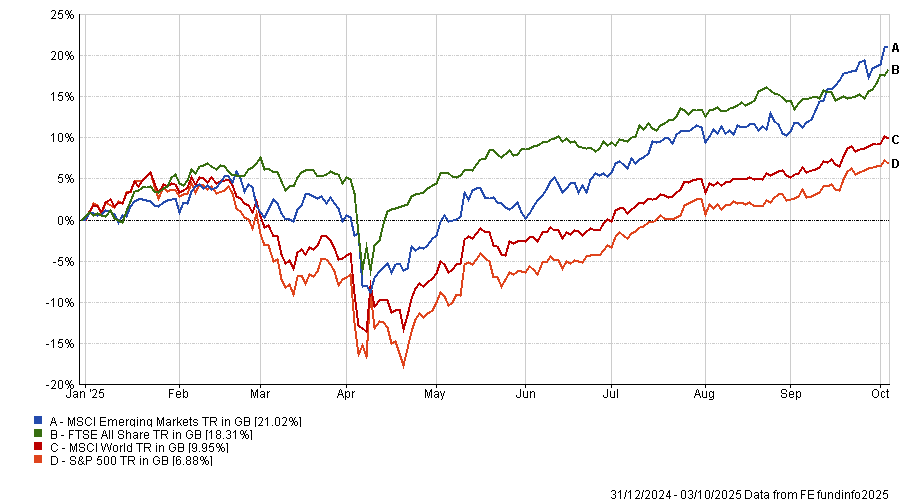

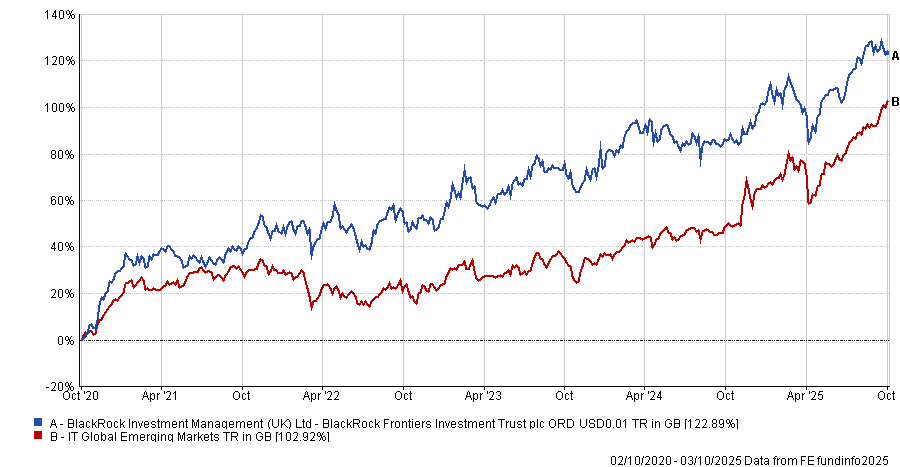

Emerging markets have taken centre stage so far this year, turning around performance and beating all major indices, as the chart below shows.

Performance of indices over the year to date

Source: FE Analytics

Some investors were caught off guard, as the space has often been neglected for its perceived riskiness. Experts however are seeing more upside potential (for example at Baillie Gifford), so it might not be too late to look at the space.

In the first part of our emerging markets guide, we covered why emerging markets have been doing better and how much of an investors’ portfolio should be allocated to the region. In the second part, experts highlighted trusts as a better option than funds and said global emerging markets trusts in particular are suited for most investors.

Below, we reveal four strategies across different emerging markets sectors that experts had a preference for.

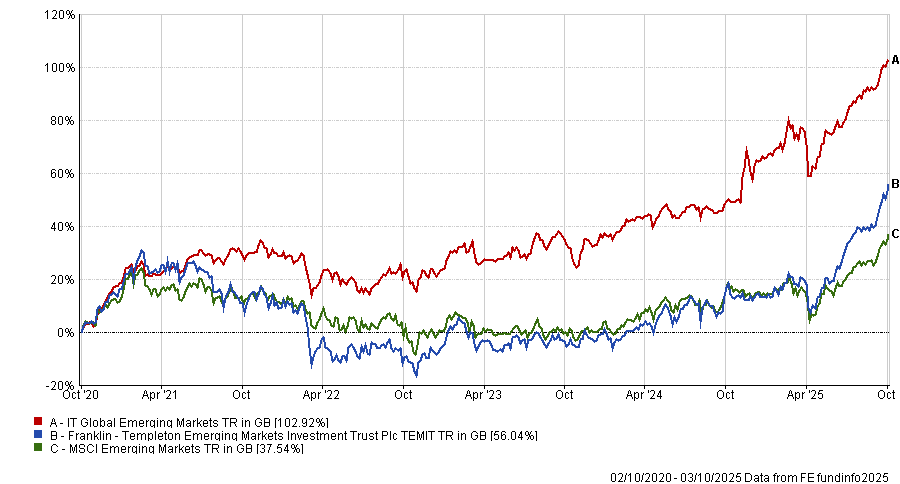

First up, the Templeton Emerging Markets trust was picked by Killik associate portfolio director Andrius Makin. With a broad mandate, this strategy looks for high-quality businesses with sustainable earnings power that are trading below their intrinsic value.

It focuses on companies that are responsible stewards of investor capital, which Makin said is “crucial in emerging markets, where shareholder rights can be a secondary consideration”.

Performance of trusts against index and sector over 5yrs

Source: FE Analytics

“The strategy’s focus on undervalued companies, coupled with the fact that it is currently trading on one of the widest discounts in the peer group, means investors are effectively benefitting from a ‘double-discount’,” Makin said.

“I also like the board’s shareholder-aligned approach. It has been active in buying back shares and introduced a performance-related tender last year running to 2029, which should help control the discount.”

