US treasury inflation-protected securities (TIPS) have become the “big bully” in the Orbis Global Cautious fund in recent months, which all other assets in the strategy are compared to, according to Alec Cutler.

Yielding a real return (after inflation) of 2.5%, and with the potential to deliver even better performance if inflation surprises on the upside or remains sticky, this makes them a high hurdle for other assets to overcome.

The recent pivot into TIPS also reflected Cutler’s belief that the equity market could underperform and fail to deliver positive returns over the next few years.

“For us, this is the cut-off point in the portfolio; we won’t own anything that can’t match that 2.5% real.”

For Cutler, this reflects his belief that successful multi-asset portfolios should be “cage matches for capital” where equities, bonds and commodities need to compete with all other assets to justify their existence. In this case, he explained, all other securities need to have more attractive returns than TIPS to justify taking on any further risk.

The portfolio is allocated with this in mind, leading to stocks such as Kinder Morgan, which have a 4.5% yield, and Taiwan Semiconductor (TSMC), where the fund can hedge out some of the risk, he explained.

This “cage match” approach to capital allocation has contributed to the Orbis Global Cautious Fund’s strong recent performance, Cutler said.

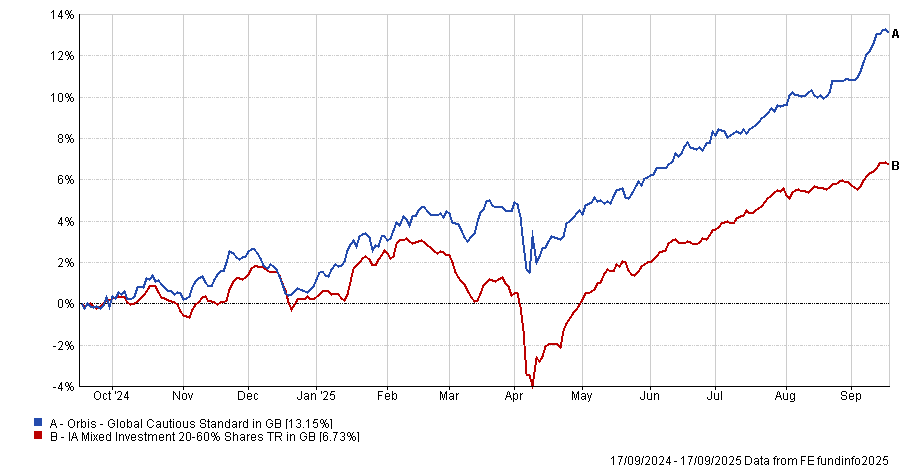

Over the past year it is up 13.3%, which is the third-best performance in the IA Mixed Investment 20-60% Shares sector. This follows top-quartile returns over the past three and five years.

Performance of fund vs sector over the past 12 months

Source: FE Analytics

What is the process and philosophy of Orbis Global Cautious?

The hope is that the fund can produce pleasing returns while taking no more risk than a standard 30% equities and 70% bonds portfolio.

We have no asset allocation mechanism to try to time the market or any of that garbage. Everything in the portfolio competes against everything else for capital.

So our bonds compete against our gold and stocks to justify their place in the portfolio and vice versa, which determines our final allocations.

What’s your biggest differentiator compared to competitors?

When we first started, we thought multi-asset funds left a lot to be desired. They were essentially equity funds with passive bond components and vice versa.

Other managers tactically marketed their funds; for example, you could find strategies in the 20-60% sector that would fix their equity allocation at 60% because they knew it would outperform and never change it.

We didn’t want to be like that. We want our portfolio to be a genuine competition for capital, where all ideas are in the same ring and compete for survival. We think that’s a more rigorous process that has worked out for us.

What’s been your best call in recent years?

Probably the decision to hold gold over bonds. For the past five years, we had a significant allocation to it and, over the past year, it has already added 2.5 percentage points of outperformance as the price kept rising.

Meanwhile, fixed income has been a laggard, so underweighting it and using gold was probably our best call.

And your worst?

On an individual holding level, buying Bayer [a German chemical company]. We purchased it in 2019 after it merged with Monsanto and it was sued in California due to the ingredients it was using.

We were convinced that the legal challenge would not be successful and that it was being undervalued but we got that wrong. We bought it at around €70, and wound up selling it at €36, so it slid by about half.

The other worst call was the lower equity weighting on the asset allocation level. We’ve been underweight equities [under 30%] for a while, because they’ve been generally expensive, but when we started the fund, we were overweight equities, because fixed income yields were almost negative.

In hindsight, we probably backed out of that too soon, but I’m more satisfied with the allocation now because I think they’ll likely underperform from here.

Why do you allocate equities according to a ‘pyramid of needs’?

Essentially, we’ve reframed our investment strategy as a pyramid, with the bottom of the pyramid comprising the most essential things to a country: national security, energy, food production, and so on. These are companies like Taiwan Semiconductor, Kinder Morgan, Samsung and Shell.

The top of the pyramid is things like social media and entertainment, that we could probably recover from losing. I’d put Meta up there, chunks of Amazon and even parts of Google.

Over the past two decades, more money has gone to social media companies at the top of the pyramid than into energy production at the bottom. These essential companies have consolidated at low valuations because no one wanted them for so long, but investors can’t afford to ignore them for much longer. So, we’ve loaded up on these names.

That’s not to say we won’t buy entertainment companies at the top of the pyramid, such as Nintendo, but the bar is a lot higher.

What do you do outside of fund management?

I pick weeds. I find that when being a contrarian and arguing is what I do for a living, it’s very relaxing to pick weeds with a drink in hand on a nice day.