For investors, one of the biggest priorities today is uncovering and backing the winners of the artificial intelligence (AI) revolution. But leaders in the race thus far will not necessarily be the ones standing on the podium when all is said and done.

While there is much to be excited about, with new and lucrative innovations announced almost daily, some investors are concerned that an AI asset bubble has formed, with prices driven too high. What happens if the bubble pops?

Andrew Oxlade, investment director at Fidelity International, noted clear comparisons with the dot-com boom.

“Then, like now, investors jostled into a narrow set of companies promising to reinvent the world,” he said. “Many of those businesses were loss-making, built on hope rather than cashflow. When the bubble burst, the Nasdaq lost three-quarters of its value.”

For investors wanting to defend their portfolios against the possibility (or eventuality) of the AI bubble popping, diversification across styles, themes and geographies will be key.

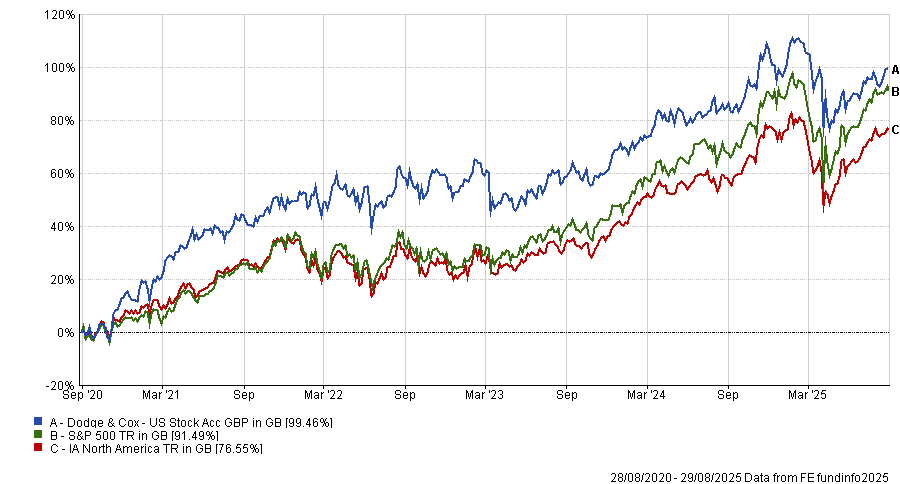

Oxlade said value investing is a “natural way” to avoid expensive areas like AI. As such, he pointed to Dodge & Cox US Stock, noting it has “a good track record and its holdings may find more favour when the AI hype fades”.

The $4bn fund has a 23.9% weighting toward healthcare stocks and 22% in financials, with top holdings including brokerage firm Charles Schwab and pharmacy and healthcare firm CVS Health Corporation.

Dodge & Cox US Stock has made a first quartile total return over five years, up 99.3%.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

Alternatively, investors could look to increase their smaller company exposure, Oxlade noted. “These companies will have less reliance on AI hype, and it is an area that has been neglected by investors for a sustained period,” he said.

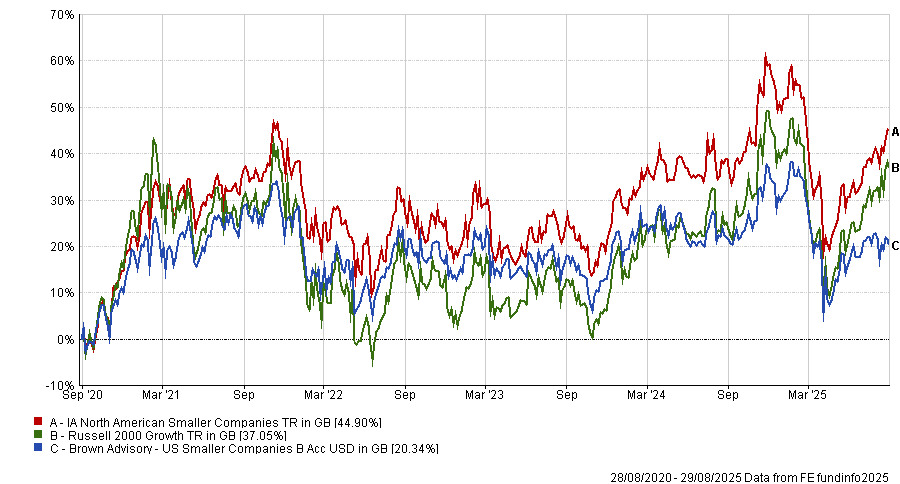

Brown Advisory US Smaller Companies was his pick, with the Fidelity investment director noting that it “seeks out quality-growth from below‑the‑radar names”.

The fund has been managed by Christopher Berrier and George Sakellaris since 2017 and targets smaller companies listed or traded on US markets and exchanges whose total market values are equal to or less than $5bn at the time of investment.

