The UK’s largest investment platform Hargreaves Lansdown has dropped the Schroder Income fund from its coveted Wealth Shortlist after veteran manager Nick Kirrage announced he is to leave the fund group to pursue new opportunities, but others have backed the team in place.

Kirrage is co-manager of the £930m Schroder Recovery and £1.3bn Schroder Income funds, as well as the £862m Schroder Income Maximiser portfolio. He is also the head of value equities, a role that will be taken up by Simon Adler.

Schroder Recovery will pass on to current co-manager Andrew Lyddon, with Tom Grady joining him. Grady was elevated to co-manager of the Schroder Income and Income Maximiser funds last month after former co-lead Andrew Evans left the firm for personal reasons. He will continue to run these strategies alongside Lyddon.

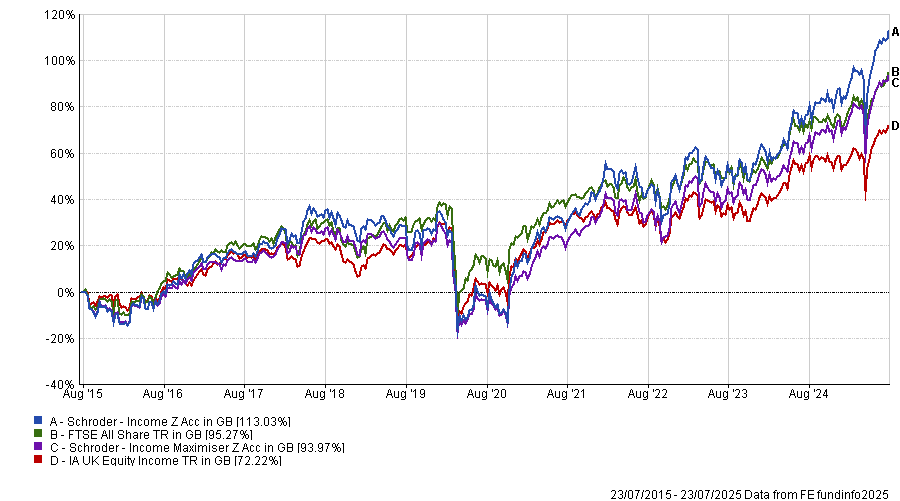

Schroder Income has been the best performer of Kirrage’s three funds, up 113% over the past 10 years, the fourth-highest return in the IA UK Equity Income sector. Schroder Income Maximiser (also in the same sector) has made 94%, a second-quartile performance over the decade.

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

Despite some continuity and an excellent long-term track record, this was not enough to convince Hargreaves Lansdown senior investment analyst Joseph Hill that the Schroder Income fund should remain on its Wealth Shortlist.

The firm removed the fund after 18 months, having only added it to the recommendations list in February 2024.

“We have a positive view of Kirrage as an investor and are disappointed to see him leave. He has an excellent long-term track record of investing in the UK stock market,” he said.

“Our conviction in the fund was based on Kirrage’s skill set, capabilities and experience of consistently applying this approach. His departure means we no longer have sufficient conviction in the fund’s future performance potential and we have therefore removed it from the Wealth Shortlist.”

Analysts at FE Investments also recommend the Schroder Income fund, but have placed the rating on hold pending further discussions.

“The loss of three managers represents a loss of a significant amount of experience and track record of successfully implementing the fund’s distinct strategy and, as such, has significantly reduced our confidence in the fund’s future performance,” they said.

Some were less sceptical of the changes, however. Schroder Recovery is among the funds recommended by The Adviser Centre, alongside the European and Global Recovery funds.

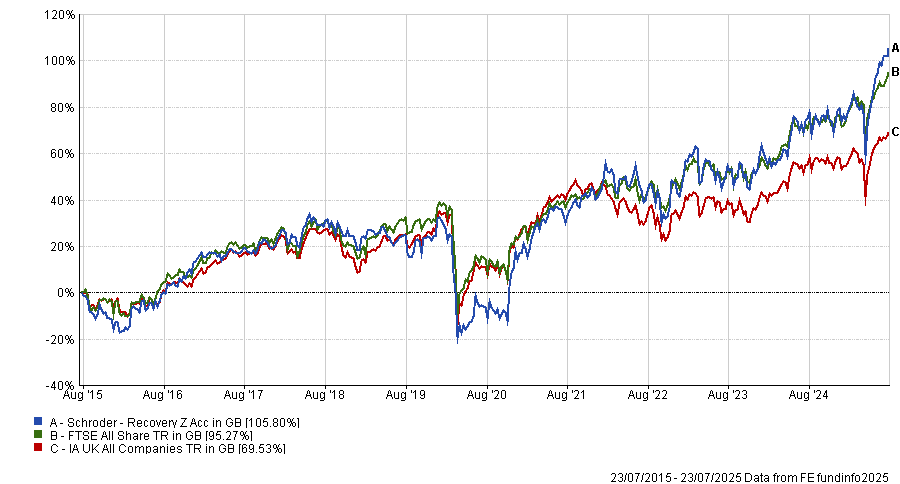

Schroder Recovery sits in the IA UK All Companies sector and has delivered 105.8% over 10 years, a top-quartile return during this time.

Performance of funds vs sector and benchmark over 10yrs

Source: FE Analytics

Chief investment officer Peter Toogood, said: “Kirrage leaving is clearly a loss but the underlying value process was established many decades ago under Jim Cox. We have witnessed a number of evolutions of the process under both Ben Whitmore and Ian McVeigh, then latterly Murphy and Kirrage.

“The remaining team have been working closely together for a number of years and we have been in regular contact with Lyddon over recent months. We will be reviewing the state of play soon but will not be rushing to change our recommendation at this point, given the longevity of the process.”

Darius McDermott, managing director at FundCalibre, recommends both the Recovery and Income funds, with both receiving an ‘Elite Rating’ from the firm. He too is not making any changes despite Kirrage’s departure.

“Kirrage leaves behind a well-resourced and stable team, with an embedded investment process and strong continuity in portfolio management,” he said.

“He has forged a great legacy at Schroders. We will not be changing the status of the current Elite ratings applied to the funds he managed.”

The fund picker suggested a ‘buy’ rating on the funds would be appropriate, meaning investors who own the funds should continue to allocate to them, while potential new investors should not be put off investing by Kirrage’s exit.