The golden age of the ‘Magnificent Seven’ is under threat, with some fund managers betting that most of the group will be left in the dust of the artificial intelligence (AI) evolution.

These stocks, made up of Alphabet, Apple, Amazon, Nvidia, Meta, Microsoft and Tesla, have dramatically outperformed broader markets in recent years, with their concentrated gains skewing index returns and proving a consistently lucrative play for investors.

Questions have circled regarding the long-term sustainability of this level of outperformance amid rising valuations and macro uncertainty.

Meanwhile, the shift from traditional software built on central processing units (CPU) to AI-driven graphics processing units (GPUs) is transforming how digital intelligence is developed and deployed, creating demand for companies offering new infrastructure, AI systems and tools for a more layered ecosystem.

Crucially, it is expected that GPUs – which enable AI systems to run with minimal human-written code – will drive down costs for consumers and be more customisable depending on their individual needs.

Storm Uru and Clare Pleydell-Bouverie, managers of Liontrust Global Technology, do not expect all seven of the US-based tech giants to thrive in this transition.

“Microsoft, Amazon, Apple and Alphabet were not built on GPUs – or software 2.0 – but on CPUs,” said Uru. “We think the argument that they will continue to grow into the future is flawed.”

Although these four companies are investing in shoring up their own AI capabilities, the faster-moving innovators in the software 2.0 space are reaping the rewards. For example, the meteoric rise of fellow Magnificent Seven stock Nvidia, which has added some $3trn to its market capitalisation since 2023.

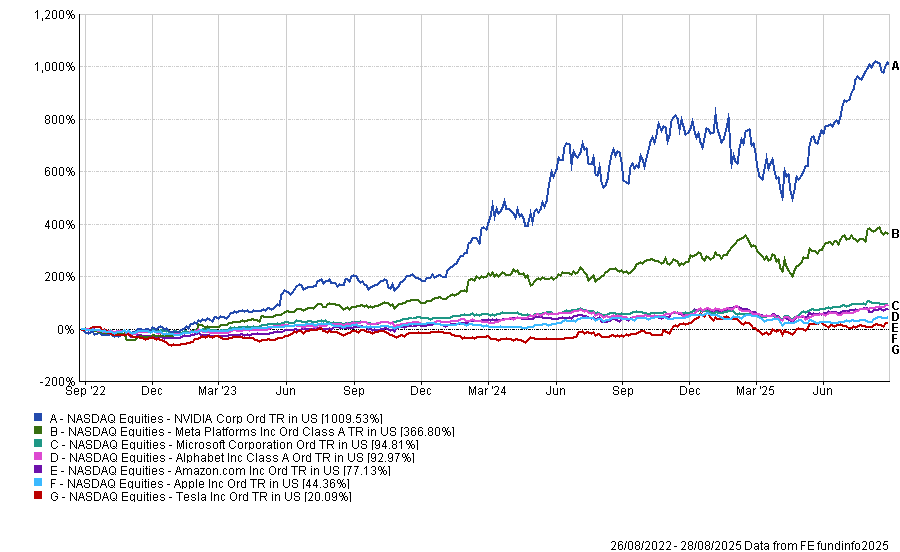

Performance of Magnificent Seven over 3yrs

Source: FE Analytics

“The entire technology ecosystem that is built on top of CPU architecture is going to really struggle, which means an end to the Magnificent Seven as we know it,” claimed Uru.

“Most of the Magnificent Seven is a very difficult play to invest in at this point in time –their fundamentals are deteriorating while others, like Nvidia, Meta and Tesla, are getting stronger.”

Chipmaker Nvidia is at the heart of the innovation wave, while Tesla should reap rewards as it continues to develop autonomous vehicles, according to the managers.

Meanwhile, Meta “owns the consumer”, said Pleydell-Bouverie. “The company has the greatest return on investment on AI out of all the Magnificent Seven because it has a major distribution advantage. It is in billions of peoples’ pockets right now.”

Liontrust Global Technology holds almost 10% in Nvidia, around 4% in Meta and 2.5% in Tesla. The managers trimmed their position in Tesla last year but have since been building it back up.

But there is also a broader suite of software 2.0 players emerging, with companies throwing elbows in the race to the front of the pack.

“Key winners include Broadcom – a leader in ethernet switching – and Amphenol Corporation, which provides high-quality interconnects that let companies talk to each other,” said Pleydell-Bouverie. The share price for both companies is up 33.1% and 61.2% respectively year-to-date.

Another company Pleydell-Bouverie and Uru see as a potential winner in the AI race is ServiceNow, a US-based enterprise software company that utilises its platform to automate and manage digital workflows across all core business functions, such as HR, customer service and IT.

Its strong growth expectations have been priced in, with a price-to-earnings (P/E) ratio of over 115x. Its second-quarter earnings per share sat at just over $4, beating analyst expectations.

Stock price performance over 5yrs

Source: Google Finance

Regionally, Pleydell-Bouverie also expects American dominance in technological innovation to be threatened by the likes of China and Japan.

“China has half the world’s AI developers and they are making huge amounts of progress and are very incentivised to build up their own AI capabilities,” she said.

“However, given the nature of Chinese competition, it is important to identify companies that are both driving innovation and passing on value to shareholders. Tencent and Alibaba are extremely well positioned in this respect.”

Japan could become a leader in physical AI through the development of robotics technologies and the disruption of traditional industries, she added.

“The big question is whether Japan’s robotics companies can hold on to their dominant market position,” Pleydell-Bouverie said. “That is the opportunity we are doing a lot of work on.”

Of course, it is unlikely Magnificent Seven companies are going to let go of their global dominance without a fight and recent earnings results show they have cash in hand to deploy to keep pace with (or take over) their rivals.

“We do think big companies in the Magnificent Seven will try to buy up competitors, but we are not quite sure that these companies will want to sell,” said Pleydell-Bouverie.

“Where Magnificent Seven companies can and should direct their capital is in building up their own infrastructure. There might be some M&A, but these Magnificent Seven companies have some genuine competition now.”

Regardless of whether the Magnificent Seven has the cash and clout to compete, for investors, the message is clear: the next decade’s tech winners may not be the same as the last, and agility will be key to navigating the race to the top.

Pleydell-Bouverie said: “We think the buy-hold is dead and that agility is imperative going forward because the pace of innovation is breathtaking at a time where market volatility over the past 12 months has also been a lot higher than historical norms.”