Donald Trump’s opposition to environmental, social and governance (ESG) investing has made one in five UK private investors more favourable toward the investment approach, according to research by the Association of Investment Companies (AIC).

The trade body’s ESG Attitudes Tracker, conducted by Research in Finance, found 66% of investors were indifferent to the US president’s stance on ESG, while just 8% said it had made them less favourable towards it.

The findings suggest that negative rhetoric from the US has not deterred UK private investors from considering environmental, social and governance factors in their investment decisions.

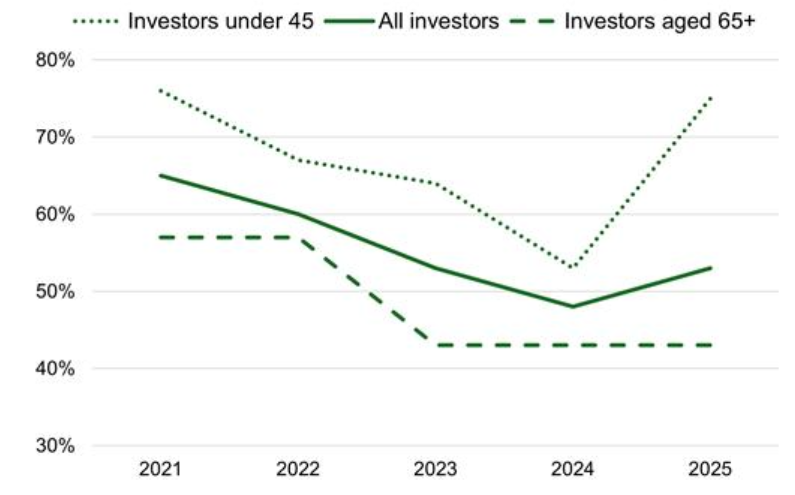

Overall, 53% of respondents said they now take ESG factors into account when investing, up from 48% last year. In addition, 49% said they were ‘fans’ of ESG investing and 55% hold at least some sustainable investments (up from 52%).

% of private investors who consider ESG when investing

Source: AIC, Research in Finance

The increase was most pronounced among younger investors. Of those under 45, 75% said they consider ESG factors and hold sustainable investments. Investors with children were also more likely to hold positive views on ESG.

Nick Britton, research director at the AIC, said: “After getting steadily worse since 2022, sentiment around ESG investing has seen a modest improvement among private investors this year. It’s not a dramatic reversal but it is a definite shift, driven in particular by younger investors and parents.

“There’s evidence that the strength of the backlash against ESG in the US has actually made UK investors less likely to adopt a similarly hostile stance. That said, ESG investing is still less popular than it was in its heyday in 2021 when two-thirds of investors said they considered ESG factors – now it’s just over half.”

Despite the shift, scepticism remains. Only 19% of investors believe ESG strategies lead to better performance and 71% prioritise returns over ESG considerations. Some argued that ESG investing limits exposure to profitable sectors, such as energy and defence.

Worries about greenwashing remain high with 68% of investors stating they were concerned about false sustainability claims, while 46% said they had seen specific examples, up from 36% last year.

More than half of investors (54%) said they trust ESG claims more now that the Financial Conduct Authority has introduced sustainability labels. That figure rises to 70% among those already holding ESG-aligned investments.