Investors passively tracking the global stock market could be misled into thinking growth is the winning investment style globally. But according to Duncan Lamont, head of strategic research at Schroders, the opposite is in fact true, with value outperforming everywhere bar the US.

When assessing the performance of global markets, the results are often skewed by growth-strong US-based companies (like the Magnificent Seven), which make up 75% of the weighting by market capitalisation.

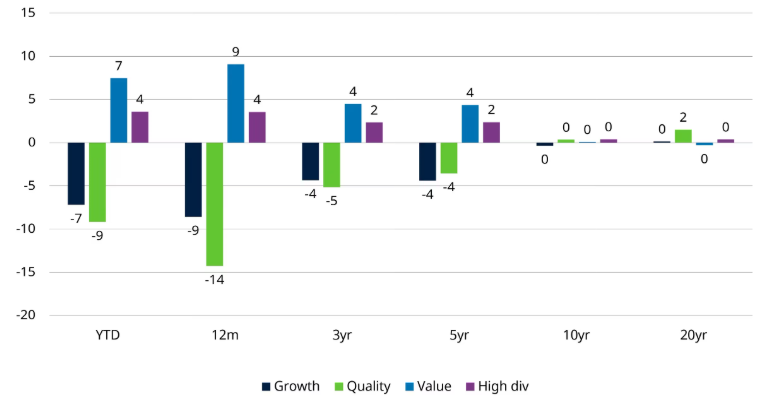

However, when looking at an index designed to represent global developed markets while excluding North America – EAFE (Europe, Australasia and the Far East) – value returned 20% in dollar terms in the 12 months ending 31 August 2025.

Value stocks outperformed the wider EAFE market by 6% and rival growth stocks by 13%, with growth lagging the market by 6%.

Performance of MSCI EAFE Value vs MSCI EAFE

Source: Schroders, LSEG Datastream, MSCI

In comparison, in the US, value underperformed growth by 17% and the market by 8% over the same assessed period.

Lamont warned investors against “incorrectly extrapolating US performance to the rest of the world”, as otherwise investment opportunities are likely to have been missed.

“Global portfolios are loaded up on US mega-cap growth-style risk and have hardly any exposure to the wider opportunity set,” he said.

“The fact that many other parts of the market are performing differently, and better, than the US, amounts to barely a rounding error in many investors’ returns.”

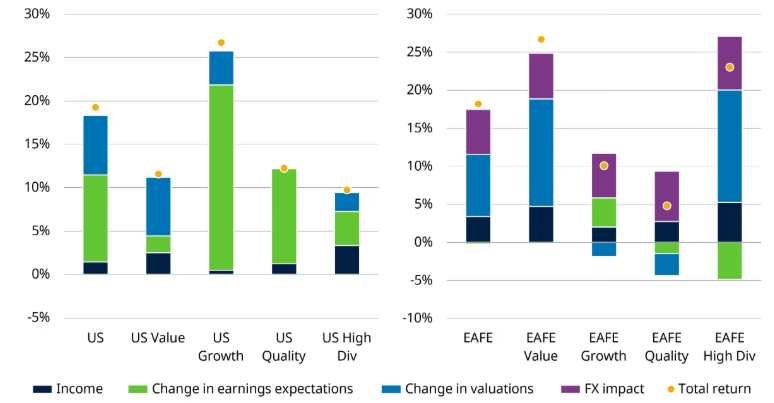

US 12-month return decomposition vs EAFE 12-month return decomposition

Source: Schroders, LSEG Datastream, MSCI

What is driving this divergence?

Growth has long been the story of the US – with the Magnificent Seven stock leading the charge – and growth-focused companies have been rewarded for strong earnings, Lamont explained. EAFE-based growth companies have not been able to say the same thing, underperforming “despite having superior earnings growth”.

