Active managers are struggling to justify their costs in a period of cheap passive tracker dominance.

In theory, active managers' higher fees are due to their potential to outperform and their flexibility, which allows them to adapt to rapidly changing markets that may trip up passive counterparts.

But in practice, just 16% of global active funds have outperformed their average passive counterparts over the past five years, according to AJ Bell’s Manager vs Machine report.

This has left investors to question if they need to go active, with so many underperforming cheap trackers. However, there are several active funds that have delivered the top returns to justify their higher fees.

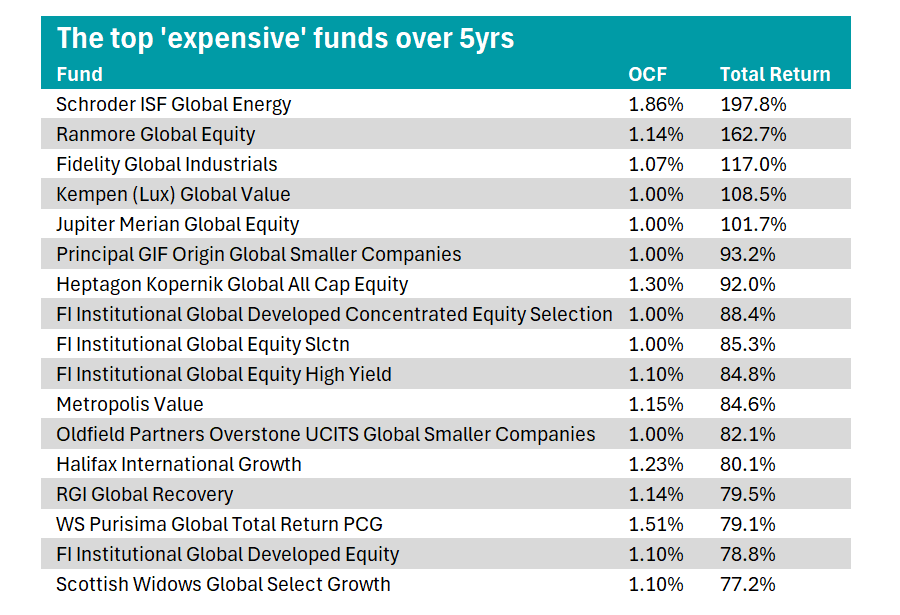

Trustnet examined funds that have delivered top-quartile returns in their respective sector over the past five years despite an ongoing charges figure (OCF) of 1% or higher. OCFs are based on the fund’s main share class, according to FE Analytics.

Starting with the IA Global sector, 17 funds match this criteria, as seen in the chart below.

Source: FE Analytics. Total returns in Sterling to the end of August

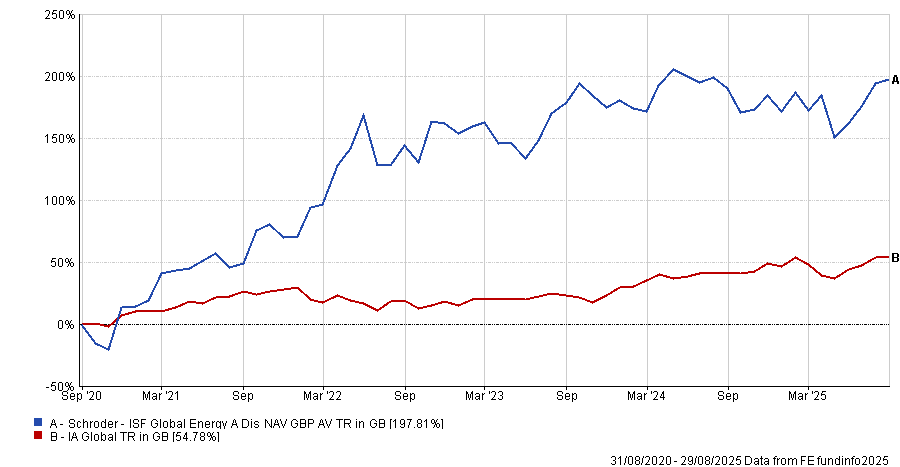

Heading up the shortlist is the Schroder ISF Global Energy fund, managed by Mark Lacey, Alex Monk and Felix Odey.