It has struggled to deliver strong total returns compared to its sector over one, three and five years, logging 20.9% over the latter period. However, over 10 years, it has fared better, managing a 166.8% gain – equivalent to a third-quartile performance compared to its sector.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

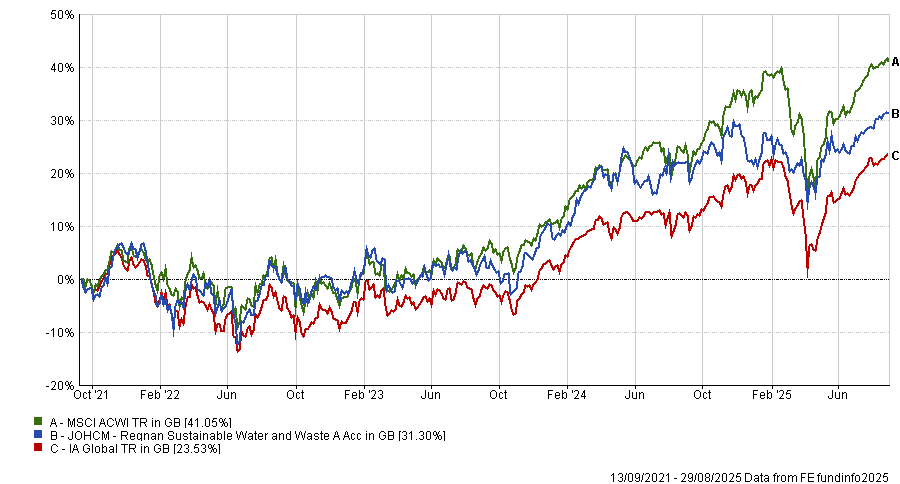

One option highlighted by FundCalibre managing director Darius McDermott, was Regnan Sustainable Water and Waste.

“Demand for water and waste solutions is underpinned by long-term structural needs with very low price sensitivity,” McDermott noted. “These companies operate largely at a local level, making them much less exposed to tariffs or geopolitical disruption.”

The £260.4m fund has been managed by Bertrand Lecourt and Saurabh Sharma since its launch in 2021, outperforming the IA Global sector but underperforming the MSCI ACWI over that four-year period. It has also managing a 27.4% return over three years.

Fund vs sector and benchmark since 2021 launch

Source: FE Analytics

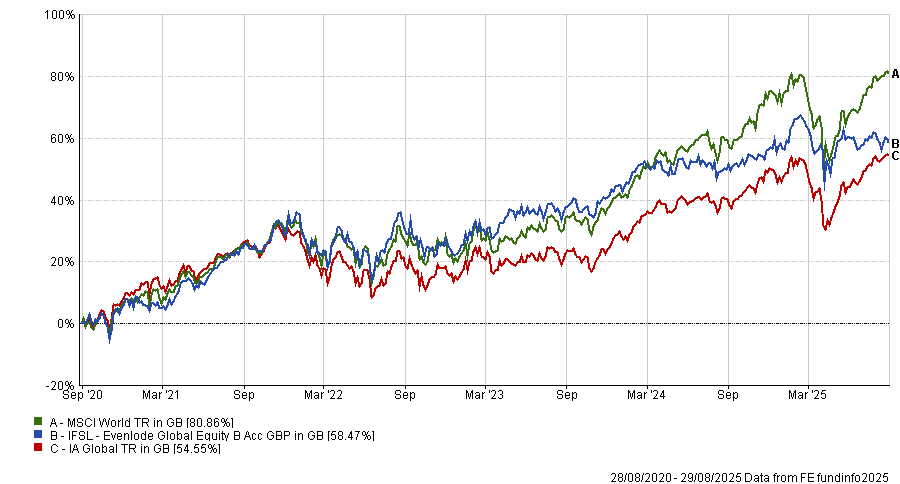

McDermott also suggested IFSL Evenlode Global Equity. “The fund takes a quality-first approach, backing capital-light companies that can compound growth without heavy reinvestment,” he said.

Earlier this year, co-manager James Knoedler, made a case for prioritising companies with characteristics that stand the test of time, rather than getting swept up in megatrends like AI.

“In contrast, [the managers] invest in financially robust businesses with durable advantages and proprietary data moats – such as information services providers and payment networks – that can harness AI to enhance productivity without relying on its success,” said McDermott.

Top holdings in the £458.6m fund – which has also been managed by Chris Elliott since its launch in 2020 – include analytics firm RELX, healthcare services company Wolters Kluwer and payments giant Mastercard.

“With quality stocks having sold off over the past year, valuations look far more appealing,” McDermott said.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

If the AI asset bubble were to burst, Marcus Blyth, collectives desk lead at Rathbones Investment Management, made a case for dividend-focused strategies.

