Britons might be chasing sun abroad this summer, but Andrew Jones is looking at hotels closer to home when it comes to his portfolio. The co-manager of the Janus Henderson UK Responsible Income fund has been adding to Premier Inn-owner Whitbread and argued the market is underestimating its potential.

Whitbread has been a weaker contributor over the past year, but Jones has kept faith despite the fact the stock was among the fund’s worst performers over the past 12 months, as the manager recently told Trustnet.

It is among the fund’s three largest active weightings right now alongside medical equipment manufacturer Smith & Nephew and energy company SSE, with Whitbread currently a 2.3% position and the fund’s ninth-largest holding.

Jones’ case is straightforward. “Whitbread is predominantly Premier Inn in the UK and Germany. It’s been held back recently by subdued UK consumer demand, which has limited revenue per room. But we think it’s undervalued. When the cycle turns, the share price will reflect that.”

He added now is an attractive entry point into the name.

“Revenue-per-room guidance has clouded the progress it is making and the value it is creating but we still think it’s a very good store of value.”

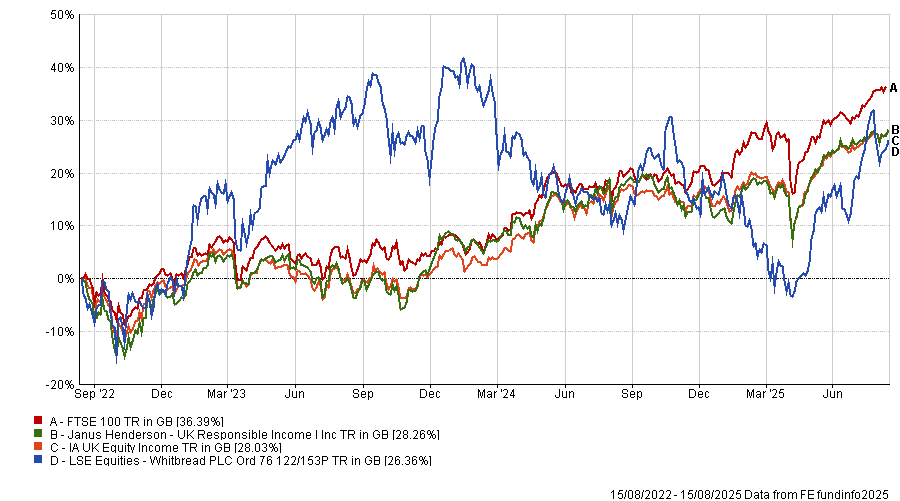

Recent performance lends some support to the “turning cycle” view. Over six months Whitbread is up 18.2% versus 7.4% for the FTSE 100; over one year it is broadly in line (12.8% vs 13.4%), while the index also leads over three, five and 10 years, as shown in the chart below.

Performance of fund and stock against index and sector over 3yrs

Source: FE Analytics

Part of his thesis for owning the stock rests on the operating model and the recent innovations, such as converting many of its restaurants into extra rooms.

“Most of the profit comes from hotels, so what they need is to be able to offer breakfast, not a full pub restaurant. Converting pubs to rooms improves returns when the property allows,” he said.

Engagement with management has reinforced his conviction, as did his visits to the hotels: “I spend a lot of time in Premier Inns and I must say they offer a very consistent and reliable guest experience.

“The long-term value proposition is strong and when consumers feel more confident, that should come through,” he added. “They have been taking market share from more expensive and slightly tired three- and four-star hotels.”

Importantly, Jones frames Whitbread not as a standalone punt but as part of the portfolio’s balance. “Together, Smith & Nephew, SSE and Whitbread reflect our approach: medical turnaround, UK consumer cyclical, and a stable utility.”

That mix also avoids the fund’s long-standing exclusions (including oil & gas, tobacco, gambling and some banks), while adhering to its income discipline.

This can leave the portfolio out of favour when excluded sectors rally, but has not prevented it from building a record of competitive returns over the long run.

For Whitbread specifically, Jones’ stance is that the fundamentals are improving while sentiment has yet to catch up. He argued the market’s focus on near-term revenue-per-room guidance is obscuring the underlying progress in the UK estate and the runway in Germany.

“It’s been held back recently by subdued UK consumer demand, which has limited revenue per room. But we think it’s undervalued. The business it has built in Germany is also very valuable.”

That combination – an operationally simple model, a consistent guest proposition and an asset-backed footprint – is, in his view, well suited to a measured recovery in UK consumer confidence.

The fund’s position size (2.3%) reflects high conviction without dominating risk and the manager has been clear that the name sits within a broader framework rather than being a single-stock bet.

As staycations and city breaks fill the calendar, the portfolio remains positioned for an eventual turn in sentiment. “When the cycle turns, we think the share price will reflect that,” he concluded.