Despite a string of disappointing returns in recent years, the Liontrust UK Growth fund still features on the buy lists of Fidelity, AJ Bell and Hargreaves Lansdown.

The £828.1m fund made a second-quartile total return in the IA UK All Companies sector over 10 years (99.7%) but was third and fourth quartile compared to its peers over one, three and five years, down 2.5%, up 17.2% and up 42.9% respectively.

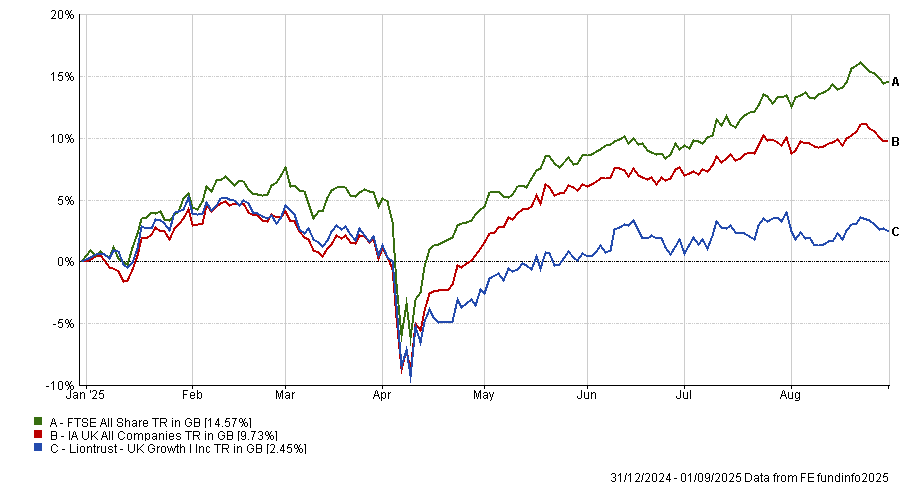

Fund vs sector and benchmark year-to-date

Source: FE Analytics

Given the fund remains a fixture on investment platform buy lists, is it time to buy, hold or fold Liontrust UK Growth?

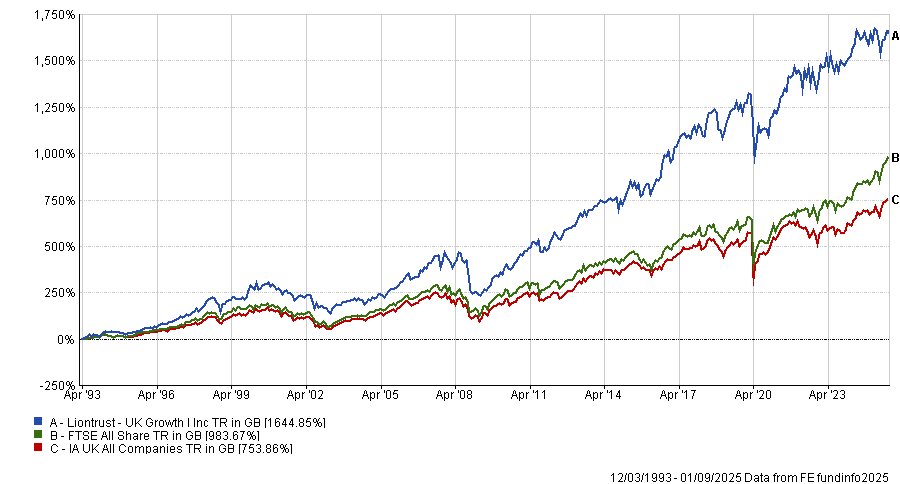

The investment platforms in question all point to its longstanding track record. Since it launched in 1993, the fund has outpaced both the sector and index, with total returns over that time up 1,659.9%.

Fund vs sector and benchmark since launch

Source: FE Analytics

Nonetheless, Fidelity, which works with independent fund research company Fundhouse to select and monitor funds on its Select 50 list, told Trustnet that Liontrust UK Growth’s sector positioning has undoubtedly been a “challenge” in recent months, noting that it is overweight industrials and underweight financials.

“Industrials holdings have faced economic and tariff-related pressures, while banks have enjoyed a strong period of performance,” they said.

However, Paul Angell, head of investment research at AJ Bell, said Liontrust’s management team benefits from the long-standing leadership of FE Fundinfo Alpha Manager Anthony Cross, who has been managing the fund since 2009.

“Cross has built a strong, collegiate team with a healthy blend of experience and fresh perspectives,” Angell said.

“The fund’s disciplined investment process – focusing on companies with intellectual property, strong distribution networks and/or recurring revenues – remains unchanged, which could serve investors well in the long-term.”

Matthew Tonge and Victoria Stevens became co-managers in 2023, but long-time co-head (and fellow Alpha Manager) Julian Fosh retired at the start of this year due to health reasons.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, also cited the management team, noting that the platform remains confident in the long-term compounding attributes of their process and companies they invest in, with valuations at “unusually attractive levels”.

But what does the wider industry think?

Rob Morgan, chief investment analyst at Charles Stanley, said Liontrust UK Growth’s performance has been “disappointing” but “unsurprising given current market trends and relative sector differentials”.

In particular, the fund’s allocation to smaller companies has weighed on returns, he noted, with more domestically oriented indices struggling to make the same level of progress as has been seen by the FTSE 100 in recent months.

Additionally, “the fund’s quality-growth style has been mostly at odds with investor sentiment as inflation and interest rates have stayed higher,” Morgan said.

Liontrust UK Growth is nonetheless a ‘hold’ in his book, with Morgan arguing that the fund’s well-established investment philosophy “can be expected to return to form once its investment style is more in tune with the market”.

Martin Ward, senior investment research analyst at Square Mile Investment Consulting and Research, said that the fund’s exposure to mid-caps has also been a headwind.

“Although it has a larger cap bias compared to its sister strategy – Liontrust Special Situations – it has a higher allocation to mid-caps and a subsequent underweight to large-caps versus the FTSE All Share, which has been a headwind to relative returns in the past year and a consistent trend over the medium-term,” Ward said.

Ward also pointed to the fund’s lack of exposure to UK banks as a major contributor to underperformance.

“Over a one-year period, the lack of exposure to HSBC has been one of the largest relative stock detractors and second only to not holding Rolls-Royce,” he said.

Nonetheless, Ward said the fund remains a ‘buy’.

“Our interactions with its management team continue to reflect a high degree of consistency and shared insight,” he explained.

The retirement of Fosh, “a renowned UK stock-picker”, has been a setback for the fund, according to Darius McDermott, managing director at Chelsea Financial Services.

“However, manager Cross remains highly rated and continues to lead the strategy with a clear and disciplined approach,” he noted.

McDermott said the fund remains a ‘hold’, arguing that its recent run of underperformance is mostly down to its approach, which has been “on the wrong side of markets in recent years”.

“That said, history suggests that, should quality stocks come back into favour, this team is well-positioned to deliver for investors,” McDermott said.

“Long-term investors may therefore choose to stay patient, while those seeking steadier near-term returns might prefer UK equity funds with greater value exposure.”