Asset management has become increasingly team-based, recent FE Analytics data suggests. In the Investment Association (IA) universe, there are almost 1,500 funds with a single named manager, compared to more than 2,000 strategies with multiple managers.

This suggests that, while funds led solely by ‘star managers’ still exist, they have become increasingly less common.

Indeed, asset managers such as Invesco have been embracing a more collegiate approach to fund management in recent years.

Stephanie Butcher, co-head of investments at Invesco, said: “We take a team-based approach, as we believe it's important to draw upon the knowledge and expertise of individuals, as well as to ensure a good level of debate and challenge within teams.”

This approach ensures that the “breadth and depth” of the process can be maintained better than if tied to a single manager.

Similarly, JP Morgan Asset Management’s Anthony Lynch, who spoke to Trustnet last week, noted that adding a manager to the JP Morgan Claverhouse Trust had brought some benefits.

“Going from two managers to three has improved our fundamental bandwidth,” he explained.

A larger team allows them to look “much deeper through the market-cap spectrum” than some of their peers. As a result, they have lower allocations to sectors such as consumer staples or tobacco, because they have found similarly yielding opportunities in underexplored parts of the market.

Model portfolio managers and fund platforms also identified the benefits of a collegiate approach to fund management.

For Joseph Hill, senior investment analyst at Hargreaves Lansdown, “succession planning” is one of the crucial things they look for in a fund.

“This means being clear on what the plan is should a fund manager step away from the fund for whatever reason,” he said, noting that having a co-manager or deputy manager in place is a reliable way to achieve this.

Hill explained that this is particularly compelling in broader areas of the market, for example, the sterling strategic bond sector, where a single manager might struggle to cover the whole market.

A team approach means one member could concentrate specifically on high-yield bonds, while another emphasises investment-grade bonds, he said.

This more collegiate structure avoids some of the pitfalls of a sole manager, who can find their time split between several tasks, including talking to the media, clients and going on the road to market the fund, all of which distract from portfolio management, he said.

However, teams can get too large and risk decisions being delayed by “committee” debates. While a team is preferred, “clarity and accountability are key, so we can be clear about who is responsible for what”, Hill said.

“These are all assessments that long-term investors should weigh up before investing.”

Andy O’Shea, head of fund solutions at Pharon Independent Advisors, uses a mixture of team and solo manager funds, noting that his preference depends on the market he is allocating to.

He agreed that team-led funds are at their best in “broader markets” where opportunities are less time-sensitive and there is too much ground for one stockpicker to cover alone. In these markets, strategies will benefit from the “increased personal experience and peer challenge” of multiple managers.

On top of this, O’Shea explained this removes star manager risk, preventing a “sharp exodus of assets and forced selling” if a lead manager departs.

For example, a well-established team of deputy managers is why some fund pickers kept their faith in Schroders Income after the departure of veteran Nick Kirrage earlier this year.

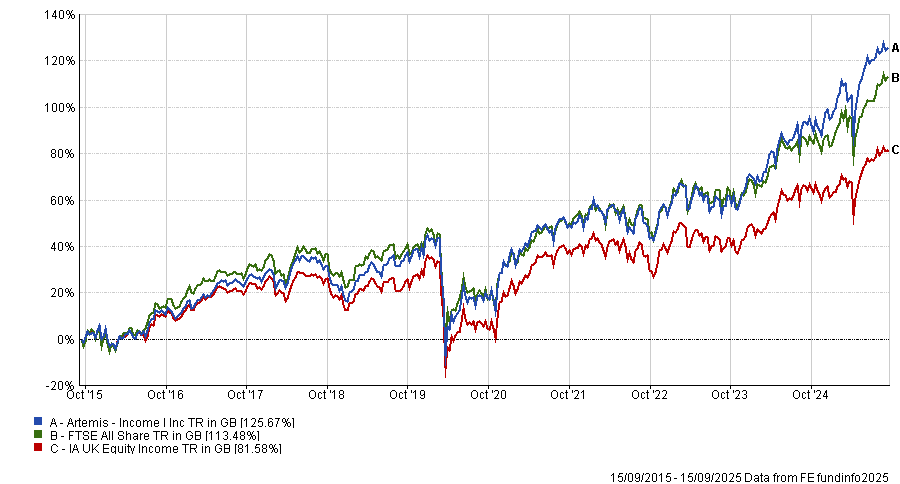

O’Shea pointed to Artemis Income as an example of a successful co-manager fund. Run by FE fundinfo Alpha Manager Adrian Frost, Nick Shenton and Andy Marsh, the three stockpickers “all actively and equally take part in stock selection and portfolio construction”.

This approach has paid off, with the strategy posting a top-quartile return in the IA UK Equity Income sector over the past one, three and 10 years.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

That said, single-manager funds are not obsolete, he explained. Smaller teams worked best in “more opportunistic markets” where reacting to fast news cycles and taking advantage of new opportunities is key.

In these smaller markets, larger teams can run into “meeting overload” where they hold too many meetings that ultimately end up becoming “time sinks, reducing productivity and morale”.

Additionally, smaller teams avoid “analysis paralysis”, allowing them to act fast to take advantage of new opportunities rather than overthinking and excessively evaluating short-term opportunities.

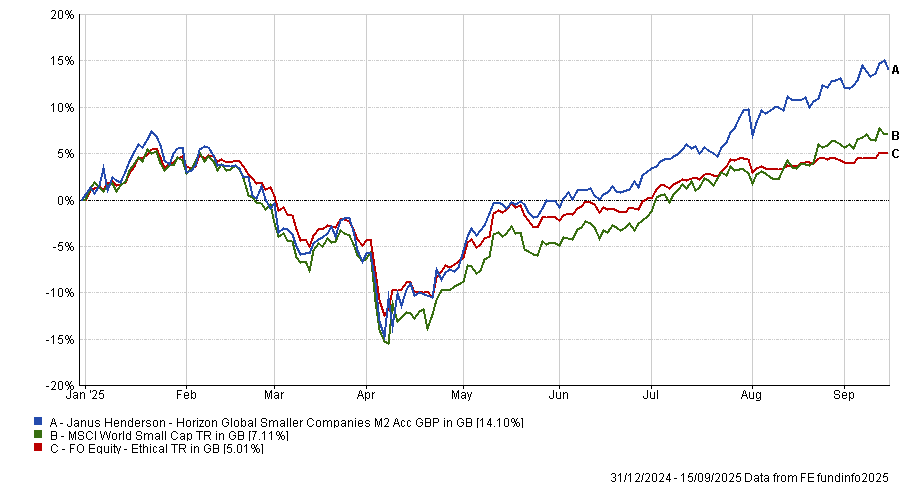

For a good example of a single-manager fund, O’Shea pointed to Nick Sheridan’s Janus Henderson Horizon Global Smaller Companies fund. Sheridan serves as the only manager monitoring ideas and the overall portfolio, supported by a small team of analysts instead of a deputy manager.

So far this year, the strategy is up 14.1%, beating the MSCI World Small Cap index.

Performance of the fund vs sector and benchmark YTD

Source: FE Analytics