“Historically, dividends have contributed around a third of total returns in the S&P 500 and, in difficult decades like the 1970s or 2000s, they were often the primary source of positive returns.”

Blyth noted that dividends have also accounted for around 60% of long-term returns in the UK market.

“With the UK lacking the AI tailwind seen in the US, it may offer a relative safe haven and potential upside in a post-AI correction environment,” he said.

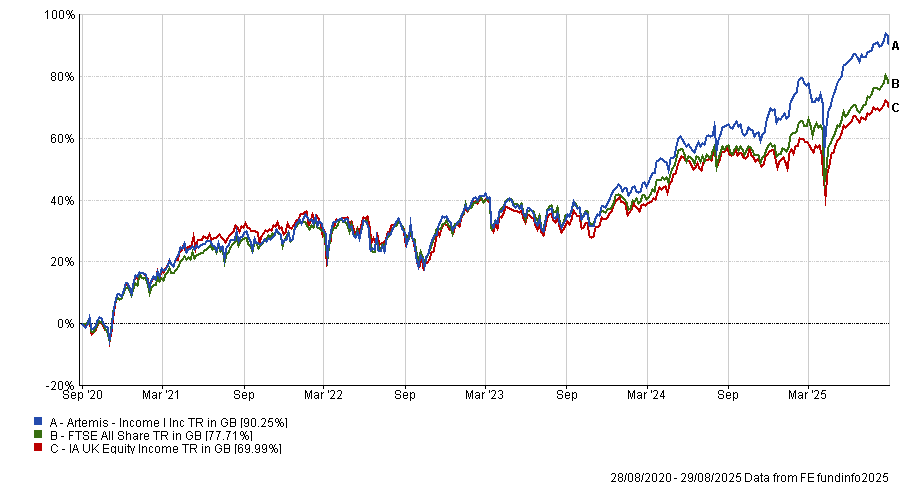

Among actively managed UK equity funds, Blyth said Artemis Income stands out for its strong long-term performance and core-value-oriented strategy.

The £5.1bn fund has outperformed both the sector and benchmark over one, three, five and 10 years, managing a 123.7% total return over the decade.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

“The fund focuses on companies the team considers as ‘buy and bury’ investments – undervalued, with robust fundamentals, that lead to a consistent income distribution profile,” Blyth said.

“This is an approach that could be beneficial to investors’ portfolios in a scenario where speculative tech valuations unwind.”

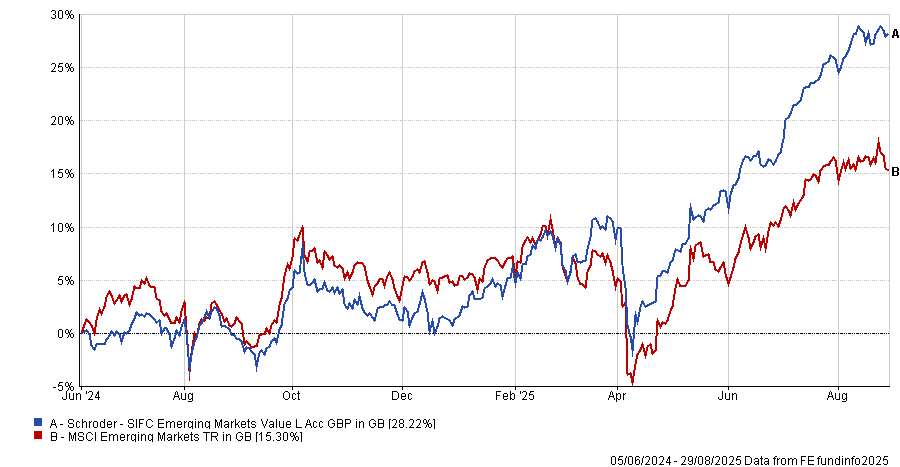

Finally, Tony Mee, chief investment officer of Asset Intelligence, pointed to Schroder SIFC Emerging Markets Value.

“This fund offers a value-oriented approach with a focus on bottom-up stock selection, providing diversification away from the technology and AI sectors susceptible to bubble risks,” he said.

Fund vs benchmark over 1yr

Source: FE Analytics

Emerging markets typically having less direct exposure to AI hype compared to developed and tech-heavy markets like the US, Mee said.

This fund in particular benefits from an experienced management team – Vera German and Juan Torres – who are focused on fundamental value investing which “can help identify resilient companies less impacted by speculative froth in AI stocks”, he noted.

Having Schroder SIFC Emerging Markets Value as a core holding could provide a “defensive yet growth-oriented strategy” that is “relatively insulated” from the volatility and potential collapse of AI-related valuations, he said.

The fund offers a 4.3% yield and delivered a 28.5% total return over a year.