The fund invests around two-thirds of its assets in small-cap and mid-cap energy securities and assets and can hold around a third of its portfolio in other assets, such as US treasuries.

At a 1.86% OCF, it is the most expensive fund on the shortlist, but its 197.8% total return is the best five-year performance in the 550-strong sector.

Performance of fund vs sector over 5yrs

Source: FE Analytics. Total returns in Sterling to the end of August

It has also delivered a top performance year to date, which managers partially attributed to positive returns from holdings such as Canadian electricity company TransAlta.

The US' threat of secondary sanctions on Russia and reciprocal tariffs on buyers of Russian oil were also identified as positive for the fund, serving to drive up oil prices in July, managers continued.

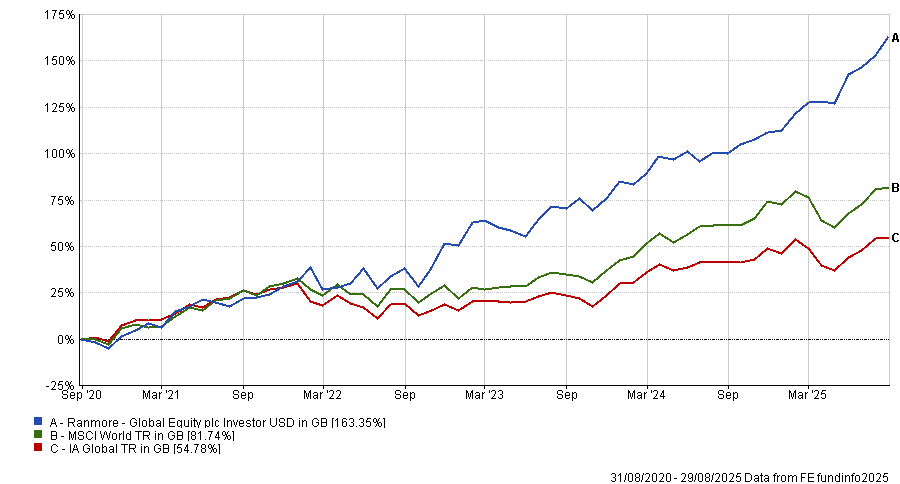

In second place is Ranmore Global Equity. Led by Sean Peche, it is a value-focused strategy which looks significantly different to the average global fund. For example, just 18% of the fund is invested in North America compared to a 74% allocation to the US in the MSCI World.

While its 1.14% OCF is expensive, its 163% return after fees is the second best in the IA Global peer group.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Total returns in Sterling to the end of August

The strategy is favoured by the team at FundCalibre, who gave it an elite rating earlier this year.

“In a world where the number of value managers has started to dwindle, Ranmore stands out like a shining star,” analysts said. They added that its performance is “particularly impressive” because its value style and emphasis on small and mid-cap companies have been out of favour.

It is far from the only value portfolio to make the shortlist. For example, the Kempen (Lux) Global Value Fund, which charges 1%, has posted a 108.5% total return over the past five years. Metropolis Value, led by FE fundinfo Alpha Managers Jonathan Mills and Simon Denison-Smith, also qualified, pairing a 1.15% OCF with an 84.6% total return.

