FSSA Asia Focus has been added to AJ Bell’s Favourite Funds list, bulking out the firm’s number of backed Asia funds to six.

It is run by FE fundinfo Alpha Managers Martin Lau and Rizi Mohanty, with the former helming the portfolio since 2015 while the latter came on board last year.

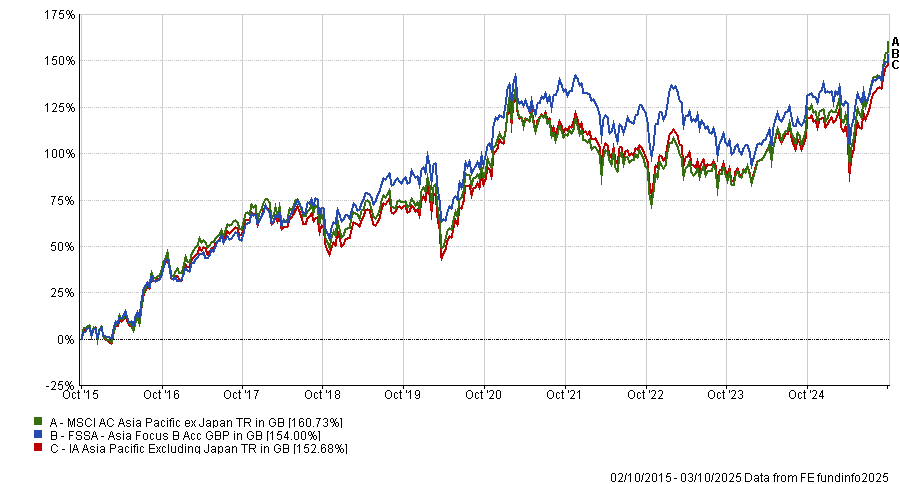

Long-term performance has been good, with the £449m fund up 154% over 10 years – a second-quartile return in the IA Asia Pacific Excluding Japan sector.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Alex Wickham, research analyst at AJ Bell, said the platform likes FSSA Asia Focus’ “disciplined investment approach”, which has been “honed” by the “experienced team head” Lau.

Lau joined the then First State Investments in 2002, where he worked closely with the “well-respected” fund manager Angus Tulloch, before taking on his own strategies under the newly-formed FSSA in 2015.

“At the heart of the fund’s investment philosophy is a commitment to ‘quality businesses’. The team therefore seek companies with strong management teams and robust balance sheets,” said Wickham.

“They assess management teams based on their alignment with all shareholders and their track record of effective capital allocation.”

The managers like companies with pricing power, competitive advantages, strong cash generation and low debt, hoping that these characteristics help their underlying holdings to maintain sustainable growth.

Typically consisting of 40-70 companies, the portfolio can look different to the market and it is currently overweight the two largest players in Asia: China and India.

Wickham described the fund as “long term and high conviction”, highlighting the use of exclusionary screens to avoid investments in fossil fuels, tobacco, weapons and other controversial sectors.

Ultimately, FSSA Asia Focus was chosen “due to the calibre of the team’s focus on quality businesses”, he said, “underpinned” by the expertise of lead manager Lau.

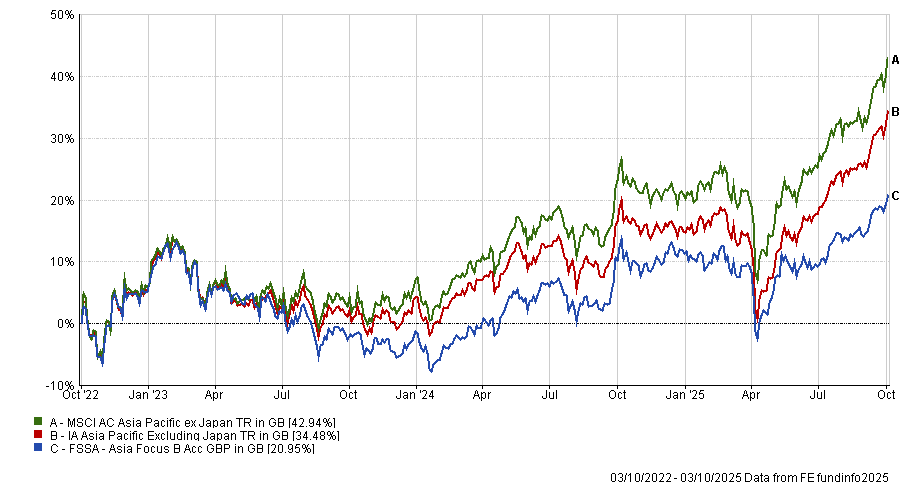

While a good long-term performer, more recent returns have been poor, with the fund up just 20.1% over the past three years – a fourth-quartile effort among its peer group.

Similarly, the fund has sat in the bottom 25% of the sector over one year and the year-to-date.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

This was not enough to dissuade the AJ Bell team, who joined Hargreaves Lansdown (HL) in recommending the fund to clients.

Analysts at HL said: “First Sentier has a long and successful history investing in the Asia Pacific region. We have long admired their disciplined investment approach and think it should do well in what can be a higher-risk area to invest.”

Titan Square Mile also rates the fund with an ‘AA’, but noted “there will be times, given the average shorter-term mindset of investors and volatile nature of this market, [the fund] will fall short” of beating its peers.

“Given the emphasis on quality, this strategy might struggle in periods when investors are chasing certain themes or when riskier stocks are in demand,” they noted.

FSSA Asia Focus joins Invesco Asian, Jupiter Asian Income and Schroder Asian Alpha Plus as AJ Bell’s top Asian equity picks. Passive options HSBC MSCI China and Vanguard FTSE Developed Asia Pacific ex Japan ETF round out the firm’s recommendations in this region.