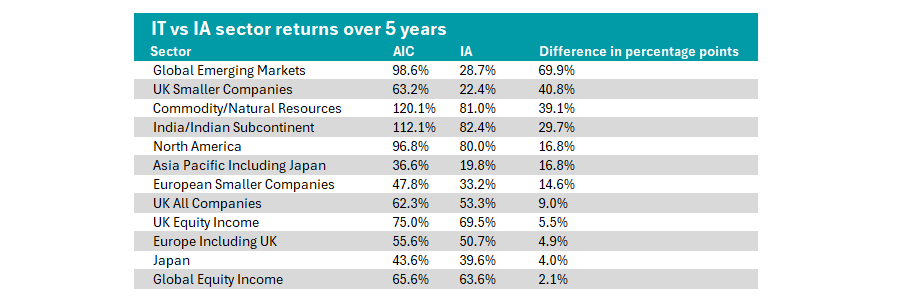

Investment trusts have generally outperformed their open-ended rivals at a sector level, according to data from FE Analytics.

For this study, Trustnet compared the five-year total returns of Investment Association (IA) sectors and their equivalent Association of Investment Companies (AIC) counterparts.

Of the 18 comparable peer groups, investment trusts came out on top two-thirds of the time (12 sectors), with just six IA sectors beating their AIC comparisons.

At the top of the chart below is the global emerging markets, where the AIC sector delivered a 98.6% total return, compared to an IA return of 28.7%.

Source: FE Analytics. Total return accurate as of 18 September.

Of the 10 trusts in the AIC sector, the JP Morgan Emerging Europe Middle East and Africa Securities Trust slid 65.1%, but every other strategy in the sector made strong returns.

AJ Bell head of investment analysis Laith Khalaf, said: “The big thing with emerging markets is that you can get wildly different performances from investments depending on where you’re investing.”

For example, any strategy that held significant amounts of Russian assets would have “cratered” after the country’s invasion of Ukraine, but many strategies in the investment trust universe avoided this entirely, he explained.

For example, the BlackRock Frontiers Investment Trust has climbed 118.6% and most other strategies in the sector posted a double-digit return, dragging the relatively small peer group’s average up.

He also highlighted the UK smaller companies’ market, where investment trusts outpaced open-ended counterparts by almost 40 percentage points.

The investment trust sector, Khalaf noted, is particularly well-suited to less liquid assets such as smaller companies.

“If you’re running an open-ended fund in a less liquid sector, there are things you need to consider that you don’t as a trust manager, mostly flows,” Khalaf explained.

If investors put money into an open-ended small-cap fund, the strategy may become too big to “take the positions managers want in smaller companies”. As a result, some open-ended smaller company funds have closed to new investors in the past to prevent them from becoming too big to deliver their investment objectives.

Equally, if money starts pouring out of the funds, managers will have to liquidate some assets, which is far more difficult in these less liquid smaller companies, Khalaf added, and could lead some to holding extra cash rather than being fully invested.

“A close-ended manager doesn’t have that monkey on their back of worrying about flows, which lets them just get on with the job,” he said. “I think more than anything, investment trusts come into their own when investing in things such as smaller companies.”

Other sectors where trusts significantly outperformed funds included Commodities and Natural resources, India and European Smaller Companies.

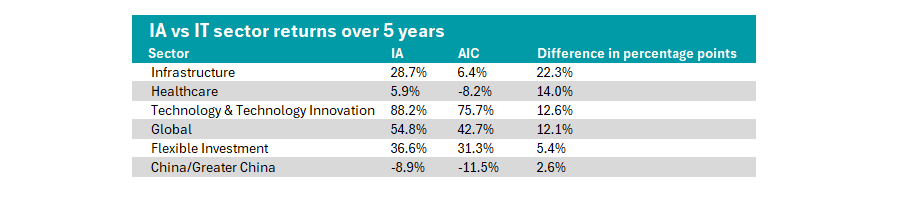

But there were some where open-ended funds won. The chart below shows where IA funds outperformed their closed-end peers.

Source: FE Analytics. Total return accurate as of 18 September.

Top of the chart is infrastructure, where open-ended funds smashed their closed-ended counterparts by roughly 22 percentage points.

Khalaf said: “The first thing you’ve got to recognise is that in a lot of cases investors are dealing with a fairly small number of investment trusts, which can skew the average pretty heavily.”

The IT Infrastructure sector is home to just five portfolios with a full five-year track record, meaning “idiosyncratic manager decisions” have a greater impact than in the larger open-ended fund sector.

Of these five trusts, 3i Infrastructure delivered a stellar 45% return, but every other fund fell behind. In second place, International Public Partnership was up less than 1%, while the remaining three all lost money for investors during this period, dragging down the sector's overall performance, he explained.

Khalaf noted that global funds also outperformed their closed-ended counterparts, which was attributed to the rising dominance of passive investing.

Tracking the market has delivered stellar returns over the past five years, with the MSCI World up 90.2% and the MSCI ACWI up 83.3%. Trusts are entirely active and so have struggled to participate in as much of this upside.

By contrast, the IA Global sector contains both passive and active funds, with passives making up three of the top five funds in the peer group over the past five years.

Additionally, there are just 11 global trusts in the AIC sector, he noted, compared with 429 in the IA equivalent, meaning individual trusts have more sway over the returns of the overall sector (both positively and, in this case, negatively).

Technology is another example where one or two funds can skew the data set, with just three trusts to choose from. Despite two of the three funds more than doubling investors’ money, one (Sure Ventures) slid nearly 17%.

Other sectors where funds outperformed trusts include Healthcare, Flexible Investment and China.