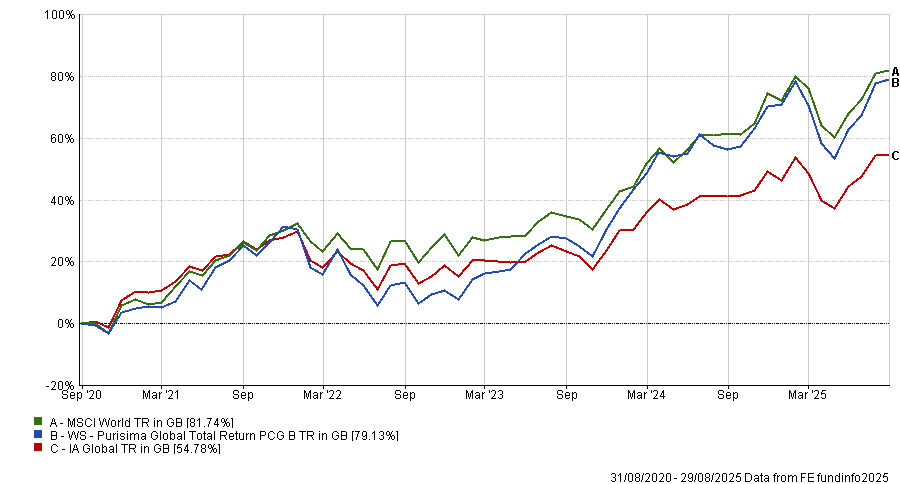

The largest strategy to make our shortlist is the £12bn WS Purisima Global Total Return PCG fund. With an ongoing charge of 1.51% it is the second most expensive strategy on the list.

Over the past five years, it has delivered a top-quartile return of 79.1%. This may be due to the large allocation towards the US and information technology, which the managers said was one of their largest positive contributors in 2024.

While this is a top-quartile return in the IA Global sector, it has narrowly underperformed its benchmark, the MSCI World.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Total returns in Sterling to the end of August

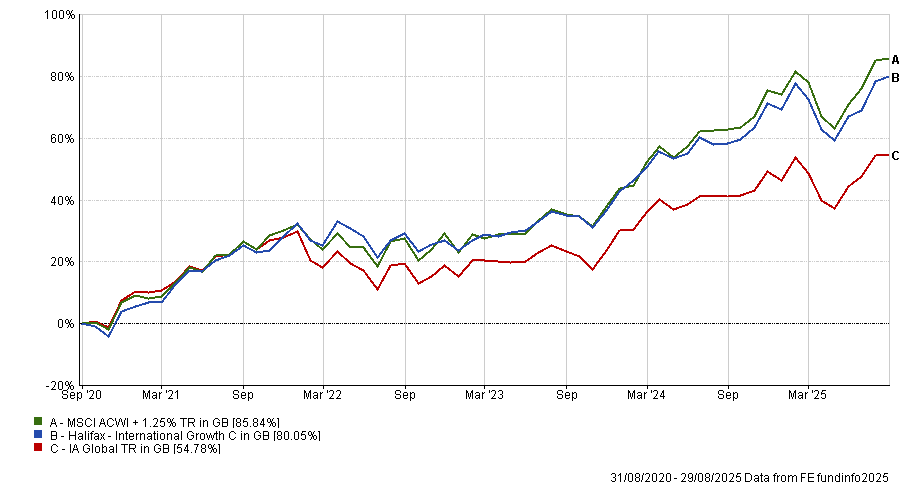

The second largest strategy to make the shortlist is Halifax International Growth, which currently holds £3.5bn in assets under management. Run by Schroders’ Philipp Kauer, the fund seeks to outperform the MSCI ACWI +1.25% index over rolling three-year periods.

Over the past five years, it has performed well, delivering an 80.1% total return to justify its 1.23% charge. This may be due to high allocations towards US mega-cap tech companies, with six of the ‘Magnificent Seven’ featured in its top holdings.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Total returns in Sterling to the end of August

It was a highly popular option for investors last year, hoovering up almost £1.1bn over the course of 2024.

Elsewhere, several mutual funds from the Fisher Investments Institutional team qualified (FI Institutional Global Developed Concentrated Equity Selection, FI Institutional Global Equity Slctn, FI Institutional Global Equity High Yield and FI Institutional Global Developed Equity), all of which outpaced the MSCI ACWI.