Fund managers need to “get over themselves” and accept that they cannot invest as they used to, according to David Jane, multi-asset manager at Premier Miton, who claimed many multi-asset funds are “stuck in the past”, relying on outdated assumptions about asset classes that do not work anymore.

In particular, he argued that many do not fully appreciate how the rise of passives has changed the way they need to invest.

With markets increasingly dominated by trackers and hedge funds, stock markets have become increasingly speculative.

Because share prices can move in response to a single set of results, one-off events, or even the words of “pundits on social media”, it is incredibly challenging for multi-asset funds to generate alpha from high conviction positions in specific securities, Jane said.

“Let’s say you have a handful of positions that are around 4% to 5%, you’ve created a portfolio where everything has an equal chance of going well as it does of going badly.”

No matter how skilled investors think they are, it is a “stretch of the imagination” for managers to think they’ll always get their stock picks right. When managers inevitably get a high conviction bet wrong, it will drag down the rest of the portfolio, he continued, making it difficult for multi-asset managers to get consistent alpha from stock selection.

He added that multi-asset managers still have distorted ideas of equity and bond markets, due to two decades of negative correlation between the asset classes.

Historically, equities and bonds either had no correlation or positive correlation, which is the “normal scenario for markets” that investors seem to get wrong. Indeed, it is often believed that bonds and equities are negatively correlated to one another.

He’s not the only investor to think this, with managers noting earlier this year that the relationship between bonds and equities has fluctuated over time.

Jane continued: “We’re back in an environment where bonds and equities are positively correlated. That is causing fund managers a lot of problems, because they’ve been trained on the belief that when equities sell off, bonds go up, and it’s just not true.”

Despite these changes to the market, Jane argued that many investors are still relying on these outdated assumptions about diversification and stock selection. “Markets don’t work the way they used to, nor do they work the way many of us have been trained. You can complain about it, but I think you must change with it.”

As a result, Jane has adopted a flexible approach to asset allocation with his Premier Miton Cautious Monthly Income fund.

Instead of relying on high conviction allocations towards single stocks, he approaches the portfolio from a top-down level, arguing that security selection is less important than asset allocation in a multi-asset strategy.

“We’re not in the business of stock selection and we’re not in the business of predicting the future. All I’ve learned over many years is that you’re going to be right as often as you’re wrong, so play the ball in front of you,” he said.

If multi-asset managers want to deliver for their clients, they need to “bet with the market”, he continued.

As a result, equities now represent 55% of Premier Miton Cautious Monthly Income’s total portfolio, near the maximum allowed for funds in the IA Mixed Investment 20-60% shares peer group.

Within this, he favours US equities, arguing that the US has been leading the global market in recent years, so investors should be exposed to it. “Good luck with betting against the market.”

However, he differs from the index by favouring stocks such as Aviva, Samsung and Bank of China over “exciting” mega-cap tech names. “I want to make multiple clean, pure plays on the macro-idea that we’re in an equity bull market.”

This belief that most of the fund should be in equities to benefit from an equity bull market shapes the rest of the portfolio, he explained.

For example, the 36% allocation towards fixed income is currently in high-quality long-duration bonds, to avoid “ramming the beta in the bond portfolio” while also having high risk in the equity portfolio.

Similarly, Jane and his team have raised the allocation to commodities because, if the correlation between bonds and equities is becoming more unpredictable, assets such as gold will be a main source of diversification, he explained.

“The key in this business is survival. To survive, you have to adapt to the fact that the market environment may not be the way you want it to be and invest in what you know works”, he concluded.

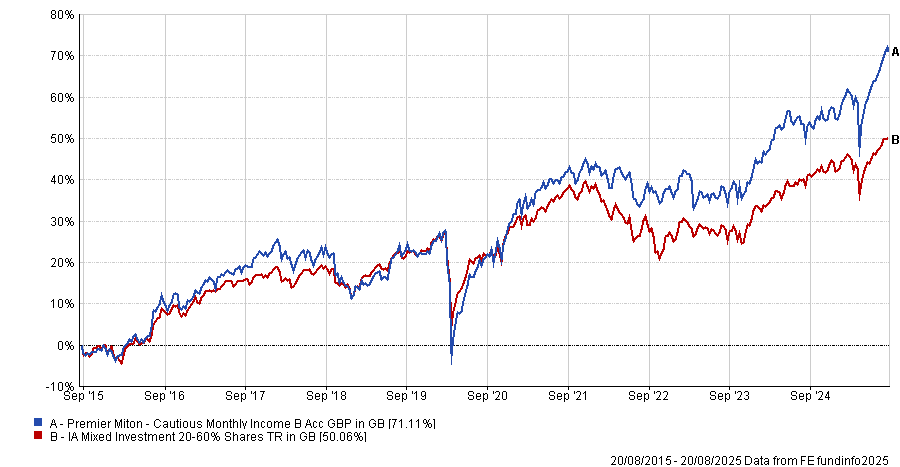

This more adaptable approach to asset allocation has worked out for the fund over the long term. Over the past one, three, five and 10 years, it has delivered top-quartile returns compared to the average IA Mixed Investment 20-60% Shares peer.

Performance of fund vs sector 10yrs

Source: FE Analytics.