Traditionally seen as a sector for growth investors, healthcare is now drawing the attention of value hunters who see opportunity in discounted valuations and defensive earnings.

Healthcare has been driven by technological and medical innovation, high margins and long-term demand, with investors prepared to pay a premium for future earnings potential.

However, the sector has been under constant pressure over the past few years due to factors such as rising operational costs and regulatory changes, as well as several global macroeconomic ripples caused by a pandemic, skyrocketing inflation and the end of the low-interest regime.

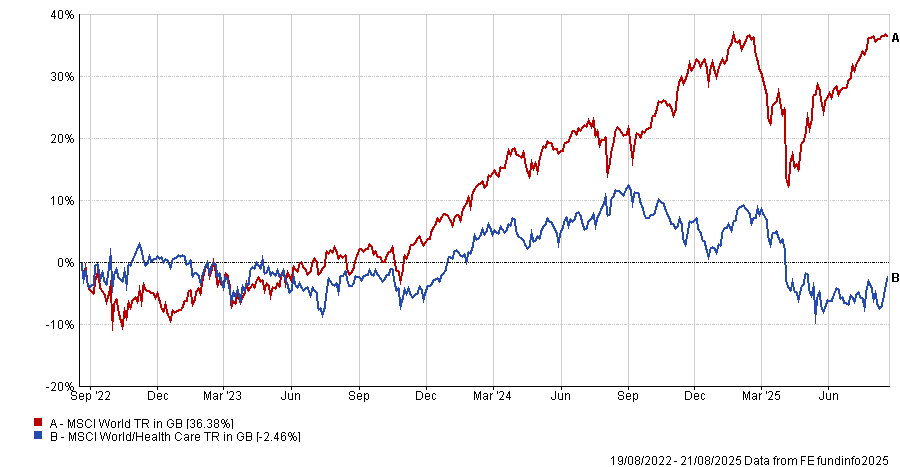

This is reflected in its recent performance, with global healthcare stocks taking a tumble.

Performance of MSCI World/Health Care vs MSCI World over 3yrs

Source: FE Analytics

As such, 2025 is shaping up to be a unique inflection point for value-based investing in the sector.

Rosanna Burcheri, portfolio manager of the Fidelity American Special Situations fund, said: “Across the healthcare sector in general, we are almost at the lowest price-to-earnings [P/E] valuation since 1992.”

These companies tend to provide products or services that are extremely necessary and will continue to be so in a world that is ageing faster than expected, Burcheri said, adding that many demonstrate good pricing power and a strong track record of delivering improvement in profitability and returns over time.

As such, many stocks in the healthcare sector and associated sub-industries look more like value stocks today.

“They have characteristics that normally provide investors with some reassurance that they are not value traps,” Burcheri said.

Bethany Shard, co-manager of the Invesco UK Opportunities fund, added she especially sees value on offer among some of the big pharmaceutical companies.

Concerns around US policy and tariff noise have dragged valuation multiples for several pharma companies down, rather than any concerning changes to the fundamentals, Shard said.

“Typically, pharma names would be viewed by many in the market as defensive but the uncertainty around the sector has been keeping many investors on the sidelines and therefore the valuations being attached to the stocks have been suppressed,” she noted.

One example highlighted by Shard was French biopharma company Sanofi, which utilises research and development and artificial intelligence to develop medicines and vaccines.

The share price is down 6.5% year-to-date and the P/E ratio sits just shy of 12x. According to Hargreaves Lansdown, the company was trading at a 21x P/E ratio as of the end of 2024.

Stock price performance YTD

Source: Google Finance

With all this in mind, healthcare stocks are beginning to appear in value funds.

According to Nedgroups investment specialist Nisha Thakrar, Nedgroup Contrarian Value Equity had zero exposure to healthcare two years ago. Today, it is rebuilding its position, with healthcare stocks currently representing around 6% of the fund.

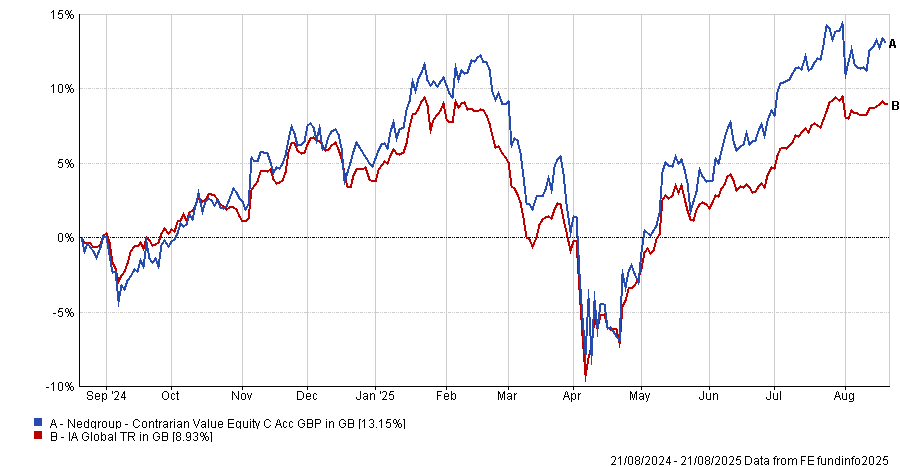

Performance of fund vs sector over 1yr

Source: FE Analytics

One of the companies the fund recently re-invested in is Thermo Fisher. “The fund owned the stock for around a decade and exited during the Covid period because it got too expensive,” Thakrar said.

“The valuation has become interesting due to short-term headwinds, so we have started building a position in the stock again. It still isn’t screamingly cheap but it is at a good level where we are willing to come in.”

The share price is down 7% year-to-date and the P/E ratio is 28x – down from 31x as of the end of 2024.

Stock price performance YTD

Source: Google Finance

Other healthcare holdings in the Nedgroup Contrarian Value Equity fund include Eurofins and ICON, which the fund’s managers expect will capitalise on more demand for chronic illness monitoring and need for outsourced scientists for clinical trials in the longer-term.