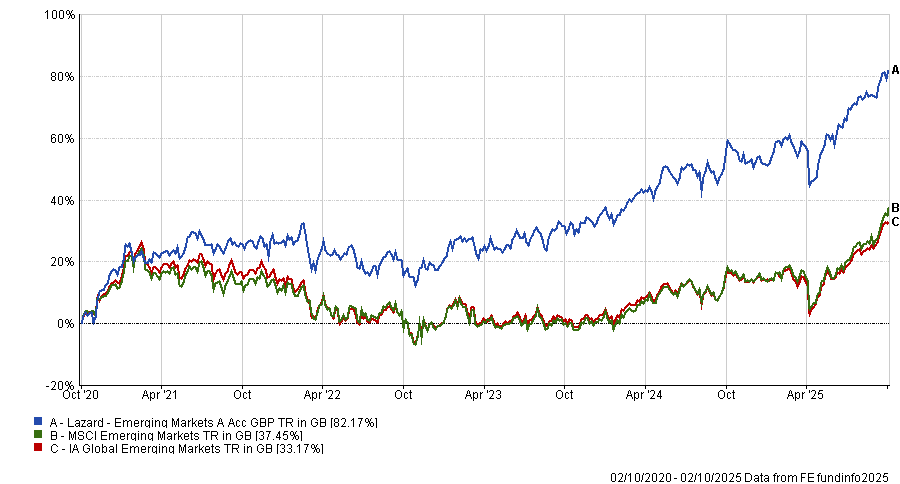

Investment director at Fidelity International Tom Stevenson picked an open-ended fund from Fidelity’s Select 50 best-buy list, Lazard Emerging Markets.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

The £1.2bn strategy is co-managed by James Donald, Rohit Chopra, Monika Shrestha and Ganes Ramachandran and achieved a maximum FE fundinfo Crown Rating of five.

The team members are contrarian investors who buy companies with depressed share prices, keeping a concentrated portfolio of about 80 shares.

Fidelity analysts said the manager of the fund is “exceptionally experienced” and focused exclusively on managing emerging market equity funds.

They suggested this fund could blend well with a quality fund that invests in businesses that are financially stronger or have competitive advantages but tend to be more expensive.

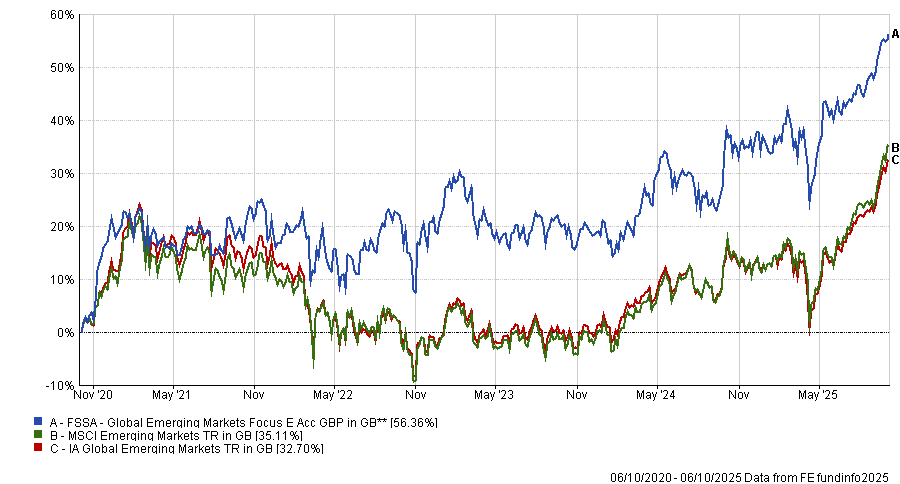

Darius McDermott, managing director at Chelsea Financial Services and FundCalibre, chose something stylistically different. Contrary to the Templeton and Lazard portfolios, his pick was the FSSA Global Emerging Markets Focus fund, which has more of a tilt towards growth rather than value.

The fund is run by the “experienced” Rasmus Nemmoe, who invests in quality companies with “sustained and predictable” growth.

From a universe of some 36,000 stocks, FSSA Global Emerging Markets Focus is a portfolio of just 40-45 best ideas, with McDermott appreciating the environmental, social and governance (ESG) ethos behind it.

“While relatively young, the fund has already shown a lot of potential,” he said.

Launched in July 2018, it has scored top-quartile returns over five years (as shown in the chart below), but 2025 has been less favourable so far.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

Currently, the main allocations are to China (37.3%), India (15.3%) and Taiwan (13.2%). At 8.3%, Taiwan Semiconductor (TSMC) is the largest name, followed by games developer Tencent (7.6%).

ICICI Bank is also among the most held names – an expression of the fund’s sectoral preference for financials (the top sector making up 27.8% of the portfolio).

Going even further afield

China and India dominate the emerging market landscape, something that investors may not be in favour of.

As such, Makin said BlackRock Frontiers could be a good option, noting it is a strategy that “should be on more investors’ radar”.

It focuses on ‘frontier’ markets, which comprise a significant portion of the global population and GDP but “barely feature in most investors’ portfolios”. Top countries in the MSCI index include Vietnam, Morocco, Romania and Slovenia.

The managers of the BlackRock trust combine a top-down process that considers macroeconomic and political risks with a bottom-up approach that attempts to find companies that are mispriced relative to their growth or intrinsic value.

Performance of fund against sector over 5yrs

Source: FE Analytics

“The fund complements a broader EM strategy, although position sizing needs reflect the higher risks of investing in these less researched markets,” Makin concluded.

The next part of this article, including how to build a cautious, balanced and adventurous portfolio of emerging market trusts, is available here.