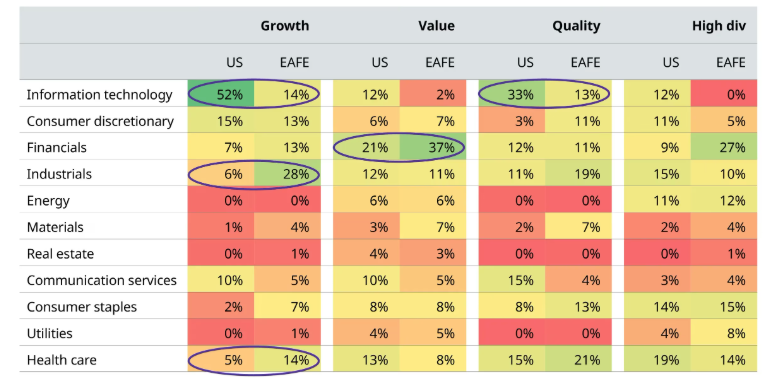

US growth stocks are not just technology, but some of this is due to classification. For example, Amazon and Tesla count as consumer discretionary, Lamont pointed out, while Alphabet is in communication services. All three would be considered by many to be technology-first businesses.

“Perversely, Meta is not a member of the MSCI USA Growth index [but] it is the largest stock on the MSCI USA Value index,” Lamont added.

Technology makes up just 14% of MSCI EAFE Growth, which has a more equally weighted array of exposures.

MSCI EAFE Growth and MSCI USA Growth weightings

Source: Schroders, LSEG Datastream, MSCI

Meanwhile, across EAFE, “rising valuations have been in the driving seat for value and high dividend styles”, Lamont said.

These stocks have performed well despite weak earnings, which is “partly a reversal of the valuation extremes that existed previously, and which still exist in the US”.

In EAFE, growth and quality stocks historically traded on expensive valuations while value and high dividend stocks were cheap, said Lamont. Today, quality stocks are trading at a “slight discount” to historical valuations and are currently at the cheapest they have been versus value for around six years.

“Everything is much more reasonable, in isolation and relative to each other,” he said.

Finding common ground

But there are commonalities to be found between the US market and elsewhere, Lamont noted. Specifically, the 12-month “terrible” performance of quality stocks – a far cry from the outperformance seen over the long run in both the US and EAFE.

Over the assessed 12 months, Lamont said quality stocks underperformed the market by 12% in EAFE and 7% in the US.

“In EAFE, this has been so punitive that quality is also now well behind on a three- and five-year basis,” he said, noting that the rate of underperformance over the past three years is “now the worst for around three decades”.

In contrast, the lowest-quality companies have performed the best for both the US and EAFE.

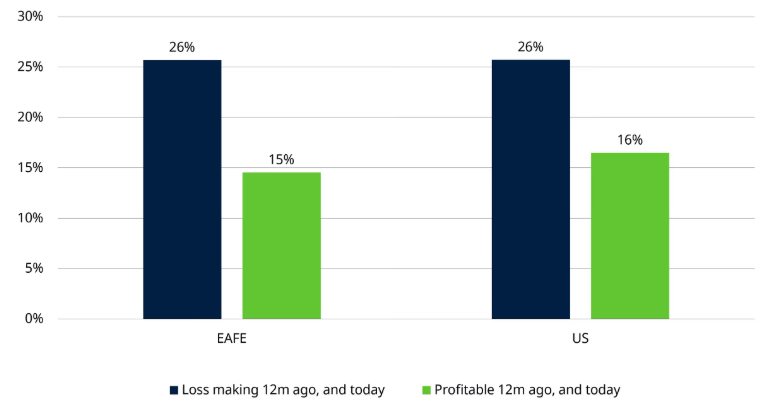

“If we deal with the real problem children, those that were loss-making 12 months ago and are still loss-making today, they have outperformed companies that were consistently profitable by more than 10% in the past 12 months,” he said.

“There are relatively few companies that fit this description in the large-cap space (2% of EAFE companies and 5% of US ones) but the scale of their outperformance is noteworthy.”

12-month market cap weighted performance in dollar terms

Source: Schroders, LSEG Datastream, MSCI