are shifting their portfolios to the shorter end.

“If you take pretty much any of our positioning across funds through to those that are benchmark agnostic, you are unlikely to find any duration above five or six years,” said Julien Houdain, head of global unconstrained fixed income at Schroders.

It’s possible to build a bond portfolio with a 7% yield in sterling terms and a lower risk profile by sticking to shorter-term investment-grade bonds. If inflation stays around 3% or 4%, that’s a healthy return, he explained.

“It’s about minimising the risk, being humble – recognise that things can get much worse, especially now that the credit valuations are expensive – and making sure we harvest this yield.

“The only way to lose money would be to park everything into the 10-year to 30-year part of the curve.”

Jennings added that he and his team have played front-end divergence between the UK and Europe and are looking for UK yields to fall relative to Europe towards the shorter end of the curve, due to a weaker UK labour market and stronger growth in Europe.

AJ Bell’s Flintoft said that short duration US treasuries and UK gilts also remain his preferred defensive position. “We see these offering attractive protection in a risk-off environment, and we don’t see them as being as vulnerable to bond market shocks,” he said.

However, some managers still see selective value.

Stuart Chilvers, fund manager in the fixed income team at Rathbones, said the Treasury could help alleviate pressure by reducing the share of funding raised from long-dated treasuries.

“We could see longer-dated treasuries offering value within the context of our portfolio if we expected US employment to weaken materially,” he said.

In this scenario, while the outright fall in longer-dated yields would likely lag that of shorter-dated treasuries, Chilvers theorised that the “multiplier effect” of longer duration could mean better relative returns over time.

Rathbones only invests in US treasuries via its Strategic Bond fund.

Riddell said Fidelity has recently added some duration to its Strategic Bond funds after exiting credit positions that had become expensive.

“Having bought credit when it cheapened in the April sell-off, we have since sold out, now that valuations are again super expensive. We’ve been moving longer rate duration in expectation of the global growth hit, where we’d moved close to neutral in the second quarter of the year.”

Meanwhile, over a quarter of Fidelity’s global flexible bond fund is invested in emerging market local currency bonds, mostly unhedged.

Harvey Bradley, co-head of Global Rates at Insight Investment, takes a moderate stance, noting that bonds out to 10 years “remain attractive, especially relative to European bonds”.

“The European Central Bank was able to bring forward its easing cycle and is now far ahead of the Fed,” he said, noting that if the Fed catches up next year, this would be positive for US bonds with a maturity of up to 10 years.

“The higher current yields in the US bond markets, combined with the rise in yields, would lead to significant outperformance for investors holding US bonds,” he said.